1570 Cedar Bark Trail Unit 11M Dayton, OH 45449

Estimated Value: $162,561 - $174,000

3

Beds

2

Baths

1,819

Sq Ft

$92/Sq Ft

Est. Value

About This Home

This home is located at 1570 Cedar Bark Trail Unit 11M, Dayton, OH 45449 and is currently estimated at $166,890, approximately $91 per square foot. 1570 Cedar Bark Trail Unit 11M is a home located in Montgomery County with nearby schools including West Carrollton High School and Bethel Baptist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 4, 2024

Sold by

Rookstool Erma Joyce

Bought by

Bowling Bradley Shane and Rayl Donna J

Current Estimated Value

Purchase Details

Closed on

Jun 30, 2014

Sold by

Gustin Linda D and Gustin John D

Bought by

Rookstool Erma J

Purchase Details

Closed on

Jan 31, 2013

Sold by

Fortney Thaddeus William

Bought by

Gustin Linda D and Gustin John D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,750

Interest Rate

4.49%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Jul 31, 2001

Sold by

Fink Michael B

Bought by

Fortney Mary Kathleen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bowling Bradley Shane | $157,000 | Landmark Title | |

| Rookstool Erma J | $72,500 | National Title | |

| Gustin Linda D | $97,000 | National Title | |

| Fortney Mary Kathleen | $95,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gustin Linda D | $72,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,719 | $37,280 | $5,170 | $32,110 |

| 2023 | $1,719 | $37,280 | $5,170 | $32,110 |

| 2022 | $1,680 | $30,270 | $4,200 | $26,070 |

| 2021 | $1,682 | $30,270 | $4,200 | $26,070 |

| 2020 | $1,681 | $30,270 | $4,200 | $26,070 |

| 2019 | $1,617 | $27,860 | $4,200 | $23,660 |

| 2018 | $2,184 | $27,860 | $4,200 | $23,660 |

| 2017 | $2,169 | $27,860 | $4,200 | $23,660 |

| 2016 | $2,448 | $30,790 | $4,200 | $26,590 |

| 2015 | $2,279 | $30,790 | $4,200 | $26,590 |

| 2014 | $2,308 | $30,790 | $4,200 | $26,590 |

| 2012 | -- | $33,070 | $7,840 | $25,230 |

Source: Public Records

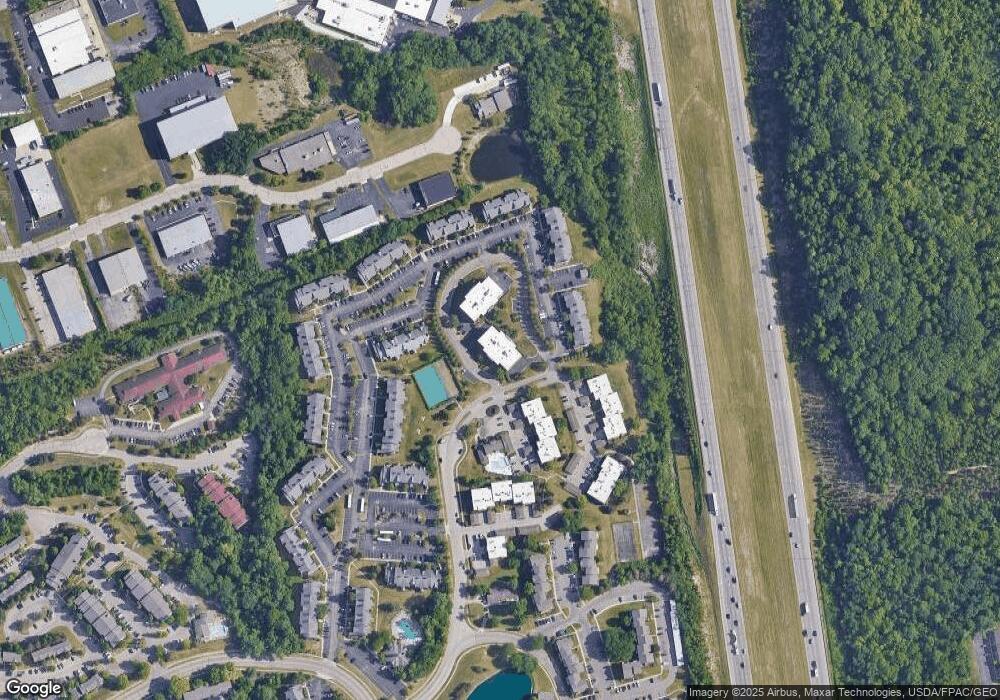

Map

Nearby Homes

- 1109 Arrowhead Crossing Unit A

- 1112 Eagle Feather Cir Unit A

- 1116 Eagle Feather Cir Unit E

- 1124 Eagle Feather Cir Unit 161

- 1008 Lookout Trail Unit C

- 1788 Cherokee Dr Unit F

- 1792 Cherokee Dr Unit A

- 1792 Cherokee Dr Unit F

- 6484 Quintessa Ct Unit 29

- 3324 Ultimate Way Unit 36

- 1642 Longbow Ln

- 3316 Vanquil Trail Unit 387

- 3304 Ultimate Way Unit 399

- 6433 Interlude Ln Unit 438

- 1333 S Elm St

- 3254 Gambit Square Unit 451

- 338 Hillhaven Dr

- 500 Lincoln Green Dr

- 609 Kings Cross Ct

- 3074 Bright Bounty Ln Unit 38

- 1570 Cedar Bark Trail Unit 3

- 1570 Cedar Bark Trail Unit 11U

- 1570 Cedar Bark Trail Unit 11U

- 1570 Cedar Bark Trail Unit 11M

- 1570 Cedar Bark Trail Unit 11G

- 1570 Cedar Bark Trail Unit 11G

- 1570 Cedar Bark Trail Unit 11G

- 1570 Cedar Bark Trail Unit 11U

- 1570 Cedar Bark Trail Unit 11U

- 1570 Cedar Bark Trail Unit 11M

- 1570 Cedar Bark Trail Unit 11M

- 1570 Cedar Bark Trail Unit 11G

- 1570 Cedar Bark Trail Unit 6

- 1570 Cedar Bark Trail Unit 1

- 1570 Cedar Bark Trail Unit 1A

- 1570 Cedar Bark Trail Unit 5

- 1570 Cedar Bark Trail Unit 4

- 1570 Cedar Bark Trail

- 1570 Cedar Bark Trail Unit 7

- 1570 Cedar Bark Trail Unit 2