1601 Cardinal Bluff Dr Unit 203 Las Vegas, NV 89128

Summerlin NeighborhoodEstimated Value: $337,288 - $361,000

3

Beds

2

Baths

1,412

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 1601 Cardinal Bluff Dr Unit 203, Las Vegas, NV 89128 and is currently estimated at $348,322, approximately $246 per square foot. 1601 Cardinal Bluff Dr Unit 203 is a home located in Clark County with nearby schools including Richard H. Bryan Elementary School, Ernest Becker Middle School, and Cimarron Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 5, 2000

Sold by

Sturonas Mark J

Bought by

Sturonas Mark J and Sturonas Prakaymas

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Outstanding Balance

$13,030

Interest Rate

7.96%

Estimated Equity

$335,292

Purchase Details

Closed on

Feb 1, 2000

Sold by

Red Hills At The Pueblo Ltd Partnership

Bought by

Sturonas Mark J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Outstanding Balance

$13,030

Interest Rate

7.96%

Estimated Equity

$335,292

Purchase Details

Closed on

Jan 31, 2000

Sold by

Kanjanapan Prakaymas

Bought by

Sturonas Mark J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Outstanding Balance

$13,030

Interest Rate

7.96%

Estimated Equity

$335,292

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sturonas Mark J | -- | -- | |

| Sturonas Mark J | $137,700 | Nevada Title Company | |

| Sturonas Mark J | -- | Nevada Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sturonas Mark J | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,321 | $71,006 | $27,300 | $43,706 |

| 2024 | $1,283 | $71,006 | $27,300 | $43,706 |

| 2023 | $1,283 | $74,258 | $33,950 | $40,308 |

| 2022 | $1,246 | $62,499 | $25,200 | $37,299 |

| 2021 | $1,210 | $61,061 | $24,850 | $36,211 |

| 2020 | $1,171 | $61,541 | $25,550 | $35,991 |

| 2019 | $1,137 | $56,490 | $20,650 | $35,840 |

| 2018 | $1,104 | $47,889 | $12,950 | $34,939 |

| 2017 | $1,595 | $48,641 | $12,950 | $35,691 |

| 2016 | $1,047 | $46,166 | $11,200 | $34,966 |

| 2015 | $1,044 | $40,291 | $7,700 | $32,591 |

| 2014 | $1,013 | $31,210 | $8,750 | $22,460 |

Source: Public Records

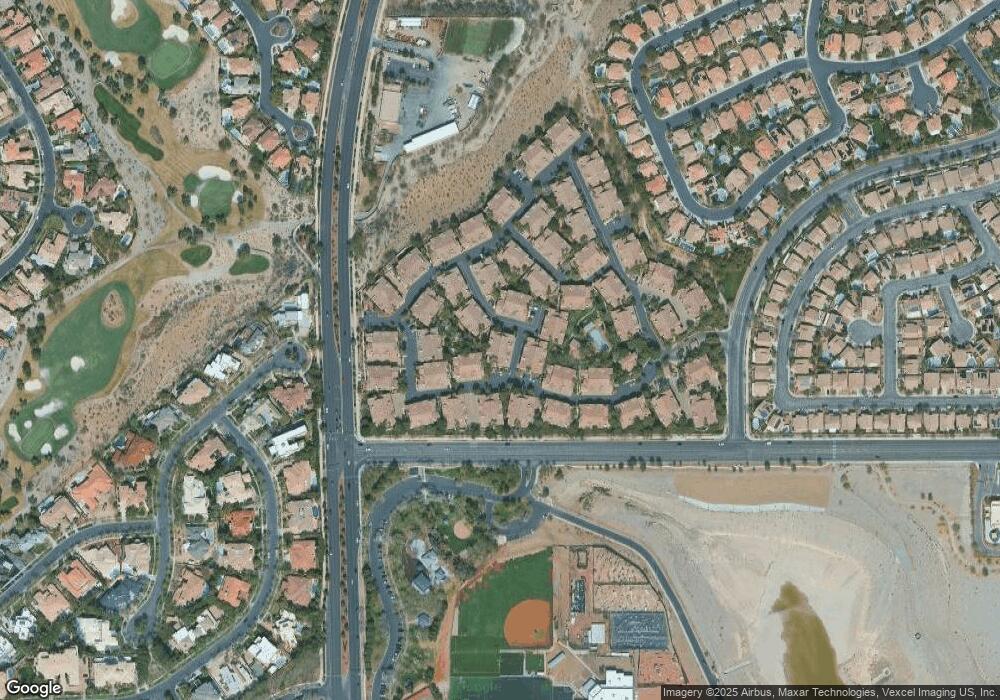

Map

Nearby Homes

- 1608 Cardinal Bluff Dr Unit 201

- 8716 Red Rio Dr Unit 103

- 8721 Red Brook Dr Unit 203

- 1605 Crimson Hills Dr Unit 204

- 8737 Red Brook Dr Unit 203

- 8737 Red Brook Dr Unit 201

- 8725 Red Rio Dr Unit 203

- 8612 Sierra Cima Ln

- 8808 Greensboro Ln

- 1429 Iron Hills Ln

- 1805 Corta Bella Dr

- 1720 Plata Pico Dr

- 1817 Wincanton Dr

- 1717 Double Arrow Place

- 1401 Iron Hills Ln

- 8412 Eagle Eye Ave

- 8420 Desert Quail Dr

- 1968 Evening Glow Dr

- 1501 Faldo St Unit 2

- 8414 Elkington Ave

- 1601 Cardinal Bluff Dr Unit 201

- 1601 Cardinal Bluff Dr Unit 104

- 1601 Cardinal Bluff Dr Unit 103

- 1601 Cardinal Bluff Dr Unit 202

- 1601 Cardinal Bluff Dr Unit 204

- 1601 Cardinal Bluff Dr Unit 103

- 1601 Cardinal Bluff Dr Unit 104

- 1601 Cardinal Bluff Dr Unit 204

- 1604 Cardinal Bluff Dr Unit 201

- 1604 Cardinal Bluff Dr Unit 104

- 1604 Cardinal Bluff Dr Unit 103

- 1604 Cardinal Bluff Dr Unit 202

- 8732 Red Brook Dr Unit 204

- 8732 Red Brook Dr Unit 201

- 8732 Red Brook Dr Unit 202

- 8732 Red Brook Dr Unit 104

- 8732 Red Brook Dr Unit 203

- 8732 Red Brook Dr Unit 103

- 8732 Red Brook Dr

- 1600 Cardinal Bluff Dr Unit 104