1543 Saint John Dr Madison, OH 44057

Estimated Value: $101,000 - $116,000

3

Beds

1

Bath

600

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 1543 Saint John Dr, Madison, OH 44057 and is currently estimated at $110,165, approximately $183 per square foot. 1543 Saint John Dr is a home located in Lake County with nearby schools including North Elementary School, Madison Middle School, and Madison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2018

Sold by

Hennessey Melvin and Dingle Sandra

Bought by

Thiele P A and D Conner Us 55 Trust

Current Estimated Value

Purchase Details

Closed on

Apr 21, 2005

Sold by

Jp Morgan Chase Bank

Bought by

Hennessey Melvin and Dingle Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,500

Interest Rate

7.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 28, 2005

Sold by

Deskin Timothy J and Deskin Lori

Bought by

Jp Morgan Chase Bank

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,500

Interest Rate

7.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 26, 2002

Sold by

Deskin Timothy J

Bought by

Deskin Timothy J and Deskin Lori

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,200

Interest Rate

8.15%

Purchase Details

Closed on

Jan 1, 1990

Bought by

Deskin Timothy J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thiele P A | $50,000 | None Available | |

| Hennessey Melvin | $52,500 | Resource Title Agency Inc | |

| Jp Morgan Chase Bank | -- | Sovereign Title Agency Llc | |

| Deskin Timothy J | -- | Cresi | |

| Deskin Timothy J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hennessey Melvin | $52,500 | |

| Previous Owner | Deskin Timothy J | $55,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $33,080 | $8,580 | $24,500 |

| 2023 | $2,284 | $20,550 | $6,960 | $13,590 |

| 2022 | $1,317 | $20,550 | $6,960 | $13,590 |

| 2021 | $1,320 | $20,610 | $7,020 | $13,590 |

| 2020 | $1,412 | $17,470 | $5,950 | $11,520 |

| 2019 | $1,270 | $17,470 | $5,950 | $11,520 |

| 2018 | $1,230 | $15,850 | $5,360 | $10,490 |

| 2017 | $1,152 | $15,850 | $5,360 | $10,490 |

| 2016 | $1,051 | $15,850 | $5,360 | $10,490 |

| 2015 | $974 | $15,850 | $5,360 | $10,490 |

| 2014 | $997 | $15,850 | $5,360 | $10,490 |

| 2013 | $999 | $15,850 | $5,360 | $10,490 |

Source: Public Records

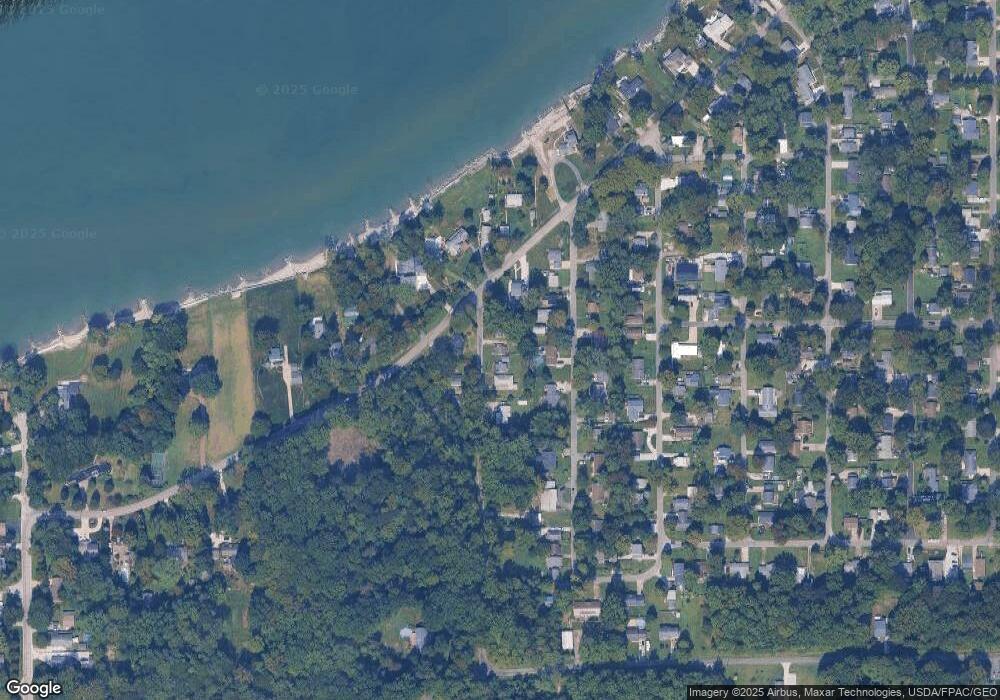

Map

Nearby Homes

- 1548 Rosena Ave

- 0 Indianola

- V/L Magnolia #12 Dr

- V/L Magnolia #14 Dr

- V/L Magnolia #15 Dr

- V/L Magnolia #13 Dr

- V/L Magnolia #16 Dr

- V/L Magnolia #11 Dr

- V/L Magnolia #17 Dr

- V/L Magnolia #18 Dr

- 1500 Easton Ave

- V/L Magnolia #20 Dr

- V/L Magnolia #21 Dr

- V/L Magnolia #19 Dr

- V/L Magnolia #23 Dr

- 1628 Red Bird Rd

- 1625 Travers Rd

- 1826 Hubbard Rd

- 6713 Dave Dr

- 6242 Maxwell Dr

- 1539 Saint John Dr

- 1549 Saint John Dr

- 1557 Saint John Dr

- 6472 Lake Rd

- 1546 Grove Ave

- 1536 Grove Ave

- 6460 Lake Rd

- 1550 Grove Ave

- 6478 Lake Rd

- 1532 Grove Ave

- 1565 Saint John Dr

- 1554 Saint John Dr

- 1560 Saint John Dr

- 1528 Grove Ave

- 1569 Saint John Dr

- 1541 Grove Ave

- 1533 Grove Ave

- 1529 Grove Ave

- 6486 Lake Rd

- 1547 Grove Ave