156 Patrick Rd Tewksbury, MA 01876

Estimated Value: $502,033 - $583,000

2

Beds

2

Baths

1,240

Sq Ft

$425/Sq Ft

Est. Value

About This Home

This home is located at 156 Patrick Rd, Tewksbury, MA 01876 and is currently estimated at $527,008, approximately $425 per square foot. 156 Patrick Rd is a home located in Middlesex County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2003

Sold by

Young Christopher M and Gavin Dawn M

Bought by

Lee Andrew

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000

Interest Rate

6.09%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 20, 2000

Sold by

Potvin Thea M

Bought by

Young Christopher M and Gavin Dawn M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,200

Interest Rate

8%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 16, 1996

Sold by

Mcsweeney William and Mcsweeney Alicia

Bought by

Potvin Thea M

Purchase Details

Closed on

Jun 22, 1987

Sold by

F I C Assoc Inc

Bought by

Mcsweeney Willliam F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lee Andrew | $239,000 | -- | |

| Young Christopher M | $179,000 | -- | |

| Potvin Thea M | $102,500 | -- | |

| Mcsweeney Willliam F | $138,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcsweeney Willliam F | $163,000 | |

| Closed | Lee Andrew | $20,000 | |

| Previous Owner | Mcsweeney Willliam F | $143,200 | |

| Previous Owner | Mcsweeney Willliam F | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,696 | $430,900 | $0 | $430,900 |

| 2024 | $5,418 | $404,600 | $0 | $404,600 |

| 2023 | $5,327 | $377,800 | $0 | $377,800 |

| 2022 | $4,765 | $313,500 | $0 | $313,500 |

| 2021 | $4,667 | $296,900 | $0 | $296,900 |

| 2020 | $4,634 | $290,200 | $0 | $290,200 |

| 2019 | $4,090 | $258,200 | $0 | $258,200 |

| 2018 | $3,912 | $242,500 | $0 | $242,500 |

| 2017 | $3,673 | $225,200 | $0 | $225,200 |

| 2016 | $3,486 | $213,200 | $0 | $213,200 |

| 2015 | $3,127 | $191,000 | $0 | $191,000 |

| 2014 | $2,979 | $184,900 | $0 | $184,900 |

Source: Public Records

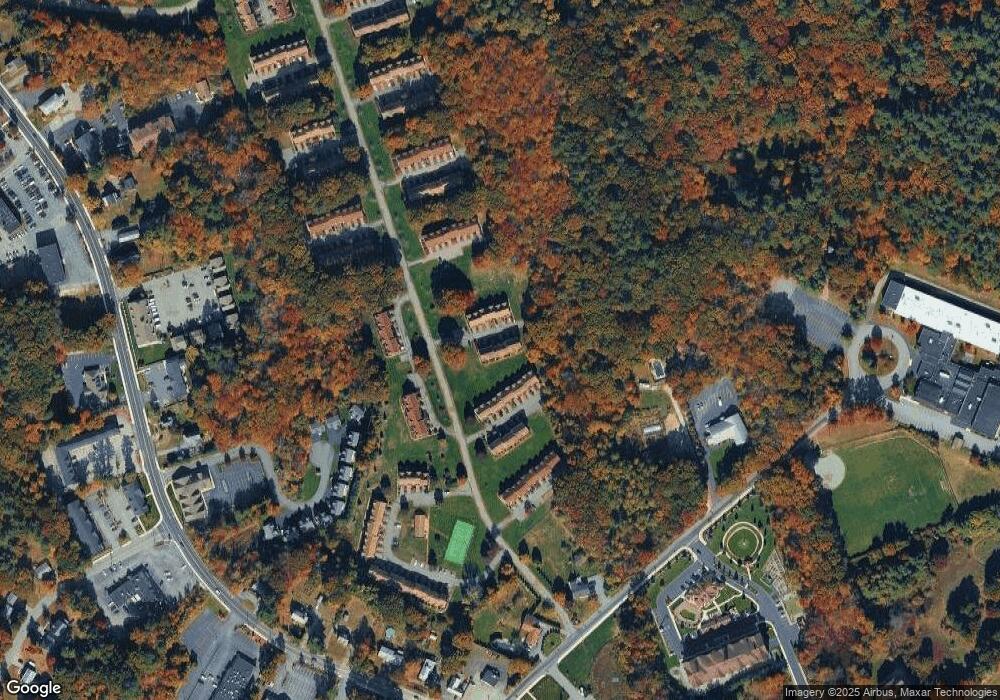

Map

Nearby Homes

- 172 Patrick Rd

- 61 Patrick Rd

- 1418 Main St Unit 201

- 43 Patrick Rd

- 1455 Main St Unit 8

- 11 Orchard St

- 1325 Main

- 12 Hillcrest Rd

- 14 Hinckley Rd

- 15 Pinewood Rd

- 20 Sophie Ruth Way

- 107 Eagle Dr Unit 107

- 93 Fairway Dr

- 127 Caddy Ct

- 13 Berkeley

- 1 Tremblay Ave

- 16 Eagle Dr

- 9 Tomahawk Dr

- 177 Apache Way Unit 177

- 71 Apache Way Unit 71

- 160 Patrick Rd

- 159 Patrick Rd

- 158 Patrick Rd

- 157 Patrick Rd

- 155 Patrick Rd

- 157 Patrick Rd Unit 157

- 154 Patrick Rd

- 153 Patrick Rd

- 152 Patrick Rd

- 151 Patrick Rd

- 150 Patrick Rd

- 149 Patrick Rd

- 170 Patrick Rd

- 169 Patrick Rd

- 168 Patrick Rd

- 167 Patrick Rd

- 166 Patrick Rd

- 165 Patrick Rd

- 164 Patrick Rd

- 163 Patrick Rd