15301 Royal Tern Blvd Mascotte, FL 34753

Estimated Value: $341,000 - $362,154

3

Beds

3

Baths

1,929

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 15301 Royal Tern Blvd, Mascotte, FL 34753 and is currently estimated at $350,289, approximately $181 per square foot. 15301 Royal Tern Blvd is a home located in Lake County with nearby schools including Groveland Elementary School, Gray Middle School, and South Lake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2020

Sold by

Starlight Homes Florida Llc

Bought by

Galindez Jose Luis and Sanchez Juana Cecilia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,500

Outstanding Balance

$210,340

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$139,949

Purchase Details

Closed on

Dec 1, 2016

Bought by

Starlight Homes Florida Llc

Purchase Details

Closed on

Jul 10, 2013

Sold by

Bay Lake Estates Of Mascotte Inc

Bought by

Trilogy Land Holdings Llc and Legacy Land Partners Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$875,000

Interest Rate

3.91%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Galindez Jose Luis | $250,000 | Fidelity Natl Ttl Of Fl Inc | |

| Starlight Homes Florida Llc | $3,656,300 | -- | |

| Trilogy Land Holdings Llc | $1,750,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Galindez Jose Luis | $237,500 | |

| Previous Owner | Trilogy Land Holdings Llc | $875,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,189 | $300,772 | $87,600 | $213,172 |

| 2024 | $5,189 | $300,772 | $87,600 | $213,172 |

| 2023 | $5,189 | $293,879 | $87,600 | $206,279 |

| 2022 | $4,652 | $250,679 | $44,400 | $206,279 |

| 2021 | $4,239 | $195,973 | $0 | $0 |

| 2020 | $4,349 | $195,973 | $0 | $0 |

| 2019 | $4,346 | $190,777 | $0 | $0 |

| 2018 | $4,015 | $184,110 | $0 | $0 |

| 2017 | $509 | $21,840 | $0 | $0 |

| 2016 | $317 | $12,480 | $0 | $0 |

| 2015 | $330 | $12,480 | $0 | $0 |

| 2014 | $298 | $12,480 | $0 | $0 |

Source: Public Records

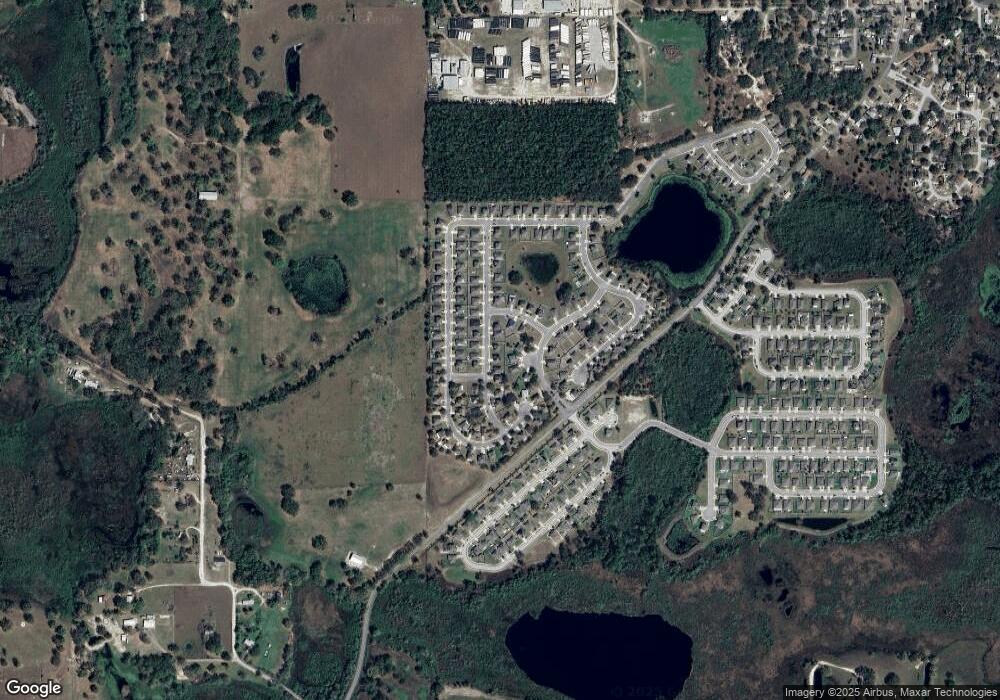

Map

Nearby Homes

- 15507 Willet Ct

- 15519 Willet Ct

- 15610 Merlin Ave

- 15216 Langsdale Ct

- 15309 Scorpio St

- 15411 Taurus Ct

- 15290 Aquarius Way

- 1616 Blue Lagoon Cir

- 1567 Sugarbelle Cir

- 2730 State Road 50

- 1838 Blue Lagoon Cir

- 392 Eventide Ave

- 1790 Blue Lagoon Cir

- 1784 Blue Lagoon Cir

- 416 Eventide Ave

- 1778 Blue Lagoon Cir

- 1772 Blue Lagoon Cir

- 428 Eventide Ave

- 0 Knight St

- 427 Shoreview Sands Ave

- 15804 Surfbird Ct

- 15317 Royal Tern Blvd

- 15808 Surfbird Ct

- 15800 Surfbird Ct

- 15321 Royal Tern Blvd

- 15812 Surfbird Ct

- 15300 Boulevard

- 15300 Royal Tern Blvd

- 15316 Royal Tern Blvd

- 15502 Willet Ct

- 15816 Surfbird Ct

- 15323 Royal Tern Blvd

- 15312 Boulevard

- 15308 Royal Tern Blvd

- 15312 Royal Tern Blvd

- 15801 Surfbird Ct

- 15304 Royal Tern Blvd

- 15504 Willet Ct

- 15404 Ivory Gull Ln