Estimated Value: $309,000 - $352,000

3

Beds

2

Baths

1,499

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 1560 Dillard Rd, Astor, FL 32102 and is currently estimated at $322,941, approximately $215 per square foot. 1560 Dillard Rd is a home located in Volusia County with nearby schools including Pierson Elementary School and T. Dewitt Taylor Middle/High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2011

Sold by

Chandler Terrie E and Mehlin Terrie E

Bought by

Mehlin Donald E and Mehlin Sarah I

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Outstanding Balance

$57,930

Interest Rate

4.85%

Mortgage Type

Seller Take Back

Estimated Equity

$265,011

Purchase Details

Closed on

Nov 15, 1987

Bought by

Mehlin Donald E and Mehlin Sarah I

Purchase Details

Closed on

Mar 15, 1983

Bought by

Mehlin Donald E and Mehlin Sarah I

Purchase Details

Closed on

May 15, 1981

Bought by

Mehlin Donald E and Mehlin Sarah I

Purchase Details

Closed on

Sep 15, 1978

Bought by

Mehlin Donald E and Mehlin Sarah I

Purchase Details

Closed on

Nov 15, 1977

Bought by

Mehlin Donald E and Mehlin Sarah I

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mehlin Donald E | $85,000 | Attorney | |

| Mehlin Donald E | $20,500 | -- | |

| Mehlin Donald E | $12,000 | -- | |

| Mehlin Donald E | $10,000 | -- | |

| Mehlin Donald E | $7,500 | -- | |

| Mehlin Donald E | $5,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mehlin Donald E | $85,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $1,886 | $128,868 | -- | -- |

| 2025 | $1,886 | $128,868 | -- | -- |

| 2024 | $1,767 | $125,237 | -- | -- |

| 2023 | $1,767 | $121,590 | $0 | $0 |

| 2022 | $1,711 | $118,049 | $0 | $0 |

| 2021 | $1,752 | $114,611 | $0 | $0 |

| 2020 | $1,721 | $113,029 | $0 | $0 |

| 2019 | $1,757 | $110,488 | $0 | $0 |

| 2018 | $1,736 | $108,428 | $0 | $0 |

| 2017 | $1,713 | $106,198 | $0 | $0 |

| 2016 | $1,629 | $104,014 | $0 | $0 |

| 2015 | $1,657 | $103,291 | $0 | $0 |

| 2014 | $1,639 | $102,471 | $0 | $0 |

Source: Public Records

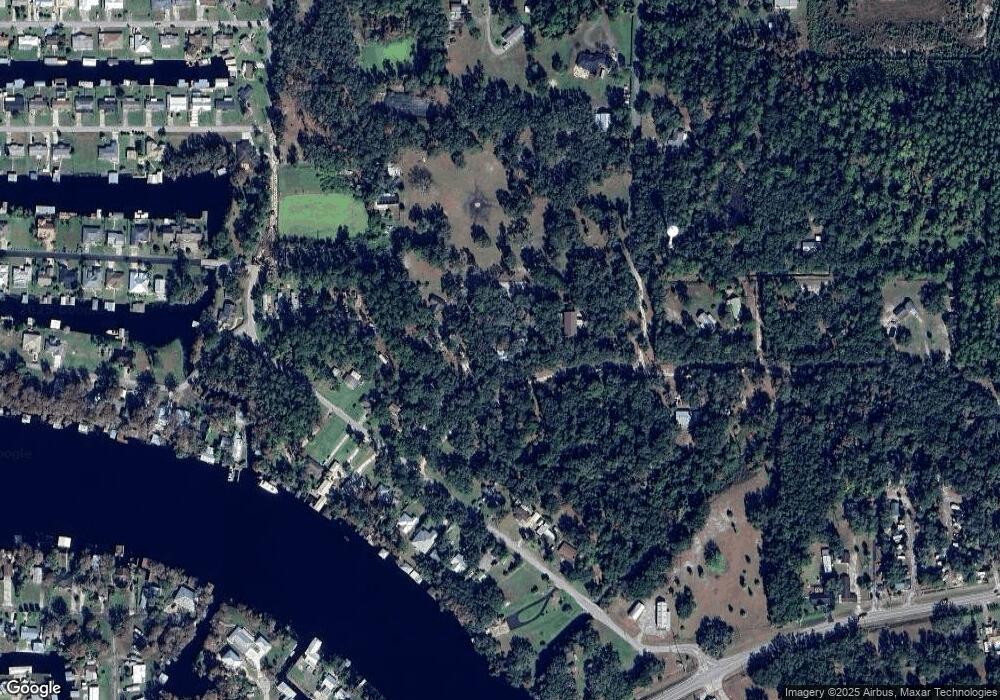

Map

Nearby Homes

- 1905 Alice Dr Unit 4

- 1620 River Rd

- 1610 Juno Trail

- 1501 Dillard Rd

- 1617 Paradise Ln

- 55744 Holiday Cir

- 1621 Spring Garden Dr

- 55730 Holiday Cir

- 1628 Paradise Ln

- 1511 Riveredge Ct

- 1636 Juno Trail

- 1640 Juno Trail Unit 204C

- 1640 Juno Trail Unit 101

- 1640 Juno Trail Unit 103

- 1640 Juno Trail Unit 202

- 1640 Juno Trail Unit 102A

- 1640 Juno Trail Unit 205

- 55746 Carroll St

- 55512 Front St

- 55805 Carrol St

Your Personal Tour Guide

Ask me questions while you tour the home.