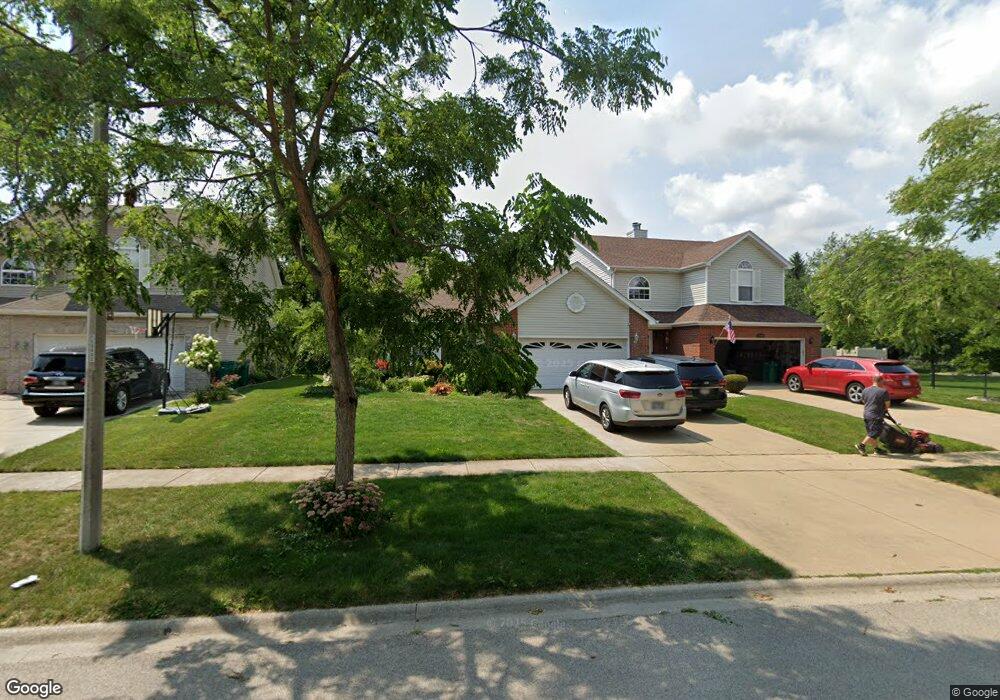

15932 Fairfield Dr Unit 1 Plainfield, IL 60586

East Plainfield NeighborhoodEstimated Value: $311,504 - $339,000

4

Beds

3

Baths

1,486

Sq Ft

$221/Sq Ft

Est. Value

About This Home

This home is located at 15932 Fairfield Dr Unit 1, Plainfield, IL 60586 and is currently estimated at $329,126, approximately $221 per square foot. 15932 Fairfield Dr Unit 1 is a home located in Will County with nearby schools including Central Elementary School, Indian Trail Middle School, and Plainfield Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 8, 2023

Sold by

Kosior Jeannette I

Bought by

Trust Number 8002392345

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,650

Outstanding Balance

$266,654

Interest Rate

7%

Mortgage Type

New Conventional

Estimated Equity

$62,472

Purchase Details

Closed on

Jul 13, 2007

Sold by

Slomiany Virginia

Bought by

Kosior James A and Kosior Jeanette I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.72%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 14, 2000

Sold by

Schelling Development Corp

Bought by

Slomiany Harry and Slomiany Virginia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trust Number 8002392345 | $287,000 | None Listed On Document | |

| Kosior James A | $225,000 | First American Title Ins Co | |

| Slomiany Harry | $170,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trust Number 8002392345 | $272,650 | |

| Previous Owner | Kosior James A | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,720 | $91,147 | $20,107 | $71,040 |

| 2023 | $6,720 | $82,322 | $18,160 | $64,162 |

| 2022 | $5,109 | $73,936 | $16,310 | $57,626 |

| 2021 | $4,783 | $69,099 | $15,243 | $53,856 |

| 2020 | $4,697 | $67,139 | $14,811 | $52,328 |

| 2019 | $4,499 | $63,972 | $14,112 | $49,860 |

| 2018 | $4,257 | $60,105 | $13,259 | $46,846 |

| 2017 | $4,090 | $57,118 | $12,600 | $44,518 |

| 2016 | $3,771 | $52,454 | $12,017 | $40,437 |

| 2015 | $3,447 | $49,137 | $11,257 | $37,880 |

| 2014 | $3,447 | $47,403 | $10,860 | $36,543 |

| 2013 | $3,447 | $47,403 | $10,860 | $36,543 |

Source: Public Records

Map

Nearby Homes

- 16040 S Arbor Dr

- 0009 Illinois Route 59

- 0007 Illinois Route 59

- 0006 Illinois Route 59

- 0005 Illinois Route 59

- 0003 Illinois Route 59

- 15707 S Route 59

- 16165 S Arbor Dr

- 15824 S Collins Dr

- 15623 S Frederick Ave

- 23538 W Rueben St Unit 6

- 23545 W Rueben St

- 23516 W Matthews St

- 25747 Yorkshire Dr

- 16410 S Howard St

- 23924 W Dayfield Dr Unit 23B

- 23660 Dayfield Ct

- 16320 Spring Creek Ln

- 23314 W Leach Dr

- 16402 S Mcgrath Dr

- 15932 Fairfield Dr

- 15940 Fairfield Dr

- 15940 Fairfield Dr Unit 1594

- 15930 Fairfield Dr

- 15930 Fairfield Dr Unit 1593

- 15942 Fairfield Dr

- 15946 Fairfield Dr

- 15946 Fairfield Dr Unit A

- 23815 W Renwick Rd

- 15948 Fairfield Dr

- 15931 Fairfield Dr

- 15921 Fairfield Dr

- 15941 Fairfield Dr

- 15956 Fairfield Dr

- 15958 Fairfield Dr

- 15911 Fairfield Dr

- 15951 Fairfield Dr

- 000 Fredrick St

- 16000 Fairfield Dr

- 15961 Fairfield Dr