15383 S Wave Rd Mulino, OR 97042

Estimated Value: $561,000 - $641,000

2

Beds

2

Baths

1,150

Sq Ft

$523/Sq Ft

Est. Value

About This Home

This home is located at 15383 S Wave Rd, Mulino, OR 97042 and is currently estimated at $601,339, approximately $522 per square foot. 15383 S Wave Rd is a home located in Clackamas County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2016

Sold by

Reasoner Jeffrey A and Reasoner Cindy S

Bought by

Newman Camron Edwin and Newman Christina Mary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,600

Outstanding Balance

$191,556

Interest Rate

4.62%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$409,783

Purchase Details

Closed on

Apr 11, 2008

Sold by

Miller Gary

Bought by

Reasoner Jeffrey A and Reasoner Cindy S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,750

Interest Rate

6.22%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 13, 2007

Sold by

Winfrey Charlotte L

Bought by

Miller Gary

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newman Camron Edwin | $174,000 | First American | |

| Reasoner Jeffrey A | $173,000 | Transnation Title Agency Or | |

| Miller Gary | $150,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Newman Camron Edwin | $233,600 | |

| Previous Owner | Reasoner Jeffrey A | $129,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,449 | $249,183 | -- | -- |

| 2024 | $3,330 | $241,926 | -- | -- |

| 2023 | $3,330 | $234,880 | $0 | $0 |

| 2022 | $2,791 | $228,039 | $0 | $0 |

| 2021 | $2,667 | $221,398 | $0 | $0 |

| 2020 | $2,595 | $214,950 | $0 | $0 |

| 2019 | $2,522 | $208,690 | $0 | $0 |

| 2018 | $2,454 | $202,612 | $0 | $0 |

| 2017 | $2,321 | $196,711 | $0 | $0 |

| 2016 | $1,234 | $105,486 | $0 | $0 |

| 2015 | $1,201 | $102,414 | $0 | $0 |

| 2014 | $1,164 | $99,431 | $0 | $0 |

Source: Public Records

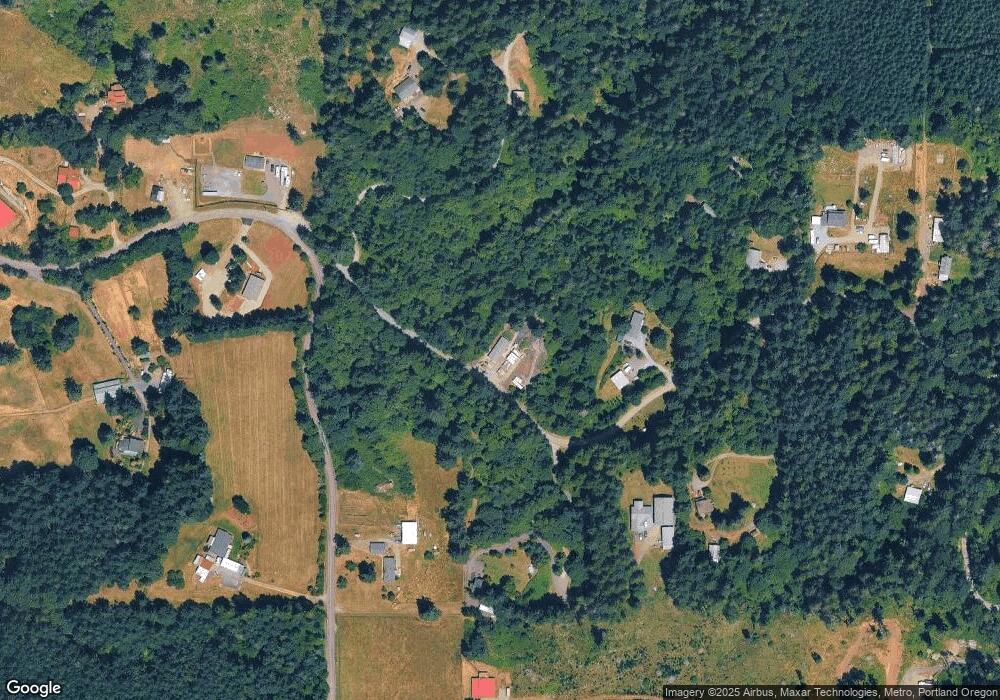

Map

Nearby Homes

- 15693 S Hidden Rd

- 26250 S Milk Creek Cir

- 14980 S Buckner Creek Rd

- 16428 S Buckner Creek Rd

- 0000 S Buckner Creek Rd

- 13920 S Lucia Ln

- 15441 S Union Mills Rd

- 14001 S Union Mills Rd

- 28381 S Salo Rd

- 13511 S Freeman Rd

- 26740 S Fish Rd

- 28502 S Highway 213

- 28502 Oregon 213

- 26684 S Fish Rd

- 29333 S Marshall Rd

- 15678 S Spangler Rd

- 24450 S Highway 213

- 26394 S Gard Rd

- 23501 S Beatie Rd

- 12192 S Mulino Rd

- 15405 S Wave Rd

- 15231 S Howards Mill Rd

- 15424 S Wave Rd

- 15398 S Wave Rd

- 15460 S Wave Rd

- 15475 S Wave Rd

- 26727 S Burns Rd

- 15211 S Howards Mill Rd

- 15202 S Howards Mill Rd

- 15232 S Howards Mill Rd

- 15505 S Wave Rd

- 26621 S Burns Rd

- 15151 S Howards Mill Rd

- 15100 S Howards Mill Rd

- 15610 S Wave Rd

- 15575 S Wave Rd

- 15303 S Howards Mill Rd

- 15125 S Howards Mill Rd

- 0 S Wave Rd

- 26585 S Burns Rd