1583 N 2530 W Clearfield, UT 84015

About This Home

Please note, our homes are available on a first-come, first-serve basis and are not reserved until the lease is signed by all applicants and security deposits are collected.

This home features Progress Smart Home - Progress Residential's smart home app, which allows you to control the home securely from any of your devices. Learn more at

Want to tour on your own? Click the “Self Tour” button on this home’s listing or call to register for a self-guided showing at a time that works best for you.

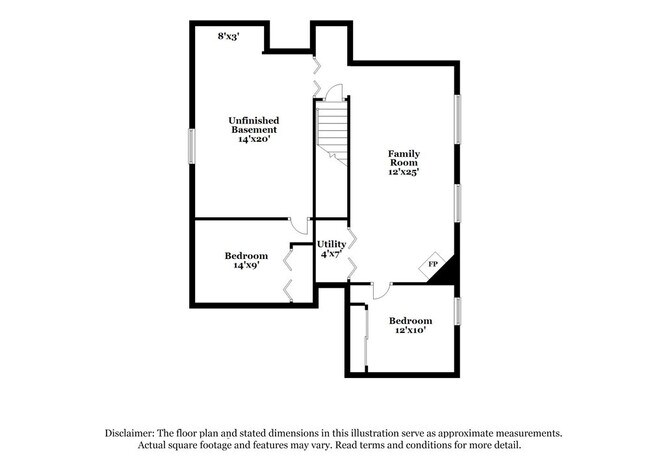

Interested in this home? You clearly have exceptional taste. This charming 5.0-bedroom, 2.0-bathroom home is not only pet-friendly, but also equipped with smart home features to make everyday life more convenient and connected. Homes like this don’t stay on the market for long—don’t miss your chance to make it yours. Apply today!

Map

- 1509 N 2475 W

- 1648 N 2615 W

- 1449 N 2475 W

- 2647 W 1445 N

- 1458 N 2400 W

- 1251 N 2525 W

- 2371 W 1300 N

- 2259 W 1800 N

- 1694 N 2225 W

- 2148 W 1570 N

- 2921 W 1300 N

- 2959 W 1300 N

- 3941 W 1800 N

- 2617 N 2080 W Unit 176

- 1665 N 1960 W

- Harvard Plan at Summerfield - Enclave

- 2208 W 2615 N

- Linden Plan at Summerfield - Vista

- Yale Plan at Summerfield - Enclave

- Gambel Oak Plan at Summerfield - Vista