15400 High Point Ct SW Cumberland, MD 21502

Estimated Value: $301,000 - $352,000

--

Bed

3

Baths

2,560

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 15400 High Point Ct SW, Cumberland, MD 21502 and is currently estimated at $325,272, approximately $127 per square foot. 15400 High Point Ct SW is a home located in Allegany County with nearby schools including Bel Air Elementary School, Washington Middle School, and Fort Hill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 11, 2020

Sold by

Wendell Kenneth L and Wendell Carol A

Bought by

Wendell Kenneth L and Wendell Carol A

Current Estimated Value

Purchase Details

Closed on

Jun 3, 1985

Sold by

Fix Randall C-Dianne M

Bought by

Wendell Kenneth L-Carol A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,000

Interest Rate

12.71%

Purchase Details

Closed on

Sep 28, 1983

Sold by

Sanders James R

Bought by

Fix Randall C-Dianne M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,000

Interest Rate

13.72%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wendell Kenneth L | -- | None Available | |

| Wendell Kenneth L-Carol A | $118,500 | -- | |

| Fix Randall C-Dianne M | $112,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Wendell Kenneth L-Carol A | $63,000 | |

| Previous Owner | Fix Randall C-Dianne M | $65,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,441 | $285,100 | $57,200 | $227,900 |

| 2024 | $3,147 | $260,700 | $0 | $0 |

| 2023 | $2,569 | $236,300 | $0 | $0 |

| 2022 | $2,558 | $211,900 | $43,700 | $168,200 |

| 2021 | $2,526 | $211,200 | $0 | $0 |

| 2020 | $2,541 | $210,500 | $0 | $0 |

| 2019 | $2,532 | $209,800 | $43,700 | $166,100 |

| 2018 | $2,532 | $209,800 | $43,700 | $166,100 |

| 2017 | $2,534 | $209,800 | $0 | $0 |

| 2016 | -- | $213,000 | $0 | $0 |

| 2015 | -- | $213,000 | $0 | $0 |

| 2014 | -- | $213,000 | $0 | $0 |

Source: Public Records

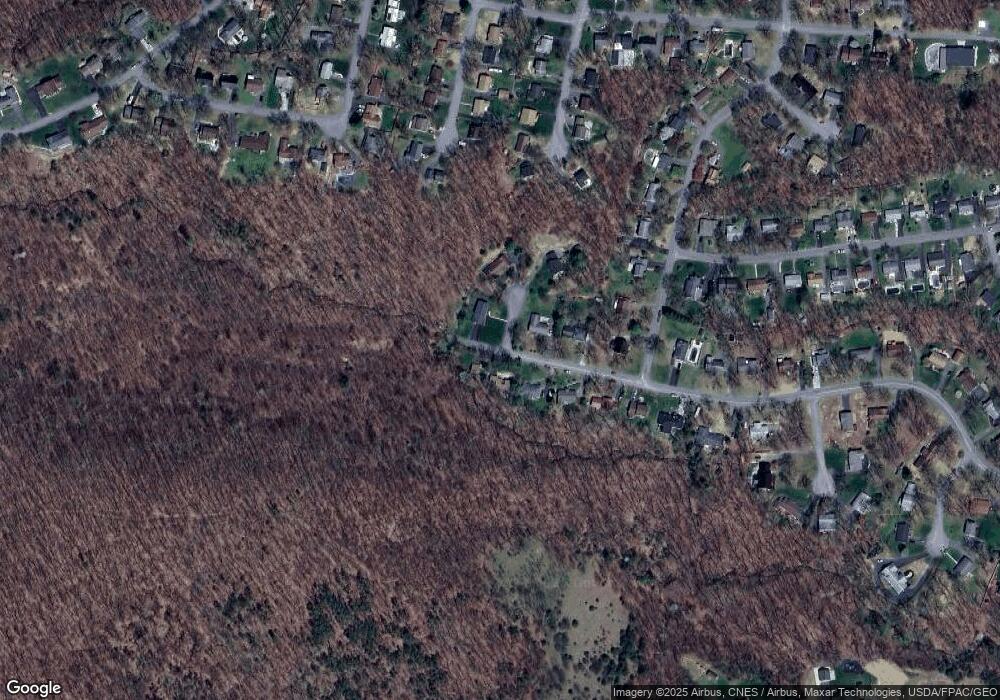

Map

Nearby Homes

- 15008 Laurel Ridge Rd SW

- 15507 Ivy Ct SW

- 15609 Westwood Rd SW

- 15509 Westwood Rd SW

- 15700 Acorn Ct SW

- 14407 N Bel Air Dr SW

- 14308L Greenfield Crescent SW

- 15708 Downing St SW

- 14219 N Bel Air Dr SW

- 14200 Stonefield Ln

- 14211 Sparrow Ln SW

- 14129 Louise Dr SW

- 14104 Louise Dr SW

- 14003 Cedarwood Dr SW

- 11813 Illinois Ave

- 14801 Connecticut Ave

- 0 Fir Tree Ln Unit MDAL2012106

- 14619 Redwood St

- 13813 Maple Tree Ln SW

- 14620 Redwood St

- 14903 N Bel Air Dr SW

- 14905 N Bel Air Dr SW

- 15403 High Point Ct SW

- 15401 Brandywine Dr SW

- 15403 Brandywine Dr SW

- 15313 Brandywine Dr SW

- 14912 Viewcrest Rd SW

- 14911 Viewcrest Rd SW

- 14901 N Bel Air Dr SW

- 15405 High Point Ct SW

- 14909 N Bel Air Dr SW

- 15311 Brandywine Dr SW

- 14909 Viewcrest Rd SW

- 15402 Brandywine Dr SW

- 14908 Viewcrest Rd SW

- 15309 Brandywine Dr SW

- 15404 Brandywine Dr SW

- 14900 N Bel Air Dr SW

- 14805 Mcgill Dr SW

- 14904 N Bel Air Dr SW