15804 Traditions Blvd Edmond, OK 73013

Traditions-Ripple Creek NeighborhoodEstimated Value: $279,277 - $300,000

3

Beds

2

Baths

1,751

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 15804 Traditions Blvd, Edmond, OK 73013 and is currently estimated at $289,069, approximately $165 per square foot. 15804 Traditions Blvd is a home located in Oklahoma County with nearby schools including Charles Haskell Elementary School, Summit Middle School, and Santa Fe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2022

Sold by

Jameson Olga and Williams David G

Bought by

Jameson Olga and Williams David G

Current Estimated Value

Purchase Details

Closed on

Mar 15, 2013

Sold by

Mandrino Joseph P and Mandrino Millicent B

Bought by

Jameson Olga and Williams David G

Purchase Details

Closed on

Nov 17, 2009

Sold by

Billings Savine L and Billings Karen L

Bought by

Mandrino Joseph P and Mandrino Millicent B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,846

Interest Rate

4.83%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 5, 2002

Sold by

G L Cobbs & Co Llc

Bought by

Billings Savine L and Billings Karen L

Purchase Details

Closed on

Mar 13, 2001

Sold by

Traditions Development I Ltd

Bought by

G L Cobbs & Co Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jameson Olga | -- | None Listed On Document | |

| Jameson Olga | $172,000 | American Eagle Title Group | |

| Mandrino Joseph P | $168,000 | Multiple | |

| Billings Savine L | $147,000 | Oklahoma City Abstract & Tit | |

| G L Cobbs & Co Llc | $30,000 | First Amer Title & Trust Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mandrino Joseph P | $153,846 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,563 | $23,213 | $4,588 | $18,625 |

| 2023 | $2,563 | $22,536 | $4,496 | $18,040 |

| 2022 | $2,508 | $21,880 | $5,029 | $16,851 |

| 2021 | $2,406 | $21,243 | $5,202 | $16,041 |

| 2020 | $2,368 | $20,625 | $5,319 | $15,306 |

| 2019 | $2,408 | $20,845 | $5,319 | $15,526 |

| 2018 | $2,355 | $20,295 | $0 | $0 |

| 2017 | $2,314 | $20,074 | $4,792 | $15,282 |

| 2016 | $2,295 | $20,019 | $4,792 | $15,227 |

| 2015 | $2,266 | $19,676 | $4,792 | $14,884 |

| 2014 | $2,260 | $19,676 | $4,792 | $14,884 |

Source: Public Records

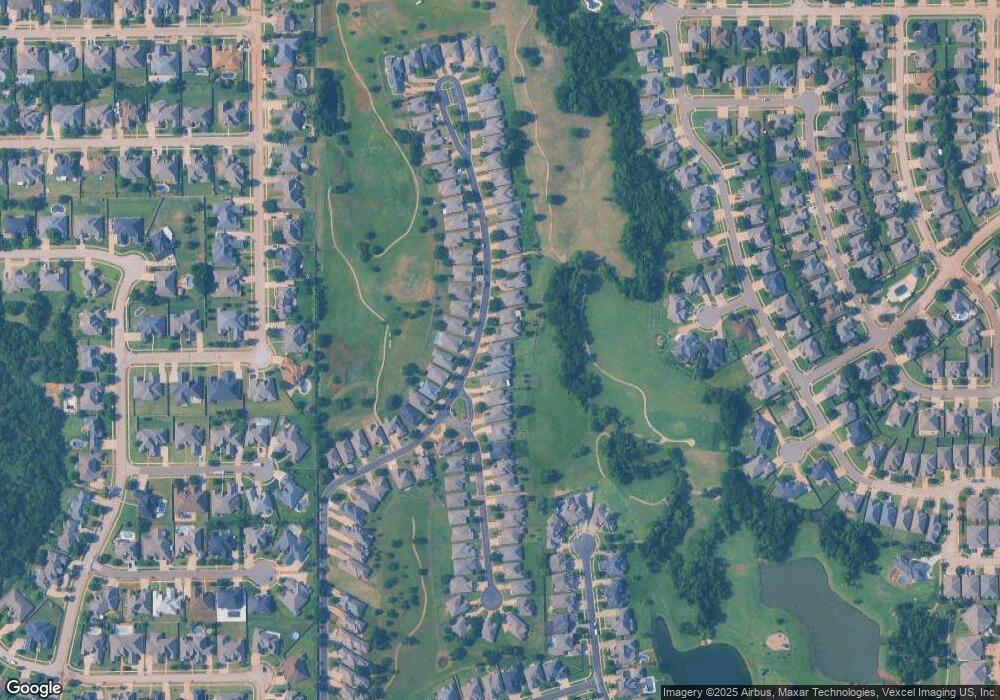

Map

Nearby Homes

- 15330 Traditions Blvd

- 15521 Park Lake Rd

- 217 NW 160th Terrace

- 513 NW 154th St

- 15400 Kestral Park Ct

- 16001 Sheffield Blvd

- 201 NW 160th Terrace

- 15505 Park Lake Rd

- 301 NW 153rd St

- 15541 Swallowtail Rd

- Clover Plan at Whistle Creek

- Ellwood Plan at Whistle Creek

- Birch Plan at Whistle Creek

- Sage Plan at Whistle Creek

- Hazel Plan at Whistle Creek

- Walnut Plan at Whistle Creek

- 25 Red Admiral Way

- 15304 Old Lake Ln

- 17 Red Admiral Way

- 116 Pueblo

- 15808 Traditions Blvd

- 15800 Traditions Blvd

- 15724 Traditions Blvd

- 15812 Traditions Blvd

- 15720 Traditions Blvd

- 15816 Traditions Blvd

- 15805 Traditions Blvd

- 15809 Traditions Blvd

- 15801 Traditions Blvd

- 15716 Traditions Blvd

- 15820 Traditions Blvd

- 15813 Traditions Blvd

- 15733 Traditions Blvd

- 15817 Traditions Blvd

- 15712 Traditions Dr

- 15900 Traditions Blvd

- 15729 Traditions Blvd

- 15901 Traditions Blvd

- 15708 Traditions Dr

- 15725 Traditions Blvd