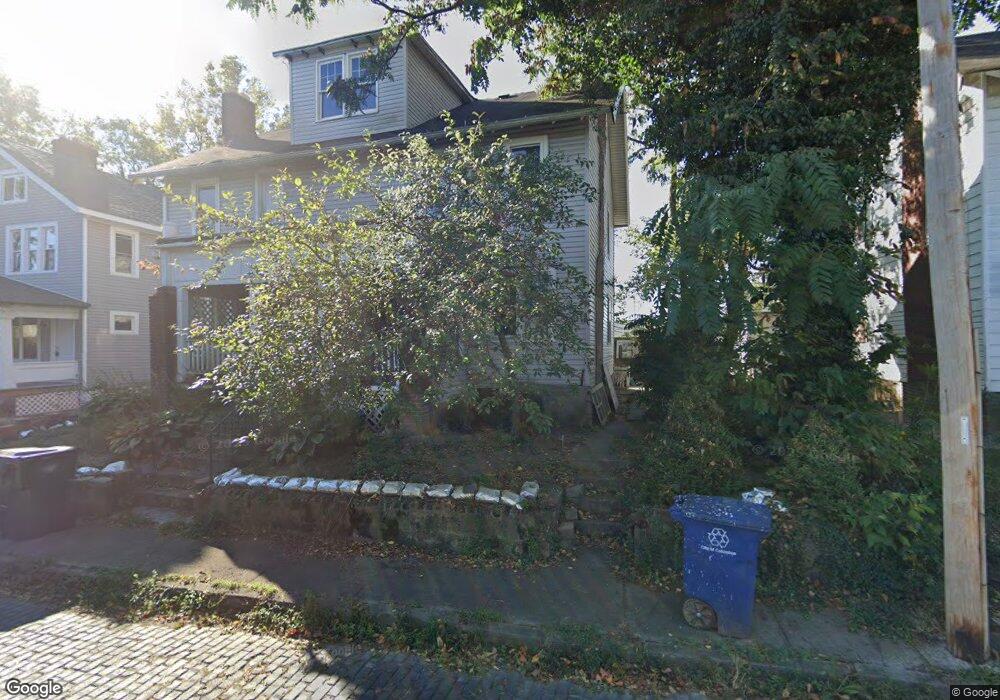

1537 E Rich St Unit 1539 Columbus, OH 43205

Franklin Park NeighborhoodEstimated Value: $352,000 - $475,683

4

Beds

2

Baths

2,405

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 1537 E Rich St Unit 1539, Columbus, OH 43205 and is currently estimated at $419,671, approximately $174 per square foot. 1537 E Rich St Unit 1539 is a home located in Franklin County with nearby schools including Ohio Avenue Elementary School, Champion Middle School, and East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 15, 2024

Sold by

Ne Business Llc

Bought by

Johns Katherine Lynn and Johns Obinna

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$427,500

Outstanding Balance

$421,191

Interest Rate

6.61%

Mortgage Type

Construction

Estimated Equity

-$1,520

Purchase Details

Closed on

Sep 12, 2023

Sold by

Rjr Phoenix Construction Group Llc

Bought by

Ne Business Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,259

Interest Rate

7.09%

Purchase Details

Closed on

Mar 8, 2019

Sold by

Estate Of Elizabeth A Frost

Bought by

Frost Earle R

Purchase Details

Closed on

Sep 27, 1996

Sold by

Scott Lynnette M

Bought by

Frost Earle R

Purchase Details

Closed on

May 3, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johns Katherine Lynn | $450,000 | Empora Title | |

| Ne Business Llc | -- | Empora Title | |

| Frost Earle R | -- | None Available | |

| Frost Earle R | $6,200 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johns Katherine Lynn | $427,500 | |

| Previous Owner | Ne Business Llc | $77,259 | |

| Previous Owner | Ne Business Llc | $191,070 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,221 | $70,280 | $15,400 | $54,880 |

| 2023 | $1,944 | $39,830 | $15,400 | $24,430 |

| 2022 | $143 | $1,860 | $1,440 | $420 |

| 2021 | $209 | $1,860 | $1,440 | $420 |

| 2020 | $99 | $1,860 | $1,440 | $420 |

| 2019 | $96 | $1,540 | $1,190 | $350 |

| 2018 | $209 | $1,540 | $1,190 | $350 |

| 2017 | $1,320 | $1,580 | $1,190 | $390 |

| 2016 | $398 | $5,220 | $2,350 | $2,870 |

| 2015 | $323 | $5,220 | $2,350 | $2,870 |

| 2014 | $324 | $5,220 | $2,350 | $2,870 |

| 2013 | $167 | $5,460 | $2,450 | $3,010 |

Source: Public Records

Map

Nearby Homes

- 1555 E Rich St Unit 557

- 356 Miller Ave

- 1230 E Main St

- 1673 E Main St

- 1571 Franklin Ave

- 1591 Franklin Ave

- 1513 Franklin Ave

- 362 Loeffler Ave

- 336 Loeffler Ave

- 266 Miller Ave Unit 268

- 1596 Franklin Ave Unit 598

- 395-397 Stoddart Ave

- 1455 Franklin Ave

- 238-240 Miller Ave

- 1692 Bryden Rd

- 1468 E Fulton St

- 939 E Rich St

- 1469 E Rich St

- 1669-1671 Oak St

- 838 Bryden Rd

- 1537 E Rich St Unit 539

- 1547 E Rich St Unit 549

- 1547 E Rich St

- 1533 E Rich St Unit 535

- 396 Kelton Ave

- 1551 E Rich St

- 404-406 Kelton Ave Unit B

- 404-406 Kelton Ave Unit A

- 404 Kelton Ave

- 404 Kelton Ave Unit B

- 404 Kelton Ave Unit C

- 404 Kelton Ave Unit A

- 1555 E Rich St Unit 57

- 1555-1557 E Rich St

- 1555 Rich St

- 406 Kelton Ave

- 406 Kelton Ave Unit E

- 406 Kelton Ave Unit D

- 406 Kelton Ave Unit E

- 406 Kelton Ave Unit F