Estimated Value: $753,000 - $1,068,000

4

Beds

4

Baths

4,231

Sq Ft

$220/Sq Ft

Est. Value

About This Home

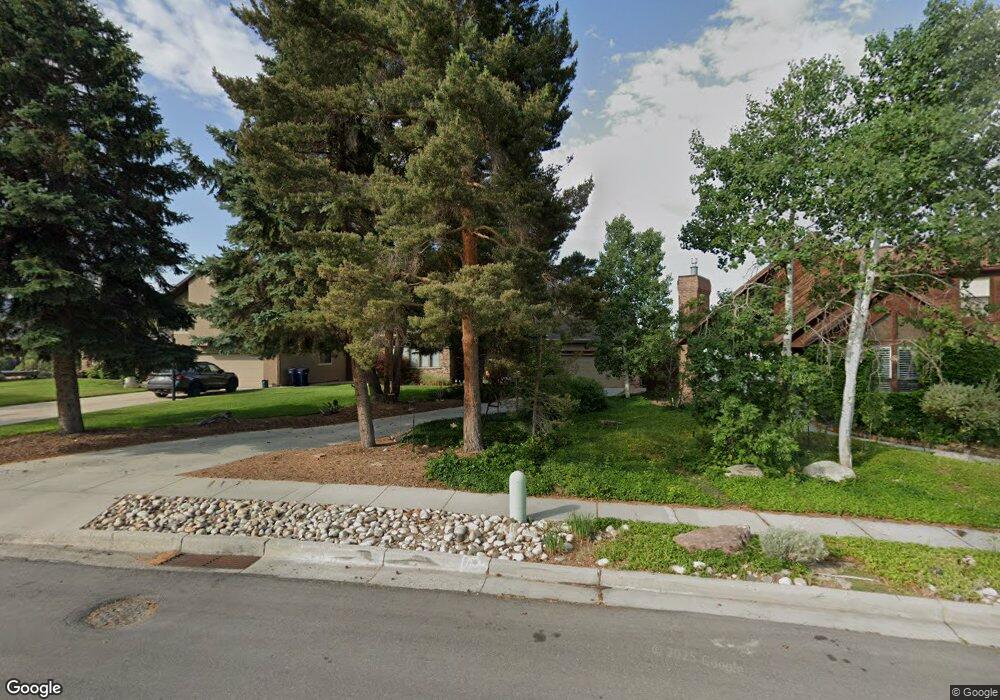

This home is located at 1588 Michael Way, Sandy, UT 84093 and is currently estimated at $931,118, approximately $220 per square foot. 1588 Michael Way is a home located in Salt Lake County with nearby schools including Silver Mesa Elementary School, Union Middle School, and Hillcrest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2025

Sold by

Gibbons Shannon

Bought by

Shannon Gibbons Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Oct 27, 2010

Sold by

Gibbons Shannon and Wilson Linda A

Bought by

Wilson Linda A and Gibbons Shannon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

4.33%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 6, 2000

Sold by

Learmonth Richard

Bought by

Gibbons Shannon and Wilson Linda A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$229,600

Interest Rate

7.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shannon Gibbons Revocable Trust | -- | None Listed On Document | |

| Linda Ann Wilson Revocable Trust | -- | None Listed On Document | |

| Wilson Linda A | -- | United Title Services | |

| Gibbons Shannon | -- | Backman Stewart Title Servic |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilson Linda A | $120,000 | |

| Previous Owner | Gibbons Shannon | $229,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,815 | $943,900 | $323,300 | $620,600 |

| 2024 | $4,815 | $902,500 | $311,200 | $591,300 |

| 2023 | $4,179 | $782,000 | $299,300 | $482,700 |

| 2022 | $4,294 | $790,400 | $293,300 | $497,100 |

| 2021 | $3,996 | $626,100 | $232,800 | $393,300 |

| 2020 | $3,907 | $577,700 | $232,800 | $344,900 |

| 2019 | $3,854 | $556,000 | $219,700 | $336,300 |

| 2016 | $3,174 | $442,900 | $198,000 | $244,900 |

Source: Public Records

Map

Nearby Homes

- 9206 Sterling Dr

- 8857 S Capella Way

- 1630 E Plata Way

- 8797 S Capella Way

- 1492 E Sandy Hills Dr

- 1579 E 8730 S

- 1430 E 8685 S

- 1798 E Sunrise Meadow Dr

- 1891 Richard Rd

- 1779 E Mombo Dr

- 8638 Piper Ln

- 8642 S Cessna Cir

- 1371 Sudbury Ave

- 1138 E Quarry Stone Way

- 8935 Quarry Stone Way

- 8492 S Mesa Dr

- 8971 Valley Bend Ct

- 8411 S 1475 E

- 1133 E Wright Way

- 1924 E Viscounti Cove

- 1588 E Michael Way

- 9040 Michael Way

- 1594 Michael Way

- 1602 E Michael Way

- 1602 Michael Way

- 1547 Waters Ln

- 9028 S Michael Way

- 9028 Michael Way

- 1557 Waters Ln

- 9061 Waters Cir

- 9061 S Waters Cir

- 9045 Waters Cir

- 9045 S Waters Cir

- 1535 Waters Ln

- 1565 Waters Ln

- 9031 Michael Way

- 1595 E Michael Way Unit 13

- 1595 E Michael Way

- 1595 Michael Way

- 1612 E Michael Way

Your Personal Tour Guide

Ask me questions while you tour the home.