1586 Jacqueline Ct Unit 15861 Columbus, OH 43232

Livingston-McNaughten NeighborhoodEstimated Value: $150,000 - $154,576

3

Beds

2

Baths

1,364

Sq Ft

$112/Sq Ft

Est. Value

About This Home

This home is located at 1586 Jacqueline Ct Unit 15861, Columbus, OH 43232 and is currently estimated at $152,144, approximately $111 per square foot. 1586 Jacqueline Ct Unit 15861 is a home located in Franklin County with nearby schools including Oakmont Elementary School, Yorktown Middle School, and Independence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2007

Sold by

Beneficial Ohio Inc

Bought by

Fonin Dmitriy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,320

Outstanding Balance

$30,358

Interest Rate

6.2%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$121,786

Purchase Details

Closed on

Dec 11, 2006

Sold by

Dewberry Mark and Case #06Cve02 2326

Bought by

Beneficial Ohio Inc and Beneficial Mortgage Co Of Ohio

Purchase Details

Closed on

May 5, 1999

Sold by

Burdette Raymond M

Bought by

Dewberry Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,200

Interest Rate

6.94%

Purchase Details

Closed on

May 31, 1994

Sold by

Matheny Peggy L

Bought by

Burdette Raymond M

Purchase Details

Closed on

Mar 20, 1990

Bought by

Burdette Raymond M

Purchase Details

Closed on

Jul 22, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fonin Dmitriy | $62,900 | Foundation | |

| Beneficial Ohio Inc | $58,000 | Foundation | |

| Dewberry Mark | $59,000 | -- | |

| Burdette Raymond M | -- | -- | |

| Burdette Raymond M | $42,900 | -- | |

| -- | $27,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fonin Dmitriy | $50,320 | |

| Previous Owner | Dewberry Mark | $47,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,444 | $32,170 | $4,200 | $27,970 |

| 2023 | $1,425 | $32,165 | $4,200 | $27,965 |

| 2022 | $1,641 | $21,080 | $2,280 | $18,800 |

| 2021 | $1,095 | $21,080 | $2,280 | $18,800 |

| 2020 | $1,097 | $21,080 | $2,280 | $18,800 |

| 2019 | $983 | $16,210 | $1,750 | $14,460 |

| 2018 | $949 | $16,210 | $1,750 | $14,460 |

| 2017 | $983 | $16,210 | $1,750 | $14,460 |

| 2016 | $1,009 | $15,230 | $2,420 | $12,810 |

| 2015 | $916 | $15,230 | $2,420 | $12,810 |

| 2014 | $918 | $15,230 | $2,420 | $12,810 |

| 2013 | $646 | $21,735 | $3,430 | $18,305 |

Source: Public Records

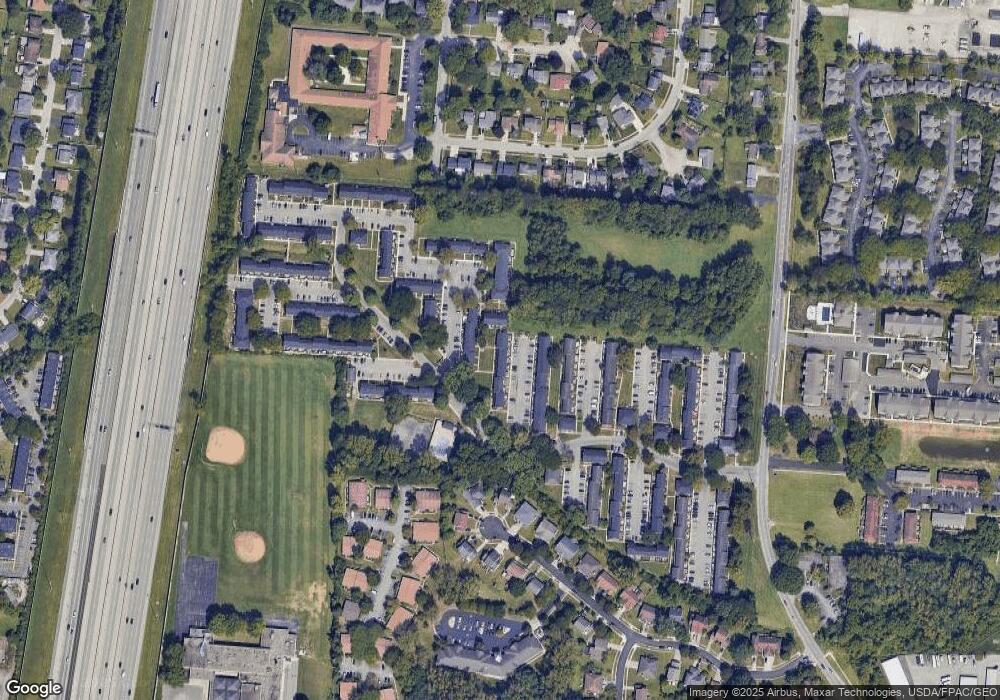

Map

Nearby Homes

- 5781 Hallridge Cir Unit B

- 5794 Hallridge Cir

- 1481 Riverton Ct E

- 1603 Hallworth Ct Unit 16038

- 5750 Hallridge Cir

- 5596 Autumn Chase Dr

- 1826-1828 Bairsford Dr

- 1334 Manor Dr

- 1888 Birkdale Dr

- 1328 Manor Dr

- 5366 Yorkshire Village Ln Unit B-22

- 1550 Idlewild Dr

- 0 Radekin Rd Unit 225029852

- 1759 Lonsdale Rd

- 1324 Idlewild Dr

- 1624 Coppertree Ln

- 1859 Woodette Rd

- 1942 Bairsford Dr Unit 944

- 5337 Ivyhurst Dr

- 0 Brice Rd

- 1588 Jacqueline Ct

- 1584 Jacqueline Ct Unit 15841

- 1590 Jacqueline Ct

- 5848 Hallridge Cir

- 5846 Hallridge Cir

- 1592 Jacqueline Ct Unit 15921

- 5852 Hallridge Cir

- 5850 Hallridge Cir

- 5846 Jacqueline Ct

- 1594 Jacqueline Ct

- 5864 Hallridge Cir

- 5860 Hallridge Cir

- 5781 Hallridge Cir Unit 5781A

- 5781 Hallridge Cir Unit 5781B

- 5781 Hallridge Cir Unit D

- 5781 Hallridge Cir Unit 5781C

- 1653 Hallworth Ct

- 5781 Hallridge Cir

- 5781 Hallridge Cir Unit A

- 5781 Hallridge Cir Unit C