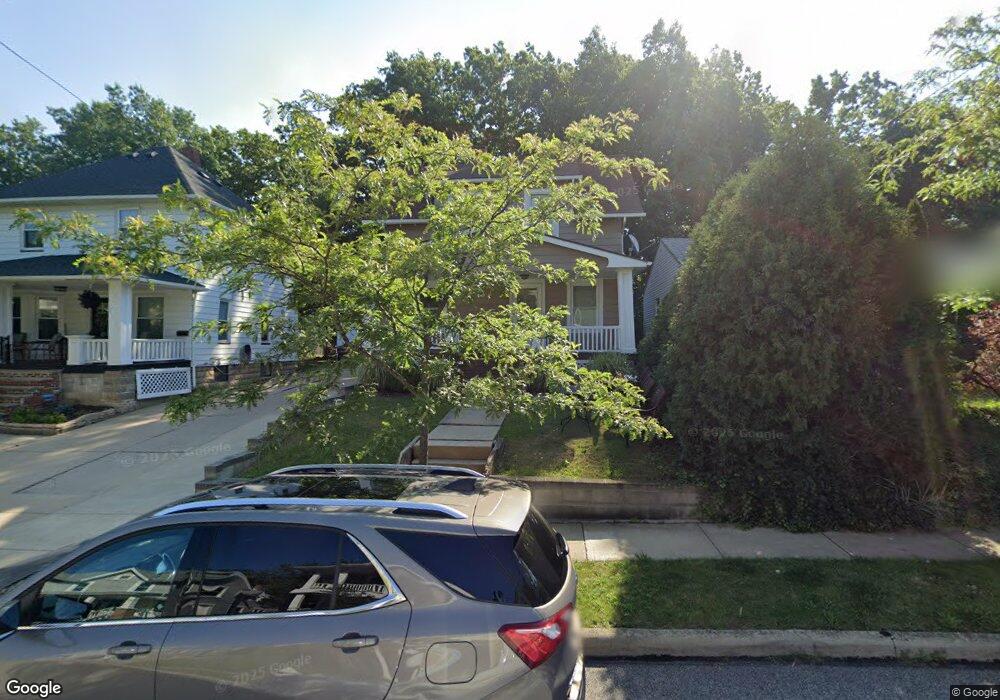

1523 Hopkins Ave Lakewood, OH 44107

Estimated Value: $148,000 - $218,000

2

Beds

2

Baths

541

Sq Ft

$338/Sq Ft

Est. Value

About This Home

This home is located at 1523 Hopkins Ave, Lakewood, OH 44107 and is currently estimated at $182,779, approximately $337 per square foot. 1523 Hopkins Ave is a home located in Cuyahoga County with nearby schools including Harrison Elementary School, Garfield Middle School, and Lakewood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 17, 2010

Sold by

Gersna Robert and Gersna Gail

Bought by

Berila Blaine R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,000

Outstanding Balance

$36,202

Interest Rate

4.3%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$146,577

Purchase Details

Closed on

Jun 5, 2001

Sold by

Mcdonnell Timothy M and Mcdonnell Denise

Bought by

Gersna Robert and Gersna Gail

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,500

Interest Rate

7.18%

Purchase Details

Closed on

Dec 14, 1984

Sold by

Powers Mary E

Bought by

Mcdonnell Timothy M

Purchase Details

Closed on

Jan 1, 1975

Bought by

Powers Mary E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Berila Blaine R | $74,000 | Pvf | |

| Gersna Robert | $70,000 | Title Access Llc | |

| Mcdonnell Timothy M | $27,000 | -- | |

| Powers Mary E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Berila Blaine R | $55,000 | |

| Previous Owner | Gersna Robert | $62,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,698 | $42,000 | $14,210 | $27,790 |

| 2023 | $2,903 | $38,680 | $11,240 | $27,440 |

| 2022 | $2,922 | $38,680 | $11,240 | $27,440 |

| 2021 | $2,892 | $38,680 | $11,240 | $27,440 |

| 2020 | $2,329 | $27,230 | $7,910 | $19,320 |

| 2019 | $2,283 | $77,800 | $22,600 | $55,200 |

| 2018 | $2,279 | $27,230 | $7,910 | $19,320 |

| 2017 | $2,291 | $24,860 | $8,720 | $16,140 |

| 2016 | $2,275 | $24,860 | $8,720 | $16,140 |

| 2015 | $3,708 | $24,860 | $8,720 | $16,140 |

| 2014 | $3,708 | $24,860 | $8,720 | $16,140 |

Source: Public Records

Map

Nearby Homes

- 1486 Hopkins Ave

- 1518 Hopkins Ave

- 1461 Newman Ave

- 1563 Winchester Ave

- 11901 Detroit Ave

- 1412 Winchester Ave

- 12115 Detroit Ave

- 1569 Newman Ave

- 1584 Newman Ave

- 12110 Detroit Ave

- 12118 Detroit Ave

- 12122 Detroit Ave

- 1391 Beach Ave

- 1622 Winchester Ave

- 1633 Hopkins Ave

- 1484 Alameda Ave

- 1477 W 116th St

- 1341 Beach Ave

- 1598 Alameda Ave

- 1585 Cohassett Ave

- 1527 Hopkins Ave

- 1519 Hopkins Ave

- 1531 Hopkins Ave

- 1515 Hopkins Ave

- 1535 Hopkins Ave

- 1513 Hopkins Ave

- 1511 Hopkins Ave

- 1510 Newman Ave

- 1510 Newman Ave Unit 2BR

- 1510 Newman Ave

- 1522 Hopkins Ave

- 1539 Hopkins Ave Unit 1539

- 1528 Hopkins Ave

- 11922 Franklin Blvd

- 1507 Hopkins Ave

- 1514 Hopkins Ave

- 1532 Hopkins Ave Unit 34

- 1541 Hopkins Ave

- 1541 Hopkins Ave Unit 1539

- 11918 Franklin Blvd