15411 75th St Bristol, WI 53104

Estimated Value: $552,000 - $635,000

3

Beds

2

Baths

1,352

Sq Ft

$431/Sq Ft

Est. Value

About This Home

This home is located at 15411 75th St, Bristol, WI 53104 and is currently estimated at $582,708, approximately $430 per square foot. 15411 75th St is a home located in Kenosha County with nearby schools including Bristol Elementary School, Central High School, and Christian Life School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2017

Sold by

Lindom Julie A and Lindom Douglas A

Bought by

Hirschmann Thomas J and Hirschmann Jennifer L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,250

Outstanding Balance

$235,392

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$347,316

Purchase Details

Closed on

Nov 15, 2005

Sold by

Lindom Douglas A

Bought by

Lindom Julie A and Lindom Douglas A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

6.13%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hirschmann Thomas J | $295,000 | Knight Barry Title | |

| Lindom Julie A | -- | Lakeside Title And Closing S |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hirschmann Thomas J | $280,250 | |

| Previous Owner | Lindom Julie A | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,974 | $321,700 | $135,600 | $186,100 |

| 2023 | $5,076 | $321,700 | $135,600 | $186,100 |

| 2022 | $5,094 | $321,700 | $135,600 | $186,100 |

| 2021 | $5,263 | $321,700 | $135,600 | $186,100 |

| 2020 | $5,263 | $321,700 | $135,600 | $186,100 |

| 2019 | $4,961 | $321,700 | $135,600 | $186,100 |

| 2018 | $4,592 | $221,000 | $98,000 | $123,000 |

| 2017 | $3,725 | $205,800 | $98,000 | $107,800 |

| 2016 | $4,015 | $205,800 | $98,000 | $107,800 |

| 2015 | $3,752 | $205,800 | $98,000 | $107,800 |

| 2014 | -- | $205,800 | $98,000 | $107,800 |

Source: Public Records

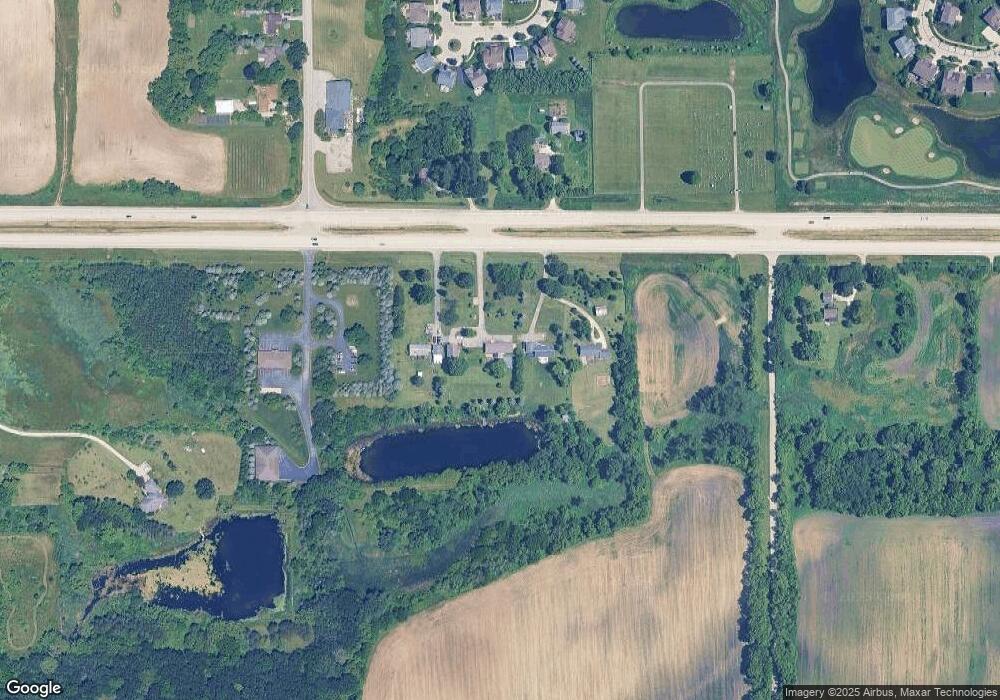

Map

Nearby Homes

- 15014 73rd St

- Lt3 144th Ave

- 14801 60th St

- 0 83rd St Unit MRD12131806

- 8064 130th Ave

- Lt0 122 Ave

- 18901 83rd Place

- 4800 128th Ave

- 18514 75th St

- 7918 Fredricksburg Ct Unit 101

- Lt0 87th St

- 8211 198th Ave

- 10907 62nd St

- 8018 200th Ave

- 6513 108th Ave

- L0 83rd St

- Lt0 75th St

- Lt 0 104th Ave

- 8126 203rd Ave

- 10011 68th St Unit 7