15505 Red Mountain Ln Collbran, CO 81624

Estimated Value: $327,000 - $429,000

3

Beds

1

Bath

1,392

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 15505 Red Mountain Ln, Collbran, CO 81624 and is currently estimated at $357,194, approximately $256 per square foot. 15505 Red Mountain Ln is a home located in Mesa County with nearby schools including Plateau Valley Elementary School, Plateau Valley Middle School, and Plateau Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2014

Sold by

York Jeffrey L

Bought by

York Jeffrey L and York Lindsay R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Outstanding Balance

$48,660

Interest Rate

4.35%

Mortgage Type

New Conventional

Estimated Equity

$308,534

Purchase Details

Closed on

Mar 14, 2008

Sold by

Branson York Llc

Bought by

York Jeffrey L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,528

Interest Rate

5.67%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 29, 2006

Sold by

Branson H Hugh and Branson Rose M

Bought by

Branson York Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| York Jeffrey L | -- | None Available | |

| York Jeffrey L | $227,700 | Utc | |

| Branson York Llc | $222,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | York Jeffrey L | $155,000 | |

| Closed | York Jeffrey L | $224,528 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $916 | $16,720 | $5,820 | $10,900 |

| 2023 | $916 | $16,720 | $5,820 | $10,900 |

| 2022 | $951 | $22,010 | $3,820 | $18,190 |

| 2021 | $1,063 | $22,650 | $3,930 | $18,720 |

| 2020 | $725 | $16,070 | $2,500 | $13,570 |

| 2019 | $643 | $16,070 | $2,500 | $13,570 |

| 2018 | $719 | $14,740 | $2,160 | $12,580 |

| 2017 | $696 | $14,740 | $2,160 | $12,580 |

| 2016 | $836 | $17,630 | $2,390 | $15,240 |

| 2015 | $803 | $17,630 | $2,390 | $15,240 |

| 2014 | $767 | $16,740 | $1,990 | $14,750 |

Source: Public Records

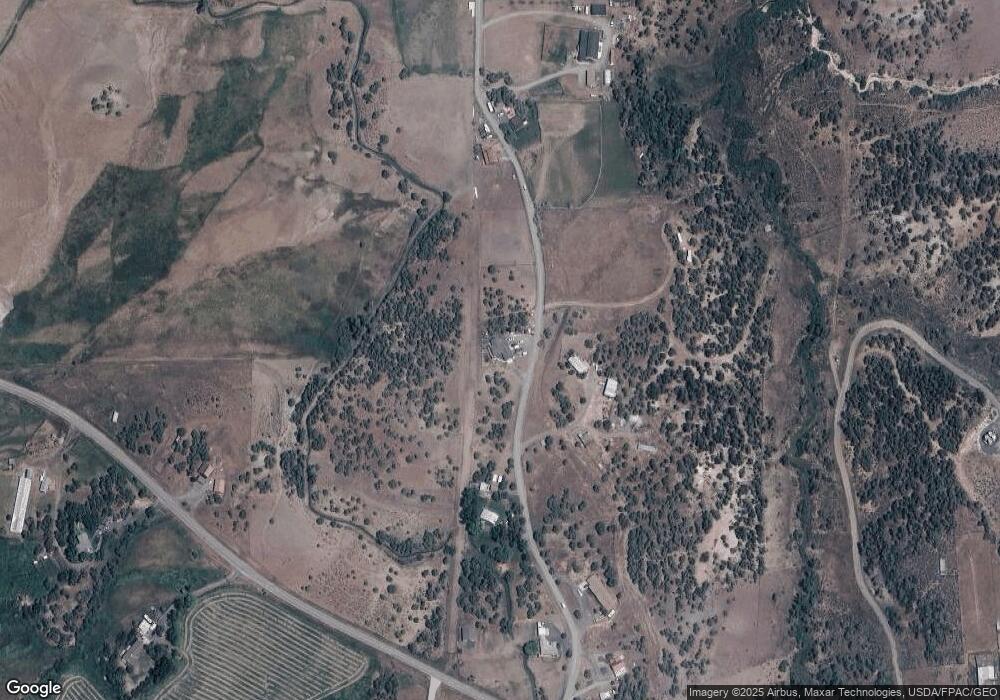

Map

Nearby Homes

- 900 Thistle Ct

- 528 Oakbrush Cir

- 58892 Highway 330 E

- 14600 N Ouray Ct

- 58590 Pe 3 10 Rd

- 14250 S Ouray Ct

- 14495 Scott Loop

- 14495 Scott Loop Unit 23

- 57374 Highway 330

- TBD H Oe Rd

- TBD 56 1 2 Rd

- 18842 58 6 10 Rd

- 18842 Kimball Creek Rd

- 57191 Me Rd

- 56106 Me Rd

- 19106 Kimball Creek Rd

- 62495 Highway 330 E

- 56106 Me Rd

- 56106 Me Rd

- 15452 Red Mountain Ln

- 15397 Red Mountain Ln

- TBD Grove Creek Rd

- 15634 Red Mountain Ln

- 15358 Red Mountain Ln Unit B

- 15337 Red Mountain Ln

- 0 Red Mountain Ln Unit 628453

- 0 Red Mountain Ln Unit 643558

- 0 Red Mountain Ln Unit 678149

- 15426 59 1/2 Rd

- 15426 59 1 2 Rd

- 15734 Red Mountain Ln

- 15252 59 1/2 Rd

- 15252 59 1 2

- 15771 Red Mountain Ln

- 15780 Red Mountain Ln

- 15223 Not Assigned

- 15752 Red Mountain Ln

- 15377 59 1/2 Rd

- 15429 59 1/2 Rd