1534 E 6015 S Salt Lake City, UT 84121

Estimated Value: $498,000 - $616,000

3

Beds

3

Baths

1,563

Sq Ft

$345/Sq Ft

Est. Value

About This Home

This home is located at 1534 E 6015 S, Salt Lake City, UT 84121 and is currently estimated at $539,717, approximately $345 per square foot. 1534 E 6015 S is a home located in Salt Lake County with nearby schools including Woodstock Elementary School, Bonneville Junior High School, and Cottonwood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 2, 2016

Sold by

Quinn Joseph R and Quinn Karen S

Bought by

Quinn Joseph Richard and Quinn Karen Sue

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,500

Outstanding Balance

$334,339

Interest Rate

4.23%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Estimated Equity

$205,378

Purchase Details

Closed on

May 13, 2015

Sold by

Quinn Joseph R and Quinn Karen S

Bought by

Quin Joseph and Living Karen Quinn Joint

Purchase Details

Closed on

Sep 10, 2014

Sold by

Gold Roger Eugene and Gold Linda Kay

Bought by

Quinn Joseph R and Quinn Karen S

Purchase Details

Closed on

Dec 7, 2000

Sold by

Gold Mary Beth E

Bought by

Gold Noel E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Quinn Joseph Richard | -- | Meridian Title | |

| Quin Joseph | -- | Pioneer Title Ins Agcy | |

| Quinn Joseph R | -- | Backman Title Services | |

| Gold Noel E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Quinn Joseph Richard | $412,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $484 | $434,500 | $130,300 | $304,200 |

| 2024 | $484 | $416,600 | $125,000 | $291,600 |

| 2023 | $473 | $397,400 | $119,200 | $278,200 |

| 2022 | $852 | $427,600 | $128,300 | $299,300 |

| 2021 | $636 | $350,000 | $105,000 | $245,000 |

| 2020 | $891 | $341,700 | $102,500 | $239,200 |

| 2019 | $868 | $321,000 | $96,300 | $224,700 |

| 2018 | $1,037 | $309,100 | $92,700 | $216,400 |

| 2017 | $1,542 | $279,400 | $83,800 | $195,600 |

| 2016 | $1,368 | $253,300 | $76,000 | $177,300 |

| 2015 | $1,383 | $241,000 | $72,300 | $168,700 |

| 2014 | $1,718 | $238,600 | $71,600 | $167,000 |

Source: Public Records

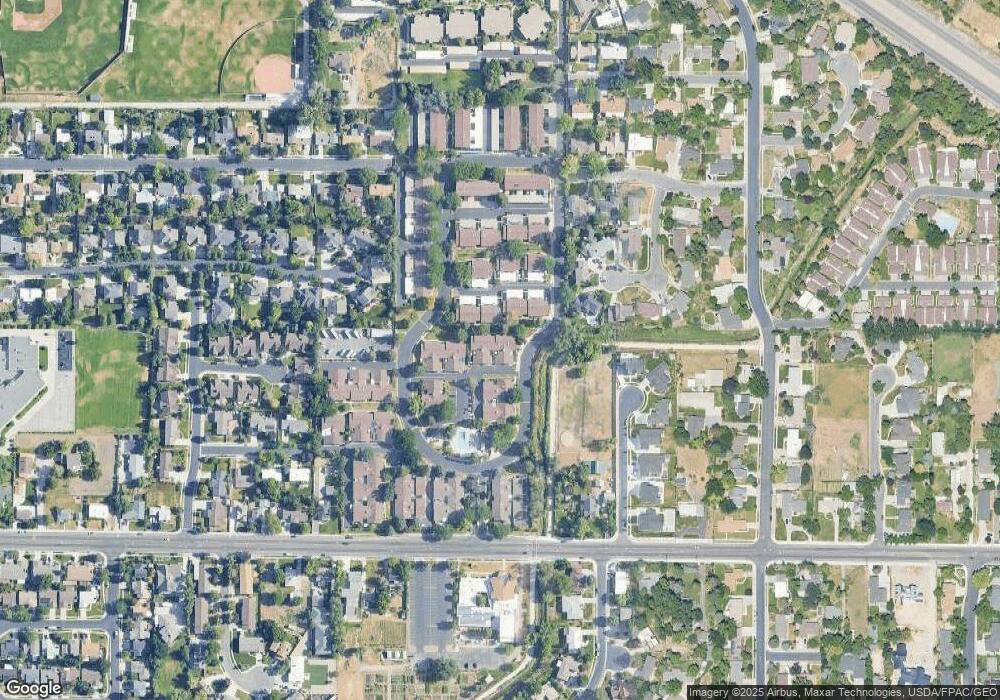

Map

Nearby Homes

- 1525 E Waterbury Dr Unit B

- 5820 S Waterbury Way Unit H

- 5809 S Waterbury Dr Unit D

- 1456 E 5935 S

- 1440 E 5935 S

- 5841 S Fontaine Bleu Cir

- 5680 S 1560 E

- 5711 S Park Place W

- 1639 E Saint James Place

- 5895 S Denarles Cir

- 1269 Woodstock Ave

- 6197 Rodeo Ln

- 1460 E Vintry Cir

- 1369 E Farm Hill Dr

- 5588 S Farm Hill Dr

- 1364 Old Maple Ct

- 1555 E Winward Dr

- 1963 E Charleston Ln

- 6294 S Lombardy Dr

- 1358 E Maplewood Cir

- 1534 E 6015 S Unit 43

- 5916 S 1490 E

- 5916 S 1490 E Unit 94H

- 1544 E 5975 S

- 5912 S 1490 E Unit 93

- 5900 S 1490 E

- 5904 S 1490 E

- 5908 S 1490 E

- 5896 S 1490 E

- 5908 S 1490 E Unit 92 H

- 1528 E 6015 S

- 1528 E 6015 S Unit 42

- 1542 E 6015 S

- 1506 Village 3 Rd

- 5911 S 1490 E

- 5944 S Village 3 Rd

- 5903 S 1490 E

- 1512 E 5930 S

- 1503 E 6015 S

- 1455 E 5935 S