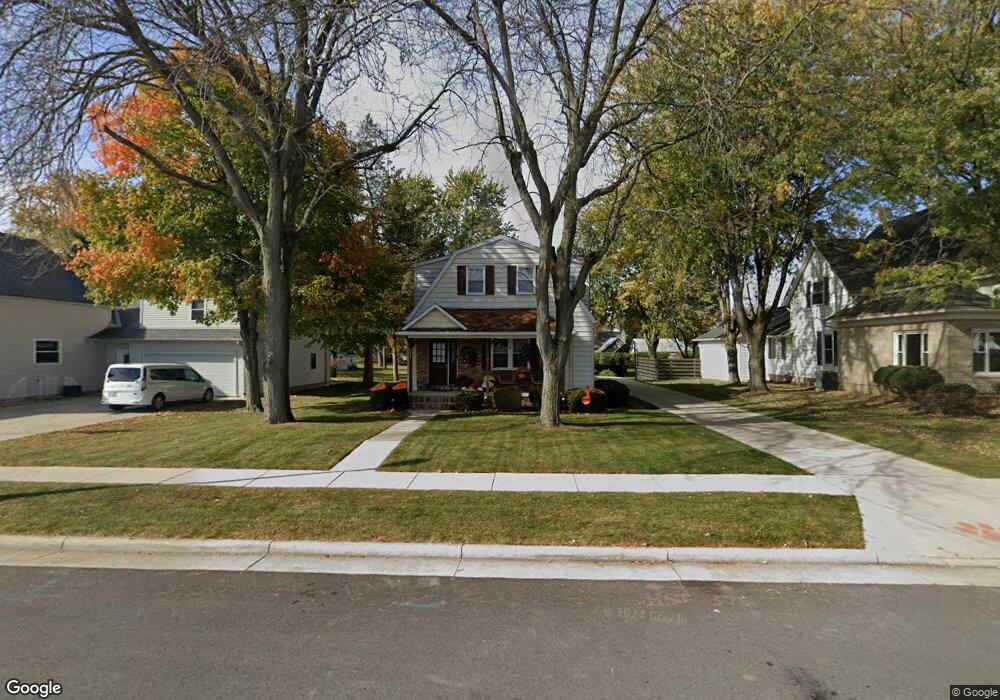

155 N Hanover St Minster, OH 45865

Estimated Value: $302,000 - $342,000

4

Beds

2

Baths

2,492

Sq Ft

$132/Sq Ft

Est. Value

About This Home

This home is located at 155 N Hanover St, Minster, OH 45865 and is currently estimated at $329,995, approximately $132 per square foot. 155 N Hanover St is a home located in Auglaize County with nearby schools including Minster Elementary School and Minster Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2023

Sold by

Niemeyer Bryan A and Niemeyer Tonya F

Bought by

Trego Joseph and Trego Lisa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,928

Outstanding Balance

$148,670

Interest Rate

6.79%

Mortgage Type

FHA

Estimated Equity

$181,325

Purchase Details

Closed on

Apr 28, 2014

Sold by

Niemeyer Bryan A and Niemeyer Tonya F

Bought by

Trego Joe and Trego Lisa

Purchase Details

Closed on

Nov 25, 2008

Sold by

Niemeyer Bryan A and Niemeyer Tonya F

Bought by

Farno John W and Farno Angela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,900

Interest Rate

6.48%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jul 9, 2001

Sold by

Trzaska Steven A

Bought by

Niemeyer Bryan A

Purchase Details

Closed on

Dec 24, 1996

Sold by

Bey Roger L

Bought by

Trzaska Steven A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trego Joseph | $155,666 | None Listed On Document | |

| Trego Joe | $171,900 | None Available | |

| Farno John W | $169,900 | Attorney | |

| Niemeyer Bryan A | $144,800 | -- | |

| Trzaska Steven A | $116,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trego Joseph | $152,928 | |

| Previous Owner | Farno John W | $154,900 | |

| Closed | Trego Joe | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,060 | $87,230 | $15,740 | $71,490 |

| 2024 | $6,060 | $87,230 | $15,740 | $71,490 |

| 2023 | $2,953 | $87,230 | $15,740 | $71,490 |

| 2022 | $2,670 | $73,280 | $14,440 | $58,840 |

| 2021 | $2,728 | $73,280 | $14,440 | $58,840 |

| 2020 | $1,403 | $73,280 | $14,445 | $58,835 |

| 2019 | $2,793 | $60,214 | $11,872 | $48,342 |

| 2018 | $2,806 | $60,214 | $11,872 | $48,342 |

| 2017 | $2,628 | $60,214 | $11,872 | $48,342 |

| 2016 | $2,396 | $52,459 | $10,770 | $41,689 |

| 2015 | $2,375 | $52,459 | $10,770 | $41,689 |

| 2014 | $2,410 | $52,459 | $10,770 | $41,689 |

| 2013 | $2,502 | $52,459 | $10,770 | $41,689 |

Source: Public Records

Map

Nearby Homes

- 17 Stonegate Dr

- 0 Stonegate Dr Unit 14 10544847

- 0 Stonegate Dr Unit 21 10544857

- 194 S Cleveland St

- 36 Shania Place Unit 23

- 28 Shania Place Unit 33

- 19 Shania Place Unit 33

- 27 Shania Place Unit 26

- 2448 Minster Egypt Pike

- 561 S Walnut St Unit Lot3

- 217 S Washington St

- 410 E Cherry St

- 129 Janice Dr

- 319 Margaret St

- 312 Margaret St

- 316 Margaret St

- 323 Margaret St

- 130 Janice Dr

- 133 Janice Dr

- 424 E Plum St

- 163 N Hanover St

- 147 N Hanover St

- 139 N Hanover St

- 171 N Hanover St

- 131 N Hanover St

- 179 N Hanover St

- 156 N Frankfort St

- 7 Melcher St

- 164 N Frankfort St

- 140 N Frankfort St

- 187 N Hanover St

- 19 Melcher St

- 132 N Frankfort St

- 172 N Frankfort St

- 115 N Hanover St

- 115 N Hanover St

- 45 W 6th St

- 39 W 6th St

- 195 N Hanover St

- 31 Melcher St