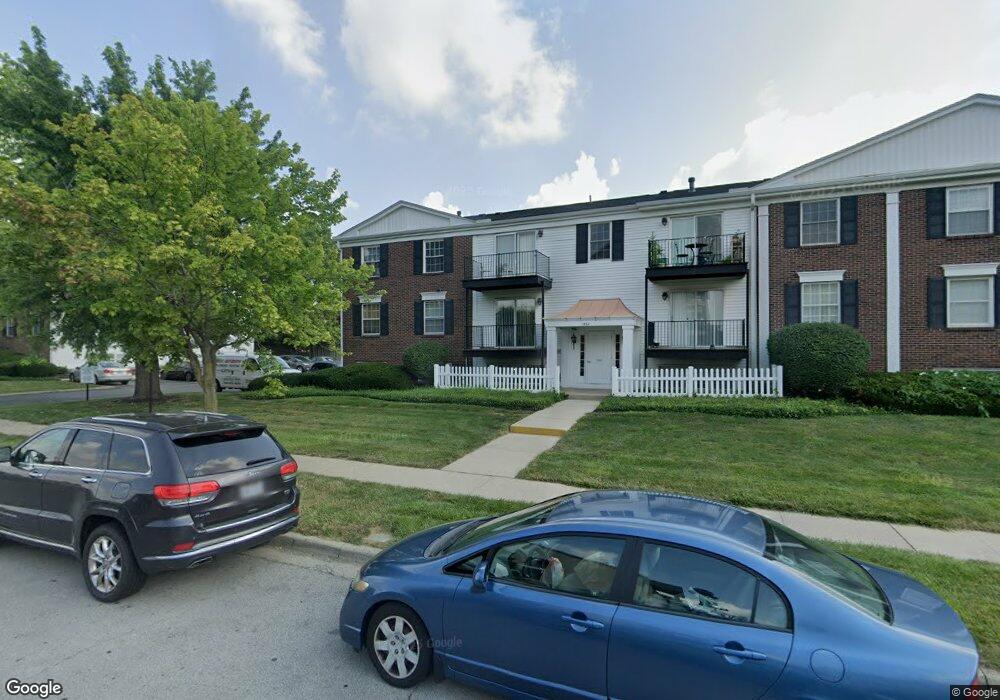

1530 Slade Ave Unit 201 Columbus, OH 43235

The Gables NeighborhoodEstimated Value: $153,000 - $172,717

2

Beds

2

Baths

900

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 1530 Slade Ave Unit 201, Columbus, OH 43235 and is currently estimated at $161,679, approximately $179 per square foot. 1530 Slade Ave Unit 201 is a home located in Franklin County with nearby schools including Gables Elementary School, Ridgeview Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 19, 2018

Sold by

Mess Steven A and Mess Jane K

Bought by

Michael Janet V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,400

Outstanding Balance

$61,467

Interest Rate

5.12%

Mortgage Type

New Conventional

Estimated Equity

$100,212

Purchase Details

Closed on

Jul 20, 2007

Sold by

Mess Elizabeth A

Bought by

Mess Steven A and Mess Jane K

Purchase Details

Closed on

May 30, 2002

Sold by

Wilcox Heidi L and Wilcox Jeffrey C

Bought by

Mess Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,920

Interest Rate

6.95%

Purchase Details

Closed on

Oct 21, 1999

Sold by

Stan Strayer C and Stan Greorgeana J

Bought by

Wilcox Heidi L and Wilcox Jeffrey C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,600

Interest Rate

7.78%

Purchase Details

Closed on

Jun 22, 1993

Purchase Details

Closed on

May 1, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Michael Janet V | $88,000 | Landsel Title Box | |

| Mess Steven A | $80,000 | Land Sel Ti | |

| Mess Elizabeth A | $59,900 | Midland Celtic Title | |

| Wilcox Heidi L | $48,000 | -- | |

| -- | $39,500 | -- | |

| -- | $40,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Michael Janet V | $70,400 | |

| Previous Owner | Mess Elizabeth A | $47,920 | |

| Previous Owner | Wilcox Heidi L | $40,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,016 | $44,910 | $12,250 | $32,660 |

| 2023 | $1,990 | $44,910 | $12,250 | $32,660 |

| 2022 | $1,443 | $27,830 | $3,430 | $24,400 |

| 2021 | $1,446 | $27,830 | $3,430 | $24,400 |

| 2020 | $1,448 | $27,830 | $3,430 | $24,400 |

| 2019 | $1,206 | $19,880 | $2,450 | $17,430 |

| 2018 | $617 | $19,880 | $2,450 | $17,430 |

| 2017 | $1,236 | $19,880 | $2,450 | $17,430 |

| 2016 | $1,347 | $19,820 | $3,890 | $15,930 |

| 2015 | $613 | $19,820 | $3,890 | $15,930 |

| 2014 | $1,229 | $19,820 | $3,890 | $15,930 |

| 2013 | $712 | $23,275 | $4,550 | $18,725 |

Source: Public Records

Map

Nearby Homes

- 1540 Slade Ave Unit 303

- 5363 Godown Rd

- 5111 Portland St

- 1246 Southport Dr

- 5111 Schuylkill St

- 1213 Nantucket Ave

- 1505 Eastmeadow Place

- 1558 Denbigh Dr

- 1739 Paula Dr Unit 1739

- 1161 Bethel Rd Unit 103/104

- 1147 Langland Dr

- 1466 Weybridge Rd

- 4818 -4820 Winterset Dr

- 5773 Middlefield Dr

- 4924 Reed Rd Unit B

- 5016 Postlewaite Rd Unit 5016

- 1865 Willoway Cir N Unit 1865

- 1835 Willoway Cir N

- 5268 Captains Ct

- 962 Augusta Glen Dr

- 1530 Slade Ave Unit 131

- 1530 Slade Ave

- 1530 Slade Ave Unit 129

- 1530 Slade Ave Unit 130

- 1530 Slade Ave Unit 122

- 1530 Slade Ave Unit 203

- 1530 Slade Ave Unit 204

- 1530 Slade Ave Unit 202

- 1530 Slade Ave

- 1530 Slade Ave Unit 304

- 1530 Slade Ave Unit 104

- 1530 Slade Ave Unit 121

- 1530 Slade Ave Unit 102

- 1530 Slade Ave Unit 303

- 1530 Slade Ave Unit 301

- 1530 Slade Ave Unit 302

- 1520 Slade Ave Unit 137

- 1520 Slade Ave Unit 142

- 1520 Slade Ave

- 1520 Slade Ave Unit 204