15225 E Riggs Rd Unit C Gilbert, AZ 85298

South Chandler NeighborhoodEstimated Value: $5,469,827

--

Bed

1

Bath

26,118

Sq Ft

$209/Sq Ft

Est. Value

About This Home

This home is located at 15225 E Riggs Rd Unit C, Gilbert, AZ 85298 and is currently estimated at $5,469,827, approximately $209 per square foot. 15225 E Riggs Rd Unit C is a home located in Maricopa County with nearby schools including Charlotte Patterson Elementary School, Willie & Coy Payne Jr. High School, and Rice Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2019

Sold by

Mominee Daniel S and Mominee Lisa D

Bought by

Lantana Ventures Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$3,000,000

Interest Rate

3.8%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 22, 2016

Sold by

White Deborah Ann Broday

Bought by

Ld Mominee Family Trust

Purchase Details

Closed on

Oct 6, 2010

Sold by

White Houston Ray

Bought by

White Deborah Ann Broday

Purchase Details

Closed on

Jun 20, 1994

Sold by

Connolly John R and Connolly Doralee

Bought by

White Houston Ray and White Deborah Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Interest Rate

8.53%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lantana Ventures Llc | $3,500,000 | First American Title Ins Co | |

| Ld Mominee Family Trust | $2,400,000 | First American Title Ins Co | |

| White Deborah Ann Broday | -- | None Available | |

| White Houston Ray | $158,000 | Trans National Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lantana Ventures Llc | $3,000,000 | |

| Previous Owner | White Houston Ray | $128,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $39,749 | $386,391 | -- | -- |

| 2024 | $40,577 | $379,491 | -- | -- |

| 2023 | $40,577 | $597,584 | $454,291 | $143,293 |

| 2022 | $40,539 | $500,098 | $367,535 | $132,563 |

| 2021 | $5,775 | $59,810 | $11,960 | $47,850 |

| 2020 | $5,681 | $49,810 | $9,960 | $39,850 |

| 2019 | $5,609 | $47,810 | $9,560 | $38,250 |

| 2018 | $5,360 | $50,310 | $10,060 | $40,250 |

| 2017 | $4,542 | $38,460 | $7,690 | $30,770 |

| 2016 | $3,149 | $38,630 | $7,720 | $30,910 |

| 2015 | $4,073 | $35,760 | $7,150 | $28,610 |

Source: Public Records

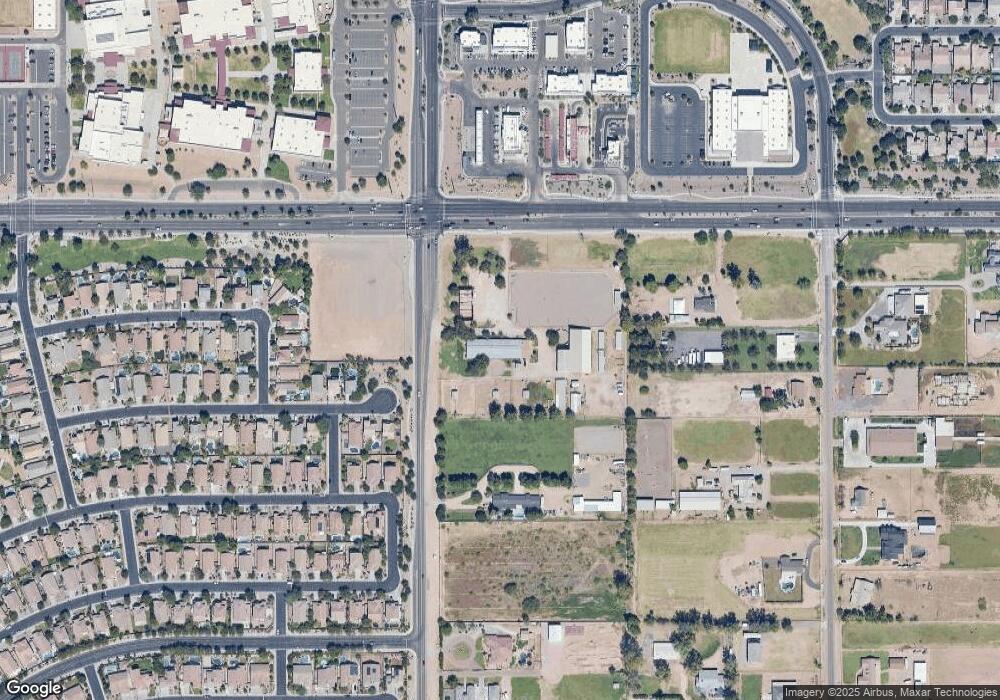

Map

Nearby Homes

- 1866 E Ravenswood Dr

- 1932 E Ravenswood Dr

- 1955 E Blackhawk Dr

- 1725 E Everglade Ln

- 2027 E La Costa Ct

- 4633 E Desert Sands Dr

- 5745 S Topaz Place

- 1997 E Flintlock Dr

- 4348 E Scorpio Place

- 4310 E Gemini Place

- 6860 S Crystal Way

- 6915 S Sapphire Way

- 4327 E Capricorn Place

- 4401 E Taurus Place

- 5940 S Gemstone Dr

- 2215 E Everglade Ln

- 5900 S Gemstone Dr

- 2358 E Runaway Bay Place

- 7342 S Debra Dr

- 4134 E Dawson Dr

- 15225 E Riggs Rd Unit 304-85-001-C

- 15317 E Riggs Rd

- 25413 S Val Vista Dr

- 25413 S Val Vista Dr

- 25413 S Val Vista Dr

- 4993 E Cherry Hills Dr

- 25236 S 154th St

- 0 S Val Vista Dr Unit 4538442

- 4983 E Cherry Hills Dr

- 4994 E Bellerive Dr

- 25416 S 154th St

- 4972 E Cherry Hills Dr

- 25610 S Val Vista Dr

- 25610 S Val Vista Dr

- 25240 S 154th St

- 4984 E Bellerive Dr

- 4973 E Cherry Hills Dr

- 4962 E Cherry Hills Dr

- 4974 E Bellerive Dr