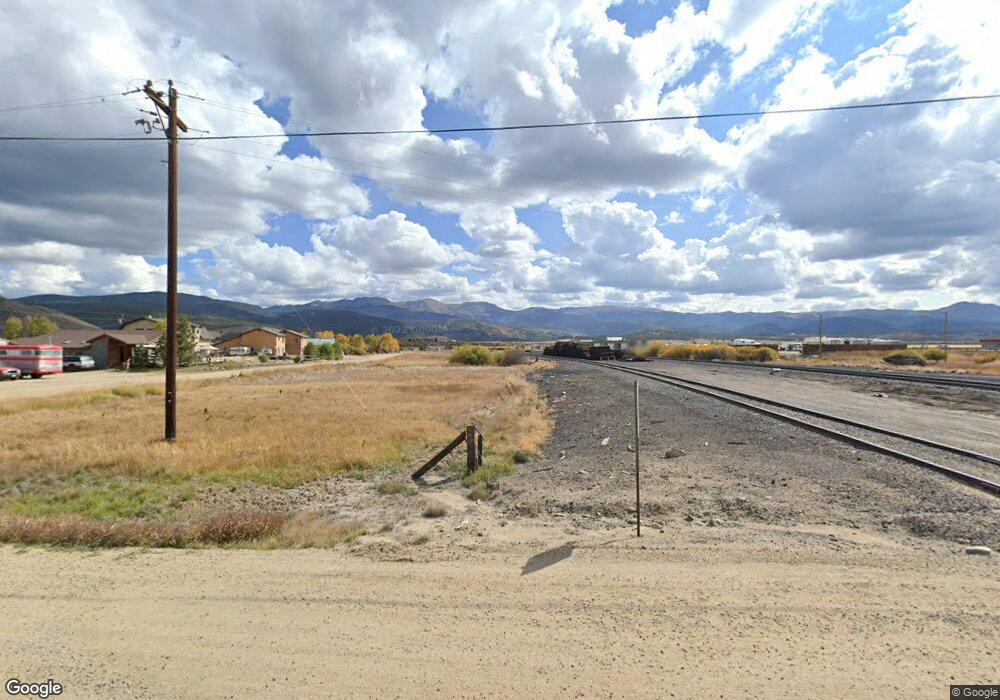

160 Co 863 Rd Tabernash, CO 80478

Estimated Value: $899,944 - $1,072,000

3

Beds

2

Baths

1,568

Sq Ft

$628/Sq Ft

Est. Value

About This Home

This home is located at 160 Co 863 Rd, Tabernash, CO 80478 and is currently estimated at $985,236, approximately $628 per square foot. 160 Co 863 Rd is a home located in Grand County with nearby schools including Middle Park High School and Grand County Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2020

Sold by

Freeman David W and Orourke Freeman Patricia

Bought by

Jones Michael A and Jones Amy H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$474,000

Outstanding Balance

$422,323

Interest Rate

2.87%

Mortgage Type

New Conventional

Estimated Equity

$562,913

Purchase Details

Closed on

May 12, 2006

Sold by

Cornier Marc Andre and Cornier Jeanette P

Bought by

Freeman David M and Rourke Freeman Patricia J O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$284,000

Interest Rate

6.5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Michael A | $721,000 | Land Title Guarantee Company | |

| Freeman David M | $355,000 | Stewart Title Of Colorado Wi |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jones Michael A | $474,000 | |

| Previous Owner | Freeman David M | $284,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,199 | $54,580 | $19,770 | $34,810 |

| 2023 | $3,199 | $54,580 | $19,770 | $34,810 |

| 2022 | $1,712 | $27,180 | $6,170 | $21,010 |

| 2021 | $1,716 | $27,960 | $6,350 | $21,610 |

| 2020 | $1,225 | $22,730 | $5,720 | $17,010 |

| 2019 | $1,193 | $22,730 | $5,720 | $17,010 |

| 2018 | $1,071 | $19,240 | $4,860 | $14,380 |

| 2017 | $1,159 | $19,240 | $4,860 | $14,380 |

| 2016 | $1,012 | $18,000 | $4,980 | $13,020 |

| 2015 | $938 | $18,000 | $4,980 | $13,020 |

| 2014 | $938 | $16,500 | $0 | $16,500 |

Source: Public Records

Map

Nearby Homes

- 226 County Rd 863 (Aka Ridge Rd)

- 797 Fawn

- 953 Gcr 86

- 90 Gcr 864

- 114 Lynx Ln

- 113 Elk Park Trail

- 313 Gcr 851

- 430 Elk Horn Dr

- 2833 Lions Ln

- 4291 Silver Creek Dr

- 600 County Road 856 Ln

- 61 County Road 8501

- 61 Lodgepole Ln

- 5950 Gcr 5

- 433 Gcr 859 Dr

- 5947 County Road 5

- 5943 Gcr 5

- 152 Badger Way

- 271 Gcr 521

- 52 County Rd

- 160 Ridge Rd

- 126 Ridge Rd

- 25 Fawn Dr

- 3 Fawn Dr

- 195 Ridge Rd

- 58 Fawn Dr

- 744 Grandview Cir

- 125 Ridge Rd

- 50 County Road 546

- 50 Ridge Rd

- 226 Cr 863 Aka Ridge Rd

- 226 Ridge Rd Aka Cr 863

- 834 County Road 86 Cir

- 227 County Road 8910 Unit 2305

- 227 County Road 8910 Unit 2106

- 227 County Road 8910 Unit 2302

- 227 County Road 8910

- 227 Co Rd 8910

- 227 Co Rd 8910 Unit 2303

- 227 Co Rd 8910 Unit 2302