15816 Fairview Farm Blvd Edmond, OK 73013

North Penn-North Western NeighborhoodEstimated Value: $1,264,000 - $2,023,000

5

Beds

6

Baths

6,599

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 15816 Fairview Farm Blvd, Edmond, OK 73013 and is currently estimated at $1,613,804, approximately $244 per square foot. 15816 Fairview Farm Blvd is a home with nearby schools including Charles Haskell Elementary School, Summit Middle School, and Santa Fe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 29, 2015

Sold by

Weitzel Marc A and Weitzel Kimberly A

Bought by

Weitzel Marc A and Kaw Trust

Current Estimated Value

Purchase Details

Closed on

Jul 12, 2012

Sold by

Roberts Don Ed and Roberts Jean E

Bought by

The Maw Trust

Purchase Details

Closed on

Dec 21, 2011

Sold by

Parduhn Philip and Philip Parduhn 1989 Revocable

Bought by

Roberts Don Ed and Roberts Jean E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,520

Interest Rate

4.03%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Apr 29, 2002

Sold by

Quail Creek Properties Llc

Bought by

Philip Parduhn 1989 Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weitzel Marc A | -- | Capitol Abstract&Title | |

| The Maw Trust | $275,000 | Capitol Abstract And Title C | |

| Roberts Don Ed | $167,500 | Capitol Abstract & Title | |

| Philip Parduhn 1989 Revocable Trust | $120,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Roberts Don Ed | $125,520 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $23,940 | $211,200 | $22,791 | $188,409 |

| 2023 | $23,940 | $201,143 | $23,478 | $177,665 |

| 2022 | $23,007 | $191,565 | $23,907 | $167,658 |

| 2021 | $22,479 | $189,090 | $26,729 | $162,361 |

| 2020 | $26,262 | $217,685 | $23,384 | $194,301 |

| 2019 | $25,152 | $207,319 | $21,451 | $185,868 |

| 2018 | $24,100 | $197,447 | $0 | $0 |

| 2017 | $22,814 | $188,044 | $30,315 | $157,729 |

| 2016 | $22,820 | $189,144 | $30,315 | $158,829 |

| 2015 | $24,025 | $198,010 | $30,315 | $167,695 |

| 2014 | $3,661 | $30,250 | $30,250 | $0 |

Source: Public Records

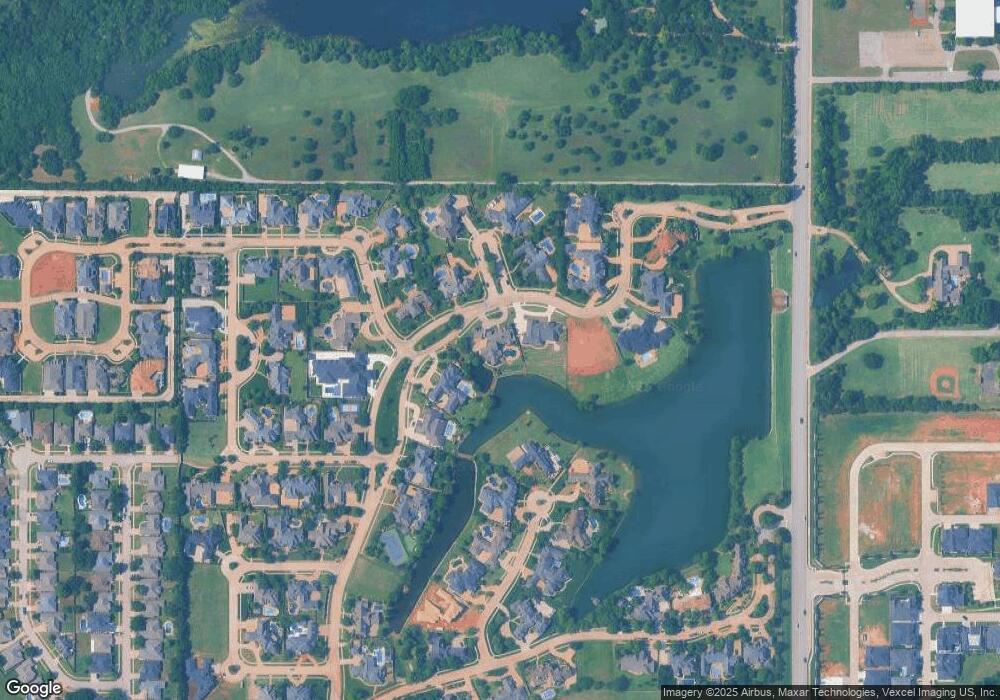

Map

Nearby Homes

- 15849 Fairview Farm Blvd

- 1301 NW 157th St

- 1309 NW 156th Terrace

- 1324 NW 157th St

- 1308 NW 156th Terrace

- 1513 NW 158th Terrace

- 15617 Waterstone Way

- 15713 Hyde Parke Dr

- 908 NW 157th Terrace

- 16401 Burgundy Dr W

- 1800 NW 160th Place

- 1216 NW 165th St

- 16013 Sonoma Lake Blvd

- 1812 NW 160th Place

- 16608 Halbrooke Rd

- 1813 NW 160th Place

- 612 NW 161st St

- 15220 Worthington Ln

- 16632 Parkhurst Rd

- 1800 NW 161st Place

- 15824 Fairview Farm Blvd

- 15808 Fairview Farm Blvd

- 15819 Farm Cove Rd

- 15842 Farm Cove Rd

- 15815 Fairview Farm Blvd

- 15800 Fairview Farm Blvd

- 15641 Bald Cypress Cove

- 15836 Chapel Ridge Ln

- 0 Chapel Ridge Rd

- 15850 Farm Cove Rd

- 15841 Farm Cove Rd

- 15836 Chapel Ridge Rd

- 15716 Fairview Farm Blvd

- 15840 Fairview Farm Blvd

- 15825 Chappel Ridge Rd

- 15633 Bald Cypress Cove

- 15809 Fairview Farm Blvd

- 15857 Fairview Farm Blvd

- 15844 Chapel Ridge Rd

- 15844 Chapel Ridge Ln