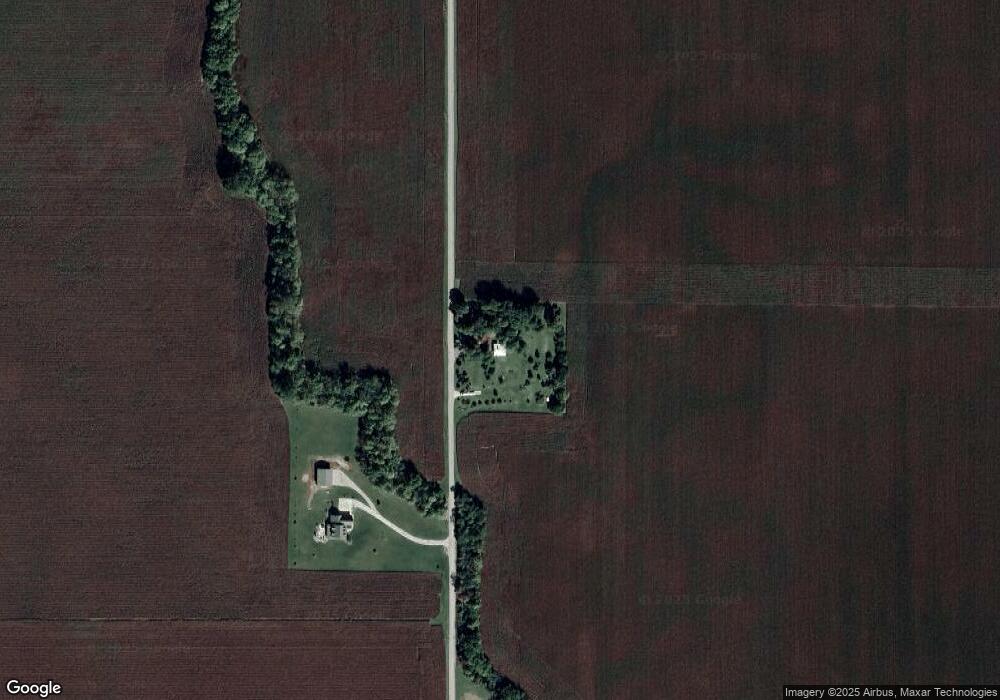

1595 S 900 W Jamestown, IN 46147

Estimated Value: $252,000 - $410,000

4

Beds

1

Bath

2,700

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 1595 S 900 W, Jamestown, IN 46147 and is currently estimated at $333,363, approximately $123 per square foot. 1595 S 900 W is a home located in Boone County with nearby schools including Western Boone Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2013

Sold by

Buck Bradley L

Bought by

Crouch Stephen W and Crouch Marisa D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,000

Outstanding Balance

$74,883

Interest Rate

5.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$258,480

Purchase Details

Closed on

May 22, 2009

Sold by

Nationstar Mortgage Llc

Bought by

Bucy Bradley L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

4.86%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 4, 2008

Sold by

Lane Larry T and Lane Rebecca L

Bought by

Nationastar Mortgage Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crouch Stephen W | -- | None Available | |

| Bucy Bradley L | -- | -- | |

| Nationastar Mortgage Llc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Crouch Stephen W | $96,000 | |

| Previous Owner | Bucy Bradley L | $90,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,724 | $238,200 | $33,900 | $204,300 |

| 2024 | $2,724 | $231,900 | $33,900 | $198,000 |

| 2023 | $2,704 | $219,400 | $33,900 | $185,500 |

| 2022 | $2,361 | $187,000 | $33,900 | $153,100 |

| 2021 | $2,301 | $169,700 | $33,900 | $135,800 |

| 2020 | $2,216 | $163,300 | $33,900 | $129,400 |

| 2019 | $2,082 | $157,000 | $33,900 | $123,100 |

| 2018 | $1,926 | $147,200 | $33,900 | $113,300 |

| 2017 | $1,842 | $145,200 | $33,900 | $111,300 |

| 2016 | $1,764 | $143,800 | $33,900 | $109,900 |

| 2014 | $1,524 | $132,200 | $35,000 | $97,200 |

| 2013 | $831 | $130,200 | $35,000 | $95,200 |

Source: Public Records

Map

Nearby Homes

- 440 Indiana 75

- 206 W Wall St

- 201 Walnut St

- 7159 W 50 S

- 7321 W 300 S

- 9402 E County Road 400 N

- W Cr 400 S

- 7820 W State Road 32

- 9136 W 500 S

- 10748 E 300 S

- 690 N 600 W

- 5005 W 200 S

- 9440 W County Road 400 S

- 750 S 500 W

- 6844 S State Road 75

- 215 S Main St

- 9613 E New Ross Rd

- 3505 W 50 S

- 1842 S 850 E

- 5388 W Hazelrigg Rd