153 Valley View Dr Lavonia, GA 30553

Estimated Value: $29,441 - $254,000

2

Beds

1

Bath

912

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 153 Valley View Dr, Lavonia, GA 30553 and is currently estimated at $188,360, approximately $206 per square foot. 153 Valley View Dr is a home located in Franklin County with nearby schools including Franklin County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2023

Sold by

Horne Robert

Bought by

Pawelski Eric and Pawelski Sharon

Current Estimated Value

Purchase Details

Closed on

Jun 13, 2019

Sold by

Carpenter Howard A

Bought by

Horne Robert B

Purchase Details

Closed on

Jun 14, 2012

Sold by

Carpener Howard

Bought by

Carpenter Howard and Carpenter Patricia

Purchase Details

Closed on

Apr 20, 2012

Sold by

Scbt

Bought by

Carpenter Howard and Carpenter Patricia

Purchase Details

Closed on

Jun 7, 2011

Sold by

Scbt Na

Bought by

Scbt Na

Purchase Details

Closed on

Jul 31, 2007

Sold by

Griggs Lynn M

Bought by

Welborn Dewayne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,391

Interest Rate

6.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 7, 2006

Sold by

Smith Willism P

Bought by

Griggs Lynn M

Purchase Details

Closed on

Oct 7, 2002

Sold by

Citifinancial Servic

Bought by

Smith William P

Purchase Details

Closed on

Nov 6, 2001

Sold by

Allen Doug

Bought by

Citifinancial Servic

Purchase Details

Closed on

Apr 23, 1999

Sold by

Maurer Shirley H

Bought by

Allen Doug

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pawelski Eric | $20,000 | -- | |

| Horne Robert B | -- | -- | |

| Carpenter Howard | -- | -- | |

| Carpenter Howard | $10,750 | -- | |

| Scbt Na | -- | -- | |

| Welborn Dewayne | -- | -- | |

| Griggs Lynn M | -- | -- | |

| Smith William P | $10,000 | -- | |

| Citifinancial Servic | $9,500 | -- | |

| Allen Doug | $7,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Welborn Dewayne | $46,391 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $199 | $8,340 | $1,560 | $6,780 |

| 2023 | $239 | $9,264 | $1,560 | $7,704 |

| 2022 | $208 | $8,048 | $1,040 | $7,008 |

| 2021 | $236 | $8,575 | $1,040 | $7,535 |

| 2020 | $250 | $8,996 | $1,040 | $7,956 |

| 2019 | $242 | $8,996 | $1,040 | $7,956 |

| 2018 | $211 | $7,840 | $1,040 | $6,800 |

| 2017 | $219 | $7,840 | $1,040 | $6,800 |

| 2016 | $201 | $6,895 | $1,040 | $5,855 |

| 2015 | -- | $6,583 | $1,040 | $5,543 |

| 2014 | -- | $6,583 | $1,040 | $5,543 |

| 2013 | -- | $6,718 | $1,040 | $5,678 |

Source: Public Records

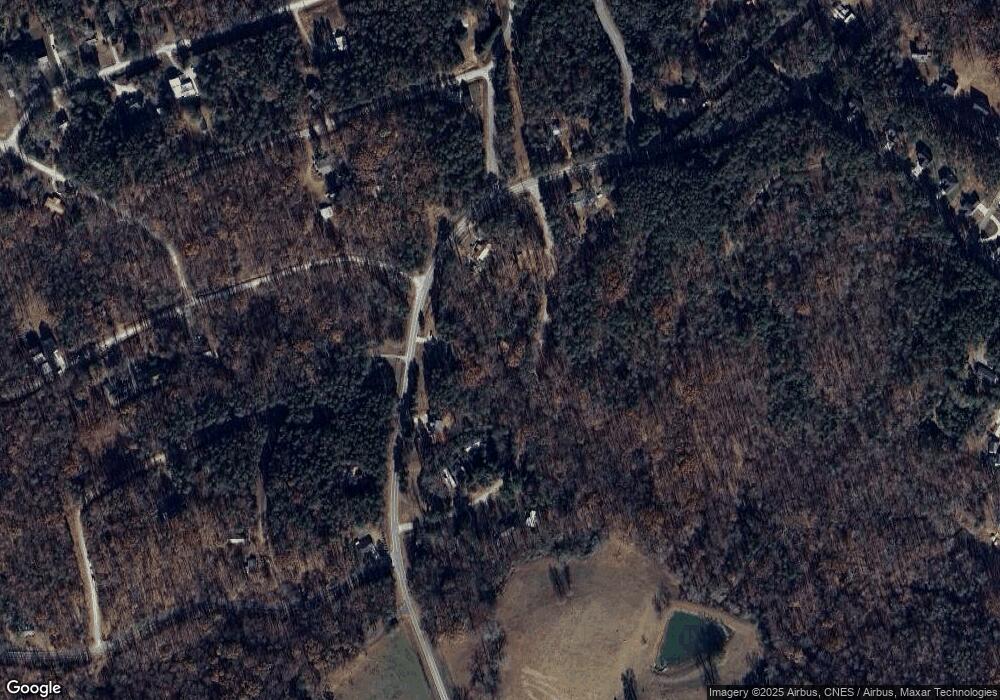

Map

Nearby Homes

- LOT 51 Alpine Way

- LOT Lake View Dr

- 234 Lake View Dr

- 34 Chestnut St

- 0 Skyline Way Unit 10490511

- LOT 11 Riverbend Rd

- 253 Trout Dr

- 0 Mountain View Rd Unit 10508238

- 257 Lake Place Dr

- 501 Capri Point

- 788 Lakeshore Rd

- 166 Cedar St

- 355, 323 & 357 Catfish Ln

- 982 Lakeshore Rd

- 570 Greenleaf Dr

- 396 Greenleaf Dr

- 0 Lewis Dr Unit 7622258

- 0 Lewis Dr Unit 7625674

- 0 Lewis Dr Unit 10572298

- 0 Lewis Dr Unit 10572955

- LOT J-013 Valley View Dr

- 1116 Poplar Springs Rd

- 71 Valley View Dr

- 1076 Poplar Springs Rd

- 1200 Poplar Springs Rd Unit 13,14,15

- 1200 Poplar Springs Rd

- 1111 Poplar Springs Rd

- 76 Valley View Dr

- 39 Valley View Dr

- 1282 Poplar Springs Rd Unit 27-31J

- 1282 Poplar Springs Rd

- 126 Lake Site Dr

- 30 Valley View Dr

- 1025 Poplar Springs Rd

- 0 Valley View Dr Unit LOT 24

- 0 Valley View Dr Unit LOT 24 7126773

- 0 Valley View Dr Unit 9036699

- 0 Valley View Dr Unit 3134168

- 0 Valley View Dr Unit 8353898

- 0 Hillshore Rd Unit 26-27L 8301461