1536 E Meadow Bluff Ln Unit 44 Draper, UT 84020

Estimated Value: $2,061,000 - $2,207,000

4

Beds

4

Baths

3,466

Sq Ft

$614/Sq Ft

Est. Value

About This Home

This home is located at 1536 E Meadow Bluff Ln Unit 44, Draper, UT 84020 and is currently estimated at $2,129,070, approximately $614 per square foot. 1536 E Meadow Bluff Ln Unit 44 is a home located in Salt Lake County with nearby schools including Oak Hollow School, Draper Park Middle School, and Corner Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 24, 2023

Sold by

Baker Brian T and Rosa Elizabeth

Bought by

Austin Revocable Living Trust

Current Estimated Value

Purchase Details

Closed on

Aug 25, 2016

Sold by

Chapman Scott E

Bought by

Baker Brian T and Baker Rosa Elizabeth

Purchase Details

Closed on

May 25, 2005

Sold by

Andersen Robert W

Bought by

Chapman Scott E

Purchase Details

Closed on

Jan 22, 2005

Sold by

Lewis Timothy L and Lewis Michelle L

Bought by

Suncrest Owners Assn Inc

Purchase Details

Closed on

Jul 28, 2004

Sold by

Suncrest Llc

Bought by

Andersen Robert W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$495,000

Interest Rate

5.92%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Austin Revocable Living Trust | -- | Truly Title | |

| Baker Brian T | -- | Cottonwood Title | |

| Chapman Scott E | -- | Cottonwood Title Ins Agency | |

| Suncrest Owners Assn Inc | -- | First American Title | |

| Andersen Robert W | -- | United Title Services |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Andersen Robert W | $495,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,511 | $1,989,900 | $455,000 | $1,534,900 |

| 2024 | $9,511 | $1,691,400 | $428,500 | $1,262,900 |

| 2023 | $9,452 | $1,669,000 | $386,800 | $1,282,200 |

| 2022 | $8,710 | $1,489,000 | $379,200 | $1,109,800 |

| 2021 | $7,909 | $1,191,600 | $284,400 | $907,200 |

| 2020 | $7,313 | $1,042,000 | $231,500 | $810,500 |

| 2019 | $7,255 | $1,010,300 | $216,300 | $794,000 |

| 2018 | $6,147 | $872,000 | $206,800 | $665,200 |

| 2017 | $2,656 | $198,200 | $198,200 | $0 |

| 2016 | $1,685 | $122,000 | $122,000 | $0 |

| 2015 | $1,635 | $109,800 | $109,800 | $0 |

| 2014 | $1,698 | $116,500 | $116,500 | $0 |

Source: Public Records

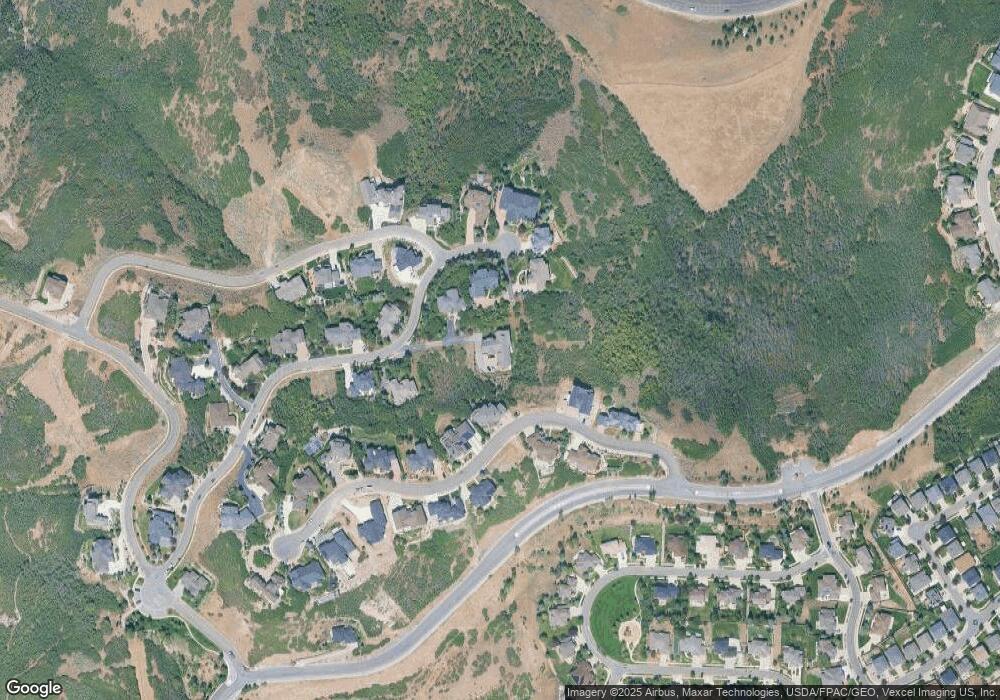

Map

Nearby Homes

- 1547 E Deer Ridge Dr Unit 85

- 1515 E Bluff Point Dr

- 1463 Meadow Bluff Ln Unit 66

- 1487 E Deer Ridge Dr

- 1459 E Meadow Bluff Ln

- 1795 E Walnut Grove Dr

- 15095 Alder Glen Ln

- 1297 E Fawn Pointe Ct

- 14902 S Saddle Leaf Ct

- 1870 E Oak Bend Dr

- 14849 S Saddle Leaf Ct

- 1871 E Vista Ridge Ct

- 14848 S Seven Oaks Ln

- 14738 S Woods Landing Ct

- 14708 S Woods Landing Ct

- 14678 S Woods Landing Ct

- 1945 E Seven Oaks Ln

- 14820 S Shadow Grove Ct

- 1263 E Wild Maple Ct

- 15211 S Tall Woods Dr Unit 24

- 1536 E Meadow Bluff Ln

- 1536 E Meadow Bluff Ln

- 1536 E Meadow Bluff Ln Unit 44

- 1559 Trail Crest Ct

- 1565 E Trail Crest Ct

- 1565 E Trail Crest Ct Unit 18

- 1532 E Meadow Bluff Ln S Unit 45

- 1547 Trail Crest Ct

- 1572 E Granite Brook Ct S

- 1562 E Granite Brook Ct

- 1542 E Meadow Bluff Ln

- 1542 Meadow Bluff Ln

- 1572 E Granite Brook Ct Unit 41

- 1572 E Granite Brook Ct

- 1535 Trail Crest Ct

- 1535 E Trail Crest Ct

- 1522 Meadow Bluff Ln

- 1522 E Meadow Bluff Ln

- 1583 E Trail Crest Ct

- 1572 E Trail Crest Ct