156 Acker Rd Kalama, WA 98625

Estimated Value: $741,592 - $826,000

3

Beds

4

Baths

2,696

Sq Ft

$287/Sq Ft

Est. Value

About This Home

This home is located at 156 Acker Rd, Kalama, WA 98625 and is currently estimated at $772,648, approximately $286 per square foot. 156 Acker Rd is a home located in Cowlitz County with nearby schools including Kalama Elementary School, Kalama Middle School, and Kalama High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2016

Sold by

Brown Ronald A and Brown Brenda L

Bought by

Rudebaugh Mark L and Rudebaugh Marella R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$224,757

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$547,891

Purchase Details

Closed on

Apr 22, 2014

Sold by

Breimon Timothy G and Breimon Leslie

Bought by

Brown Ronald A and Brown Brenda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,000

Interest Rate

4.32%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rudebaugh Mark L | $365,000 | Chicago Title Vancouver | |

| Brown Ronald A | $217,600 | Cowlitz County Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rudebaugh Mark L | $280,000 | |

| Previous Owner | Brown Ronald A | $174,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,494 | $611,620 | $130,060 | $481,560 |

| 2023 | $4,842 | $547,940 | $121,550 | $426,390 |

| 2022 | $5,162 | $532,090 | $105,700 | $426,390 |

| 2021 | $5,287 | $507,700 | $81,310 | $426,390 |

| 2020 | $4,740 | $503,750 | $77,360 | $426,390 |

| 2019 | $4,492 | $438,106 | $73,675 | $364,431 |

| 2018 | $3,433 | $406,240 | $73,670 | $332,570 |

| 2017 | $2,749 | $337,910 | $70,170 | $267,740 |

| 2016 | $2,590 | $284,770 | $63,790 | $220,980 |

| 2015 | $2,704 | $271,490 | $62,540 | $208,950 |

| 2013 | -- | $252,010 | $74,510 | $177,500 |

Source: Public Records

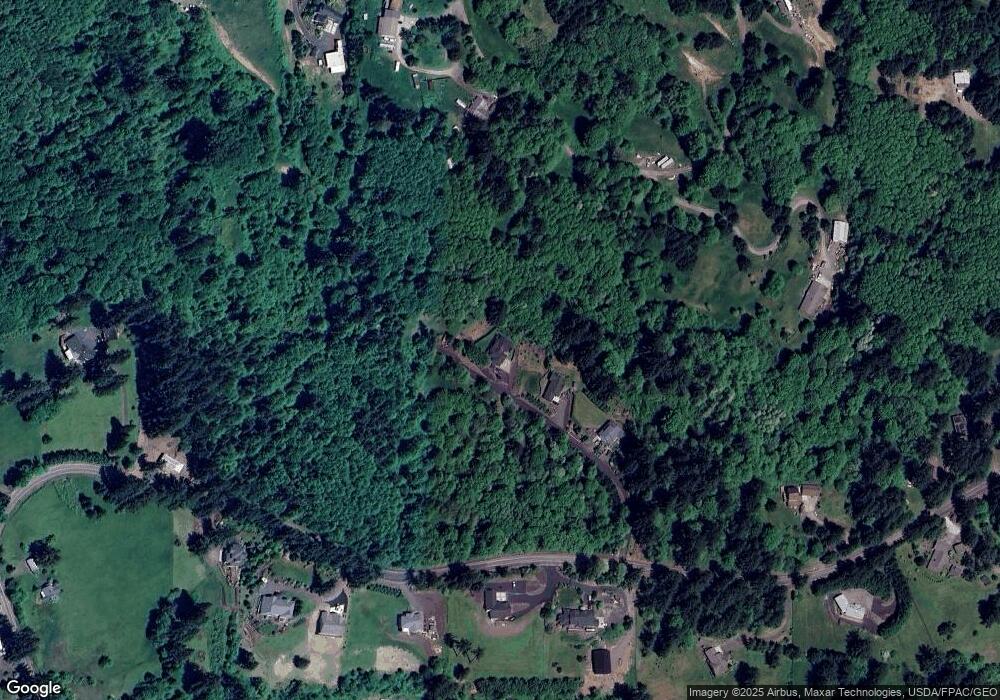

Map

Nearby Homes

- 4130 Green Mountain Rd Unit 1

- 2683 Green Mountain Rd

- 4733 Green Mountain Rd

- 100 Nova Ln

- 134 Newman Rd

- 2987 Green Mountain Rd Unit B

- 2987 Green Mountain Rd Unit A

- 903 Confer Rd

- 324 Champion Rd

- 2987 Green Mountian Rd Unit A

- 276 Champion Rd

- 387 Je Johnson Rd

- 161 Sauer Rd

- 1415 Cloverdale Rd

- 156 Wilson Ridge Rd

- 160 Windy River Rd

- 202 Windy River Rd

- 0 Ring Rd

- 1545 China Garden Rd

- 3287 Green Mountain Rd

- 140 Acker Rd

- 160 Acker Rd

- 124 Acker Rd

- 827 Sauer Rd

- 2473 Green Mountain Rd

- 2507 Green Mountain Rd

- 701 Sauer Rd

- 835 Sauer Rd

- 2588 Green Mountain Rd

- 2351 Green Mountain Rd

- 2395 Green Mountain Rd

- 2352 Green Mountain Rd

- 807 Sauer Rd

- 2401 Green Mountain Rd

- 109 Green Mtn Extension Rd

- 717 Sauer Rd

- 107 Green Mtn Extension Rd

- 2545 Green Mountain Rd

- 105 Green Mtn Extension Rd

- 105 Green Mtn Extension Rd