153 Arnold Rd East Peoria, IL 61611

Estimated Value: $209,000 - $252,000

3

Beds

2

Baths

1,404

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 153 Arnold Rd, East Peoria, IL 61611 and is currently estimated at $228,925, approximately $163 per square foot. 153 Arnold Rd is a home located in Tazewell County with nearby schools including P.L. Bolin Elementary School, Neil A. Armstrong School, and Central Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2018

Sold by

Reno Johnny Christopher and Reno Stephanie L

Bought by

Anderson Michael J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,288

Outstanding Balance

$137,175

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$91,750

Purchase Details

Closed on

May 20, 2009

Sold by

Comeens Rick D and Comeens Patricia J

Bought by

Reno Johnny Christopher and Reno Stephanie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,300

Interest Rate

4.9%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson Michael J | $165,000 | Premier Title | |

| Reno Johnny Christopher | $132,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anderson Michael J | $159,288 | |

| Previous Owner | Reno Johnny Christopher | $135,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,925 | $62,620 | $17,390 | $45,230 |

| 2023 | $4,925 | $57,640 | $16,010 | $41,630 |

| 2022 | $4,668 | $53,560 | $14,880 | $38,680 |

| 2021 | $4,458 | $51,500 | $14,310 | $37,190 |

| 2020 | $4,216 | $50,000 | $13,890 | $36,110 |

| 2019 | $4,190 | $50,000 | $13,890 | $36,110 |

| 2018 | $3,077 | $39,220 | $13,890 | $25,330 |

| 2017 | $3,048 | $38,830 | $13,750 | $25,080 |

| 2016 | $2,976 | $38,830 | $13,750 | $25,080 |

| 2015 | $2,917 | $0 | $0 | $0 |

| 2013 | $2,937 | $38,830 | $13,750 | $25,080 |

Source: Public Records

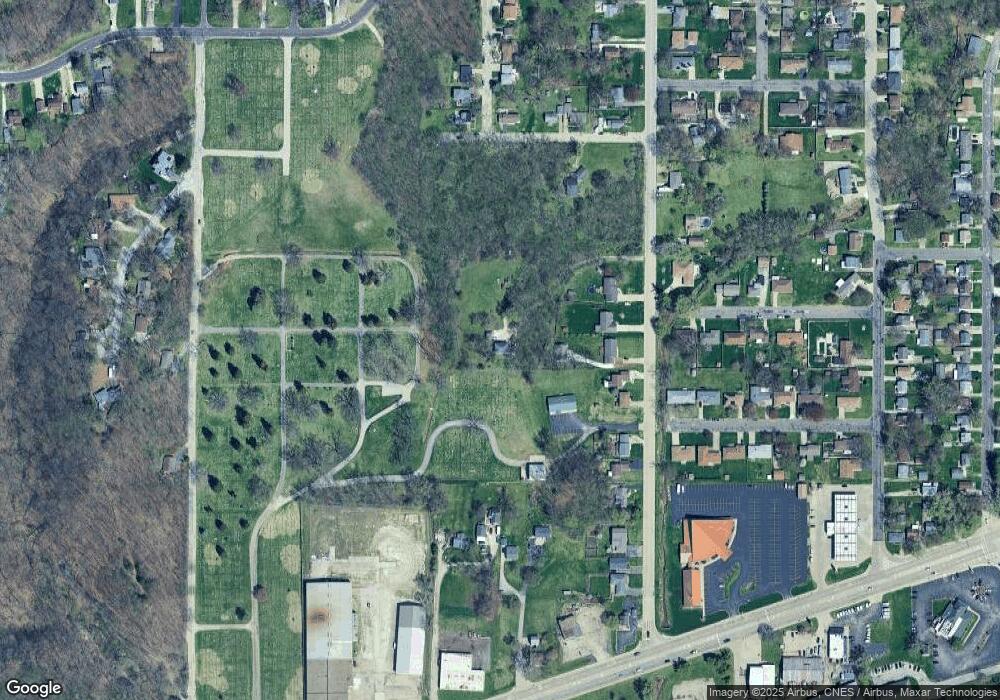

Map

Nearby Homes

- 117 Greenlawn Ct

- Lot 7 Sundance Ln

- 208 Montrose Ave

- 114 Raynor St

- 0000 Highway 24

- 508 Highview Rd

- 615 Meadow Ave

- 202 Castle Ln

- 304 Indian Cir

- 108 Walnut Ct

- 950 N Main St

- 123 Terrace Ln

- 125 Canterbury Ct

- 717 Bloomington Rd

- 104 N Inglewood Dr

- 1513 Bloomington Rd

- 700 N Main St

- 132 Star Rim Dr

- 129 Cherbourg Ct

- 331 Oakwood Ave