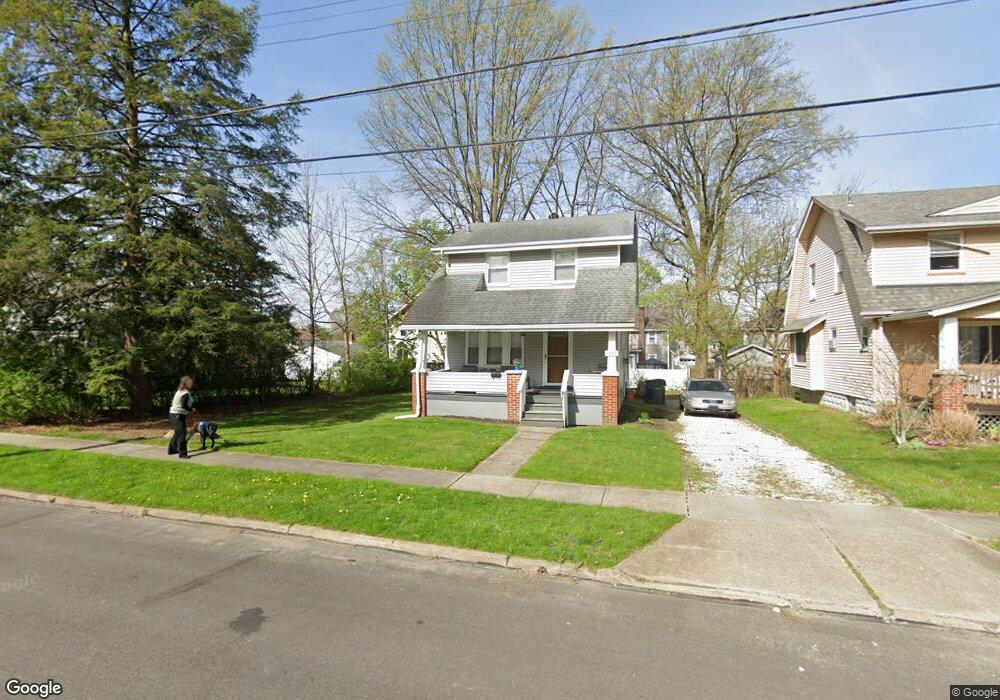

1586 10th St Cuyahoga Falls, OH 44221

Southeast Cuyahoga Falls NeighborhoodEstimated Value: $158,000 - $183,000

3

Beds

1

Bath

1,088

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 1586 10th St, Cuyahoga Falls, OH 44221 and is currently estimated at $168,341, approximately $154 per square foot. 1586 10th St is a home located in Summit County with nearby schools including Dewitt Elementary School, Bolich Middle School, and Cuyahoga Falls High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 7, 2015

Sold by

Shay Tracy L and Forrer Tracy L

Bought by

Shay Tracy L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,127

Interest Rate

3.81%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 17, 2006

Sold by

Fannie Mae

Bought by

Forrer Tracy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,100

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 24, 2006

Sold by

Stankiewicz Mark A

Bought by

Federal National Mortgage Association

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shay Tracy L | -- | First American Title Insuran | |

| Forrer Tracy L | $79,000 | Beacon Title Agency Inc | |

| Federal National Mortgage Association | $70,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shay Tracy L | $63,127 | |

| Previous Owner | Forrer Tracy L | $71,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,547 | $44,307 | $11,067 | $33,240 |

| 2024 | $2,547 | $44,307 | $11,067 | $33,240 |

| 2023 | $2,547 | $44,307 | $11,067 | $33,240 |

| 2022 | $2,313 | $32,579 | $8,138 | $24,441 |

| 2021 | $2,213 | $32,579 | $8,138 | $24,441 |

| 2020 | $2,278 | $32,580 | $8,140 | $24,440 |

| 2019 | $2,316 | $30,200 | $7,730 | $22,470 |

| 2018 | $1,989 | $30,200 | $7,730 | $22,470 |

| 2017 | $1,625 | $30,200 | $7,730 | $22,470 |

| 2016 | $1,626 | $27,020 | $7,730 | $19,290 |

| 2015 | $1,625 | $27,020 | $7,730 | $19,290 |

| 2014 | $1,626 | $27,020 | $7,730 | $19,290 |

| 2013 | $1,612 | $27,020 | $7,730 | $19,290 |

Source: Public Records

Map

Nearby Homes

- 736 Chestnut Blvd

- 1523 8th St

- 1224 Chestnut Blvd

- 1740 11th St

- 852 Arcadia Ave

- 839 Sackett Ave

- 1510 2nd St

- 1348 Grant Ave

- 1839 9th St

- 1333 Meriline St

- 120 Grant Ave

- 419 Sackett Ave

- 1757 3rd St

- 1933 10th St

- 1758 16th St

- 1624 17th St

- 1312 Riverside Dr

- 1734 Front St Unit 34

- 1734 Front St Unit 37

- 1734 Front St Unit 36