160 Stillmeadow Dr Unit 10 Cincinnati, OH 45245

Estimated Value: $169,000 - $214,000

3

Beds

3

Baths

1,304

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 160 Stillmeadow Dr Unit 10, Cincinnati, OH 45245 and is currently estimated at $187,438, approximately $143 per square foot. 160 Stillmeadow Dr Unit 10 is a home located in Clermont County with nearby schools including Merwin Elementary School, West Clermont Middle School, and West Clermont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2020

Sold by

Khare Development Group Llc

Bought by

Wood Melinda S and Eubanks James A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,850

Outstanding Balance

$86,352

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$101,086

Purchase Details

Closed on

Sep 2, 2006

Sold by

Va

Bought by

Khare Development Group Llc

Purchase Details

Closed on

Jun 14, 2006

Sold by

Vespie Matthew A and Mortgage Electronic Registrati

Bought by

Va

Purchase Details

Closed on

Mar 21, 2001

Sold by

Harmon Joan P

Bought by

Vespie Matthew A and Vespie Lisa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,940

Interest Rate

7%

Mortgage Type

VA

Purchase Details

Closed on

Jun 26, 2000

Sold by

Rhude Rachel I

Bought by

Harmon Joan P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,800

Interest Rate

8.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 1, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wood Melinda S | $103,000 | None Available | |

| Khare Development Group Llc | $93,000 | None Available | |

| Va | $63,333 | None Available | |

| Vespie Matthew A | $97,000 | -- | |

| Harmon Joan P | $93,500 | -- | |

| -- | $65,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wood Melinda S | $97,850 | |

| Previous Owner | Vespie Matthew A | $98,940 | |

| Previous Owner | Harmon Joan P | $88,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,580 | $50,510 | $8,470 | $42,040 |

| 2023 | $2,583 | $50,510 | $8,470 | $42,040 |

| 2022 | $1,845 | $31,360 | $5,250 | $26,110 |

| 2021 | $1,824 | $31,360 | $5,250 | $26,110 |

| 2020 | $1,834 | $30,800 | $5,250 | $25,550 |

| 2019 | $1,496 | $27,200 | $1,440 | $25,760 |

| 2018 | $1,511 | $27,200 | $1,440 | $25,760 |

| 2017 | $1,531 | $27,200 | $1,440 | $25,760 |

| 2016 | $1,635 | $26,670 | $1,400 | $25,270 |

| 2015 | $1,592 | $26,670 | $1,400 | $25,270 |

| 2014 | $1,536 | $26,670 | $1,400 | $25,270 |

| 2013 | $1,565 | $27,020 | $1,890 | $25,130 |

Source: Public Records

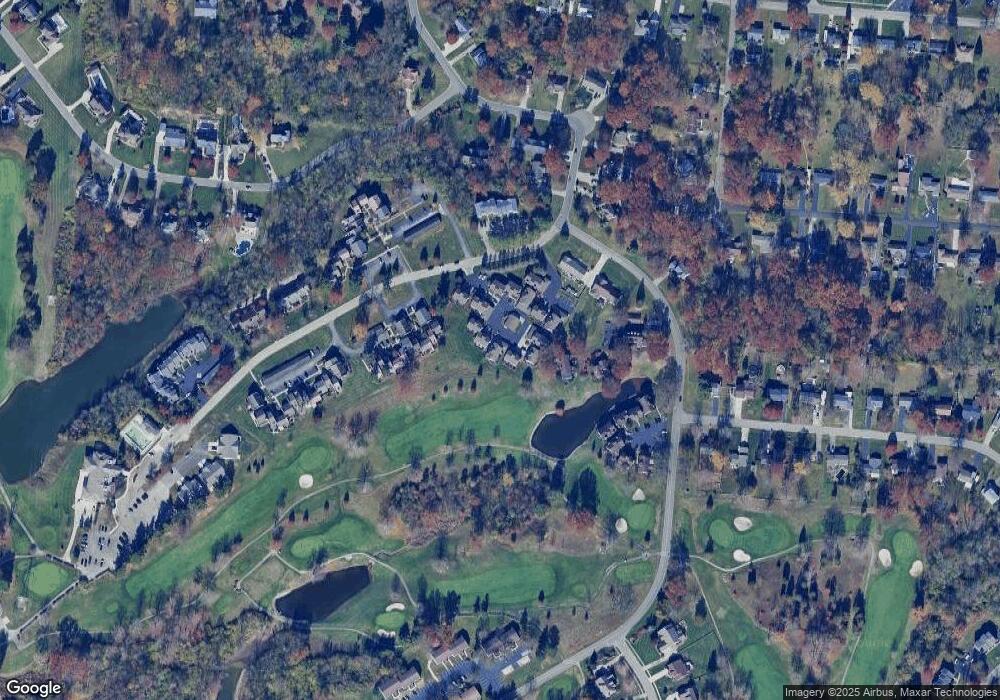

Map

Nearby Homes

- 168 Stillmeadow Dr

- 63 Stillmeadow Dr Unit 63

- 3 Stillmeadow Dr Unit 3F

- 1084 Muirfield Dr

- 1001 Castlebay

- 3690 Parfore Ct

- 933 Country Club Dr

- 3638 Parfore Ct

- 921 Country Club Dr

- 3728 Merwin 10 Mile Rd

- 971 Cedar Ridge Dr

- 1108 Orchard Ln

- 3815 Sturbridge Way

- 3779 Sturbridge Way

- 3767 Sturbridge Way

- 1115 Twigg Ln

- 990 Vixen Dr

- 1142 Will O Ee Dr

- 3790 Prestwick Cir

- The McPherson Plan at Prestwick Place - Designer Collection

- 302 Saint Andrews Dr

- 302 Saint Andrews Dr

- 302 Saint Andrews Dr

- 302 Saint Andrews Dr

- 302 Saint Andrews Dr Unit C

- 162 Stillmeadow Dr

- 158 Stillmeadow Dr

- 158 Stillmeadow Dr Unit 11

- 164 Stillmeadow Dr

- 166 Stillmeadow Dr

- 156 Stillmeadow Dr

- 300 Saint Andrews Dr

- 300 Saint Andrews Dr

- 300 Saint Andrews Dr

- 300 Saint Andrews Dr

- 150 Stillmeadow Dr Unit 16

- 170 Stillmeadow Dr Unit 5

- 152 Stillmeadow Dr

- 154 Stillmeadow Dr Unit 13

- 172 Stillmeadow Dr Unit 4