16011 Faircrest Dr Whitney, TX 76692

Estimated Value: $378,000 - $424,000

3

Beds

3

Baths

2,244

Sq Ft

$177/Sq Ft

Est. Value

About This Home

This home is located at 16011 Faircrest Dr, Whitney, TX 76692 and is currently estimated at $397,699, approximately $177 per square foot. 16011 Faircrest Dr is a home located in Hill County with nearby schools including Whitney Elementary School, Whitney Intermediate School, and Whitney Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2019

Sold by

U S Bank N A

Bought by

Sutch Jason and Sutch Rauchelle

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,000

Outstanding Balance

$195,757

Interest Rate

3.6%

Mortgage Type

VA

Estimated Equity

$201,942

Purchase Details

Closed on

Aug 6, 2019

Sold by

Corder James R and Corder Gina

Bought by

Us Bank Trust Na and Lsf10 Master Participation Trust

Purchase Details

Closed on

Feb 4, 2010

Sold by

Schultz James R and Schultz Billie Bcyant

Bought by

Llc Dba Home Team Mortgage

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

5.11%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sutch Jason | -- | None Available | |

| Us Bank Trust Na | $249,033 | None Available | |

| Llc Dba Home Team Mortgage | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sutch Jason | $223,000 | |

| Previous Owner | Llc Dba Home Team Mortgage | $210,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,265 | $343,350 | $16,810 | $326,540 |

| 2024 | $4,848 | $342,970 | $16,810 | $326,160 |

| 2023 | $4,475 | $330,850 | $16,810 | $314,040 |

| 2022 | $4,887 | $279,240 | $8,090 | $271,150 |

| 2021 | $5,063 | $238,240 | $8,090 | $230,150 |

| 2020 | $4,793 | $215,940 | $8,090 | $207,850 |

| 2019 | $4,899 | $210,710 | $7,160 | $203,550 |

| 2018 | $4,851 | $208,990 | $7,240 | $201,750 |

| 2017 | $4,922 | $210,070 | $7,280 | $202,790 |

| 2016 | $4,502 | $192,160 | $7,430 | $184,730 |

| 2015 | -- | $185,940 | $8,340 | $177,600 |

| 2014 | -- | $182,430 | $9,920 | $172,510 |

Source: Public Records

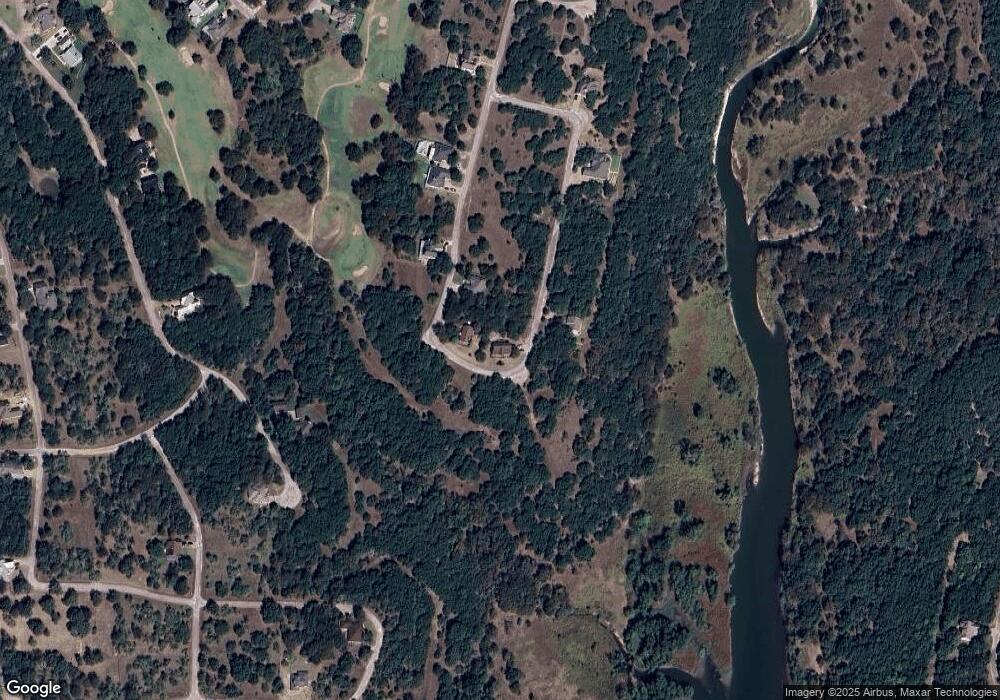

Map

Nearby Homes

- 16012 Faircrest Dr

- 16046 Faircrest Dr

- 16045 Faircrest Dr

- 16044 Faircrest Dr

- 17151 Woodway Dr

- 21111 Hill Terrace Ct

- 17081 Faircrest Dr

- 17145 Woodlawn Dr

- 17149 Woodlawn Dr

- 17154 Woodway Dr

- 17048 Faircrest Dr

- 17150 Woodway Dr

- 17001 Trailwood Dr

- 17124 Trailwood Dr

- 12131 Trailwood Dr

- 12129 Trailwood Dr

- 12130 Trailwood Dr

- 21049 Hill Terrace Ct

- 21051 Hill Terrace Ct

- 21046 Hill Terrace Ct

- 16010 Faircrest Dr

- 16059 Faircrest Dr

- 59 Faircrest Dr

- 16054 Faircrest Dr

- 8 Faircrest Dr

- 16061 Faircrest Dr

- 17 Faircrest Dr

- 102 Faircrest Dr

- 16007 Faircrest Dr

- 16049 Faircrest Dr

- 16064 Faircrest Dr

- 16047 Faircrest Dr

- 16017 Faircrest Dr

- 16067 Faircrest Dr

- 16002 Faircrest Dr

- 16043 Faircrest Dr

- 21002 Woodlawn Ct

- 16001 Faircrest Dr

- 16068 Faircrest Dr

- 16041 Faircrest Dr