16 Wood St Rehoboth, MA 02769

Estimated Value: $684,701 - $768,000

4

Beds

2

Baths

1,964

Sq Ft

$369/Sq Ft

Est. Value

About This Home

This home is located at 16 Wood St, Rehoboth, MA 02769 and is currently estimated at $725,675, approximately $369 per square foot. 16 Wood St is a home located in Bristol County with nearby schools including Dighton-Rehoboth Regional High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 29, 2000

Sold by

Anderson David M

Bought by

Daponte William M and Daponte Ana P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,000

Interest Rate

7.76%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 8, 1999

Sold by

Stoddard Edward C

Bought by

Anderson David M

Purchase Details

Closed on

Apr 18, 1997

Sold by

Tucker William F

Bought by

Perry Joseph and Perry Dru M

Purchase Details

Closed on

Aug 26, 1993

Sold by

Troy Peter J

Bought by

Tucker 3D William F

Purchase Details

Closed on

Jan 27, 1989

Sold by

Ferreira Fqarms Ltd

Bought by

Troy Peter J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Daponte William M | $234,000 | -- | |

| Anderson David M | $235,000 | -- | |

| Perry Joseph | $210,000 | -- | |

| Tucker 3D William F | $195,000 | -- | |

| Troy Peter J | $200,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Troy Peter J | $40,000 | |

| Closed | Troy Peter J | $50,000 | |

| Closed | Troy Peter J | $43,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $63 | $567,000 | $198,500 | $368,500 |

| 2024 | $6,180 | $544,000 | $198,500 | $345,500 |

| 2023 | $6,020 | $519,900 | $194,900 | $325,000 |

| 2022 | $5,938 | $468,700 | $194,900 | $273,800 |

| 2021 | $6,127 | $437,900 | $187,100 | $250,800 |

| 2020 | $3,576 | $419,800 | $187,100 | $232,700 |

| 2018 | $5,197 | $409,200 | $179,300 | $229,900 |

| 2017 | $4,547 | $362,000 | $179,300 | $182,700 |

| 2016 | $4,417 | $363,500 | $179,300 | $184,200 |

| 2015 | $4,084 | $331,800 | $172,100 | $159,700 |

| 2014 | $3,930 | $315,900 | $164,900 | $151,000 |

Source: Public Records

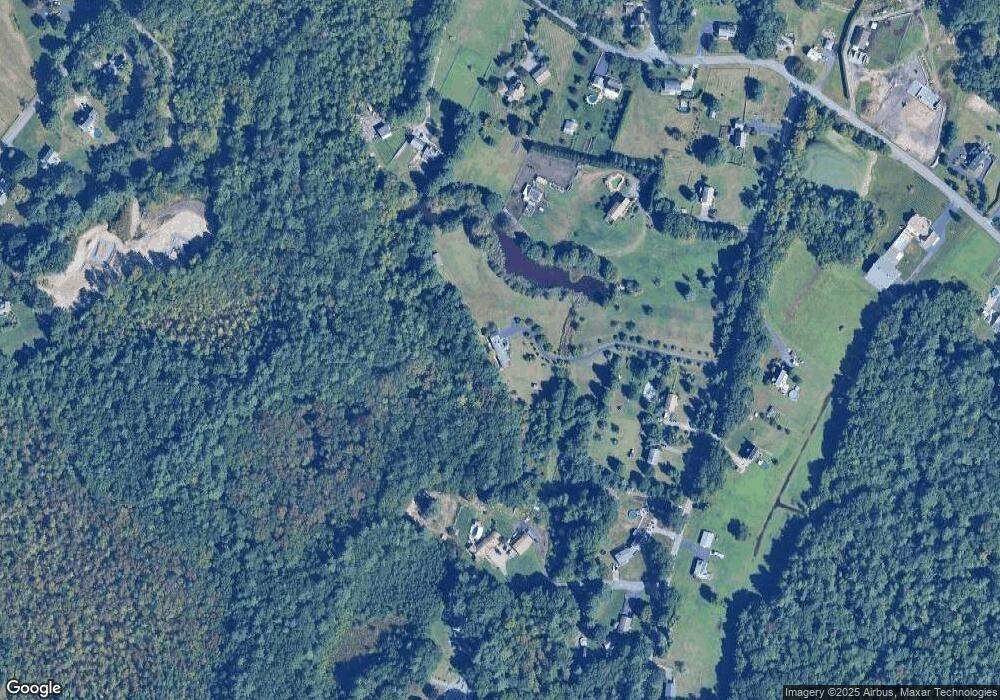

Map

Nearby Homes

- 198 Brook St

- 32 Providence St

- 0 Winter St

- 267 Chestnut St

- 205 Providence St Bldr Lot 3

- 203 Providence St Bldr Lot 5

- 42 Linden Ln

- 67 Wheeler St

- 8 Linden Ln

- 8 Linden Ln

- 127 Mason St

- 36 Columbine Rd

- 206 Moulton St

- 92 Martin St

- 20 School St

- 17 Sassafras Rd

- 120 Plain St

- 111 Summer St

- 75 Martin St

- 14 Deborah Ann Dr Unit 41