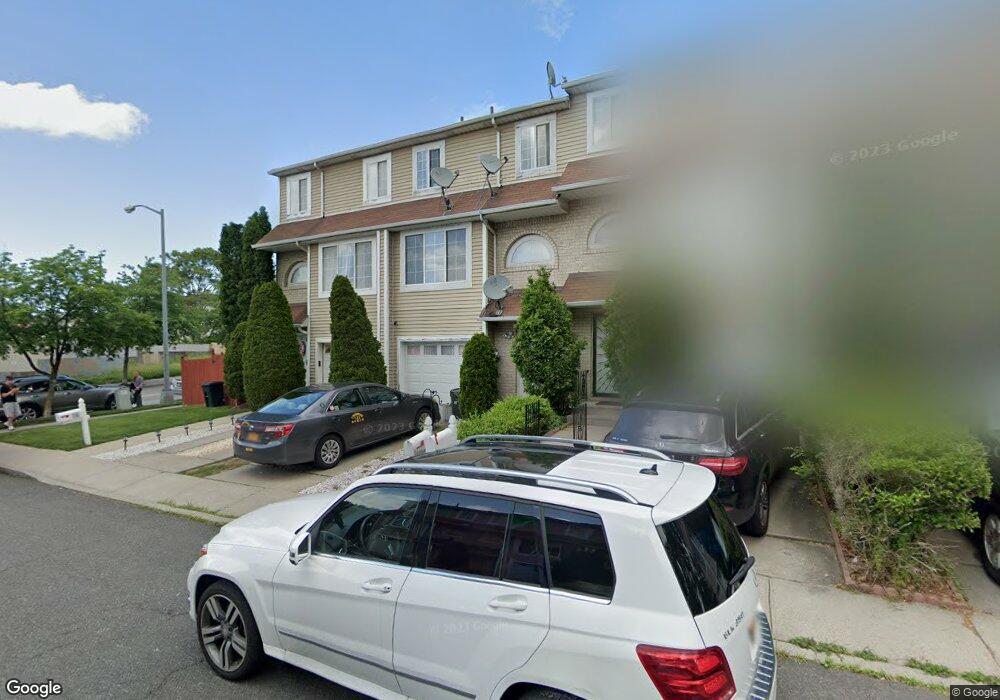

16 Claudia Ct Unit 22 Staten Island, NY 10303

Graniteville NeighborhoodEstimated Value: $510,705 - $611,000

3

Beds

2

Baths

1,595

Sq Ft

$353/Sq Ft

Est. Value

About This Home

This home is located at 16 Claudia Ct Unit 22, Staten Island, NY 10303 and is currently estimated at $563,426, approximately $353 per square foot. 16 Claudia Ct Unit 22 is a home located in Richmond County with nearby schools including P.S. 22 Graniteville, I.S. 51 Edwin Markham, and Port Richmond High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 11, 2017

Sold by

Zaslavskiy Boris and Zaslavskaya Lyudmila

Bought by

Chen Yun Y

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Outstanding Balance

$178,894

Interest Rate

5.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$384,532

Purchase Details

Closed on

Dec 20, 2012

Sold by

Zaslavskiy Boris and Zaslavaskaya Lyudmila

Bought by

Zaslavskiy Boris and Zaslavskaya Lyudmila

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

3.35%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 13, 1999

Sold by

Innocenti Edith Marie and Klele Selma

Bought by

Chase Manhattan Bank

Purchase Details

Closed on

Jun 26, 1995

Sold by

Wilcox Development Corp

Bought by

Innocenti Edith Marie and Klele Selma

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,900

Interest Rate

6.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chen Yun Y | $350,000 | Old Republic National Title | |

| Zaslavskiy Boris | -- | None Available | |

| Chase Manhattan Bank | $24,500 | -- | |

| Innocenti Edith Marie | $183,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chen Yun Y | $210,000 | |

| Previous Owner | Zaslavskiy Boris | $280,000 | |

| Previous Owner | Innocenti Edith Marie | $161,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,807 | $29,220 | $4,428 | $24,792 |

| 2024 | $4,807 | $30,720 | $3,973 | $26,747 |

| 2023 | $4,861 | $23,933 | $3,712 | $20,221 |

| 2022 | $4,742 | $29,580 | $5,100 | $24,480 |

| 2021 | $4,716 | $25,440 | $5,100 | $20,340 |

| 2020 | $4,475 | $26,400 | $5,100 | $21,300 |

| 2019 | $4,172 | $25,500 | $5,100 | $20,400 |

| 2018 | $4,066 | $19,944 | $3,970 | $15,974 |

| 2017 | $3,735 | $19,794 | $4,523 | $15,271 |

| 2016 | $3,423 | $18,674 | $4,641 | $14,033 |

| 2015 | -- | $17,617 | $4,142 | $13,475 |

| 2014 | -- | $16,620 | $4,260 | $12,360 |

Source: Public Records

Map

Nearby Homes

- 51 Adrianne Ln

- 38 Eleanor Place

- 12 Doreen Dr

- 15 Ludwig Ln

- 33 Ludwig Ln

- 5 Ludwig Ln Unit B

- 49 Doreen Dr

- 268 Bruckner Ave Unit 268

- 21 Carol Place

- 257 Maple Pkwy

- 336 van Name Ave

- 22 Spirit Ln Unit 37

- 317 Van Pelt Ave

- 123 Amity Place

- 331 Union Ave

- 73 Westbrook Ave

- 964 Richmond Ave

- 151 Amity Place

- 335 Simonson Ave

- 128 Bruckner Ave