1544 Morning Rose Place Unit 1 Trinity, FL 34655

Estimated Value: $420,455 - $469,000

3

Beds

2

Baths

2,672

Sq Ft

$167/Sq Ft

Est. Value

About This Home

This home is located at 1544 Morning Rose Place Unit 1, Trinity, FL 34655 and is currently estimated at $447,114, approximately $167 per square foot. 1544 Morning Rose Place Unit 1 is a home located in Pasco County with nearby schools including Trinity Elementary School, Seven Springs Middle School, and James W. Mitchell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 21, 2015

Sold by

Gibson Stephen K and Gibson Kathy A

Bought by

Gibson Stephen K and Gibson Kathy T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$415,500

Outstanding Balance

$318,921

Interest Rate

3.34%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Estimated Equity

$128,193

Purchase Details

Closed on

Jul 2, 2013

Sold by

Roemer Edward D and Roemer Betty L

Bought by

Gibson Stephen K and Gibson Kathy A

Purchase Details

Closed on

Apr 4, 2011

Sold by

Parker Angela A and Parker Warren O

Bought by

Roemer Edward D and Roemer Betty L

Purchase Details

Closed on

May 30, 2003

Sold by

Us Home Corp

Bought by

Parker Warren C and Parker Angela A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$193,450

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gibson Stephen K | -- | Fairview Title Company | |

| Gibson Stephen K | $241,000 | None Available | |

| Roemer Edward D | $230,000 | Sunbelt Title Agency | |

| Parker Warren C | $215,000 | North American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gibson Stephen K | $415,500 | |

| Previous Owner | Parker Warren C | $193,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,587 | $374,399 | $88,353 | $286,046 |

| 2024 | $6,587 | $394,846 | $88,353 | $306,493 |

| 2023 | $6,525 | $328,540 | $0 | $0 |

| 2022 | $5,477 | $349,312 | $80,373 | $268,939 |

| 2021 | $4,808 | $271,527 | $72,076 | $199,451 |

| 2020 | $4,696 | $259,865 | $67,872 | $191,993 |

| 2019 | $4,655 | $249,296 | $67,872 | $181,424 |

| 2018 | $4,523 | $240,649 | $67,872 | $172,777 |

| 2017 | $4,358 | $226,029 | $67,872 | $158,157 |

| 2016 | $4,273 | $220,145 | $67,872 | $152,273 |

| 2015 | $4,199 | $211,221 | $67,872 | $143,349 |

| 2014 | $4,066 | $207,503 | $75,222 | $132,281 |

Source: Public Records

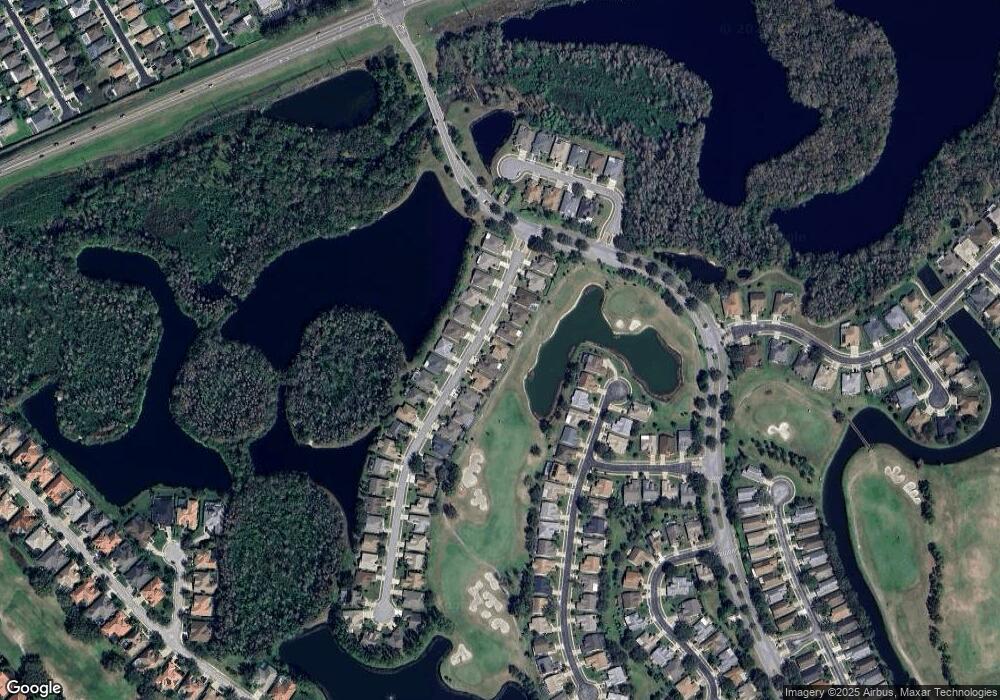

Map

Nearby Homes

- 1517 Morning Rose Place

- 11018 Courtland St

- 1353 El Pardo Dr

- 1311 Eveningside Ct

- 10653 Garda Dr

- 1817 Loch Haven Ct

- 10700 Garda Dr

- 1826 Loch Haven Ct

- 10708 Northridge Ct

- 10639 Ruffino Ct

- 10644 Garda Dr

- 1251 Rambling Vine Ct

- 11247 Wedgemere Dr

- 1231 Flora Vista St

- 10533 Baracoa Ct

- 10516 Peppergrass Ct

- 1208 Flora Vista St

- 1927 Alecost Ct

- 1046 Almondwood Dr

- 1042 Tuscany Dr

- 1550 Morning Rose Place

- 1540 Morning Rose Place

- 1536 Morning Rose Place

- 1554 Morning Rose Place

- 1543 Morning Rose Place

- 1549 Morning Rose Place Unit 1

- 1539 Morning Rose Place

- 1532 Morning Rose Place

- 1553 Morning Rose Place

- 1602 Morning Rose Place

- 1535 Morning Rose Place

- 1601 Morning Rose Place

- 1528 Morning Rose Place

- 1531 Morning Rose Place

- 1607 Morning Rose Place

- 1527 Morning Rose Place

- 1524 Morning Rose Place

- 1614 Morning Rose Place

- 1531 Canberley Ct

- 1525 Canberley Ct