1550 Cedarwood Dr Unit 4 Westlake, OH 44145

Estimated Value: $187,000 - $233,874

3

Beds

2

Baths

881

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 1550 Cedarwood Dr Unit 4, Westlake, OH 44145 and is currently estimated at $209,719, approximately $238 per square foot. 1550 Cedarwood Dr Unit 4 is a home located in Cuyahoga County with nearby schools including Dover Intermediate School, Lee Burneson Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2023

Sold by

Krummert Robert B and Krummert Joan

Bought by

Stepp Robert Michael and Stepp Elizabeth Joy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,700

Outstanding Balance

$150,654

Interest Rate

6.15%

Mortgage Type

New Conventional

Estimated Equity

$59,065

Purchase Details

Closed on

Sep 11, 2018

Sold by

Talaga Cassidy J

Bought by

Joan Krymert Robert B and Joan Krymert

Purchase Details

Closed on

Jul 6, 2015

Sold by

Miller Alyssa

Bought by

Talaga Cassidy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

4.05%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 24, 2004

Sold by

Miller Arnold

Bought by

Miller Arnold and The Arnold Miller Revocable Trust

Purchase Details

Closed on

May 13, 1986

Sold by

Schlosser Paul T and N J

Bought by

Miller Arnold

Purchase Details

Closed on

Jan 1, 1979

Bought by

Schlosser Paul T and N J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stepp Robert Michael | $173,000 | Miller Home Title | |

| Joan Krymert Robert B | $131,000 | Ohio First Land Title | |

| Talaga Cassidy J | $75,000 | Ohio First Land Title | |

| Miller Arnold | -- | -- | |

| Miller Arnold | $64,000 | -- | |

| Schlosser Paul T | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stepp Robert Michael | $155,700 | |

| Previous Owner | Talaga Cassidy J | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,868 | $60,550 | $5,250 | $55,300 |

| 2023 | $2,345 | $42,320 | $4,240 | $38,080 |

| 2022 | $2,307 | $42,315 | $4,235 | $38,080 |

| 2021 | $2,310 | $42,320 | $4,240 | $38,080 |

| 2020 | $2,152 | $36,160 | $3,610 | $32,550 |

| 2019 | $2,087 | $103,300 | $10,300 | $93,000 |

| 2018 | $2,096 | $36,160 | $3,610 | $32,550 |

| 2017 | $2,106 | $33,850 | $3,400 | $30,450 |

| 2016 | $2,075 | $33,850 | $3,400 | $30,450 |

| 2015 | $3,474 | $33,850 | $3,400 | $30,450 |

| 2014 | $3,474 | $34,900 | $3,500 | $31,400 |

Source: Public Records

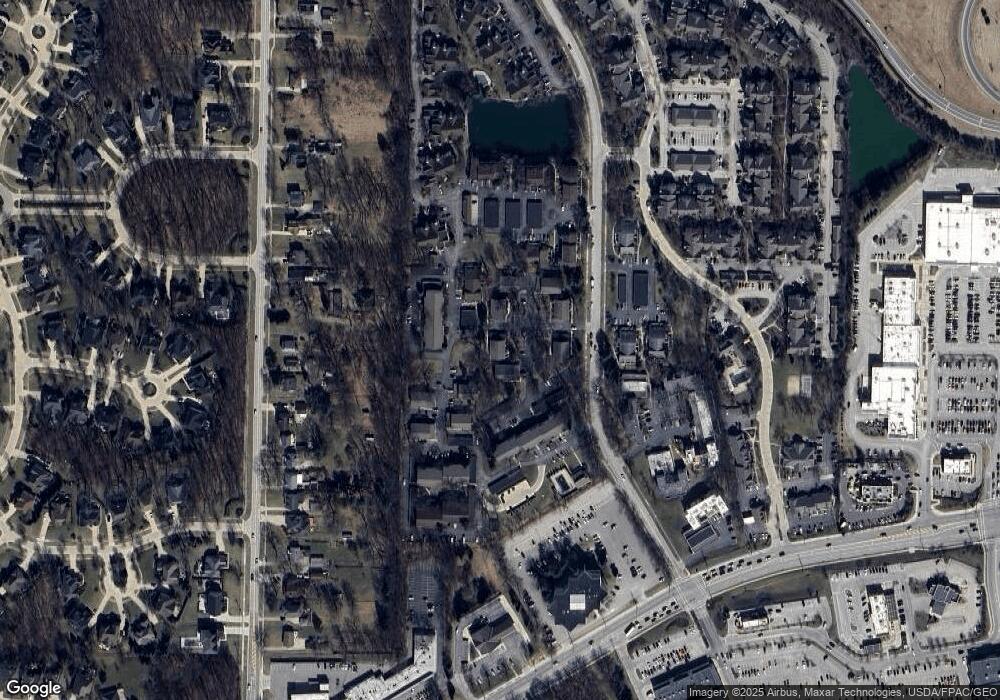

Map

Nearby Homes

- 1510 Alder Ln Unit 7C

- 1480 Cedarwood Dr Unit 21F

- 1670 Cedarwood Dr Unit 148

- 1625 Cedarwood Dr Unit 218

- 1316 Cedarwood Dr Unit D3

- 31000 Logan Ct

- 2066 Bradley Rd

- 1476 Bobby Ln Unit 7

- 29379 Detroit Rd

- 29363 Detroit Rd Unit 5

- 0 Avon Rd Unit 4372753

- 0 Avon Rd Unit 4372752

- 2075 Bassett Rd

- 31035 Wilderness Trail

- 28323 Farrs Garden Path

- 625 Bassett Rd

- 31857 Avon Rd

- 584 Wildbrook Dr

- 32854 Walnut Dr

- 31072 Riviera Ln

- 1560 Cedarwood Dr Unit 11A

- 1560 Cedarwood Dr Unit C

- 1560 Cedarwood Dr

- 1560 Cedarwood Dr Unit 11B

- 1560 Cedarwood Dr Unit 11C

- 1560 Cedarwood Dr Unit A

- 1560 Cedarwood Dr Unit B

- 1560 Cedarwood Dr Unit 1

- 1550 Cedarwood Dr Unit 4

- 1550 Cedarwood Dr Unit 4

- 1550 Cedarwood Dr Unit B

- 1550 Cedarwood Dr Unit D

- 1570 Cedarwood Dr Unit TH3A

- 1570 Cedarwood Dr Unit TH3C

- 1570 Cedarwood Dr Unit 3C

- 1570 Cedarwood Dr Unit 3a

- 1570 Cedarwood Dr Unit 3B

- 1530 Cedarwood Dr Unit TH5D

- 1530 Cedarwood Dr Unit TH5A

- 1530 Cedarwood Dr