Estimated Value: $569,000 - $675,000

3

Beds

2

Baths

1,800

Sq Ft

$340/Sq Ft

Est. Value

About This Home

This home is located at 16036 143rd Ave SE, Yelm, WA 98597 and is currently estimated at $612,503, approximately $340 per square foot. 16036 143rd Ave SE is a home located in Thurston County with nearby schools including Yelm Prairie Elementary School, Ridgeline Middle School, and Yelm High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2025

Sold by

Skean Bonnie Mae

Bought by

Revocable Trust Agreement Of Bonnie Mae Skean and Skean

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2004

Sold by

Laird C G and Laird Peter H

Bought by

Skean Bonnie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

4.5%

Mortgage Type

Unknown

Purchase Details

Closed on

Jun 2, 1998

Sold by

Rainier General Development Inc

Bought by

Laird Peter H and Laird C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,215

Interest Rate

7.1%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Revocable Trust Agreement Of Bonnie Mae Skean | -- | None Listed On Document | |

| Skean Bonnie M | $250,014 | Chicago Title Co | |

| Laird Peter H | $153,452 | Thurston County Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Skean Bonnie M | $70,000 | |

| Previous Owner | Laird Peter H | $130,215 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $435 | $494,100 | $208,000 | $286,100 |

| 2023 | $435 | $485,200 | $216,400 | $268,800 |

| 2022 | $477 | $443,700 | $140,400 | $303,300 |

| 2021 | $493 | $373,800 | $146,800 | $227,000 |

| 2020 | $507 | $296,600 | $94,900 | $201,700 |

| 2019 | $511 | $262,900 | $94,100 | $168,800 |

| 2018 | $522 | $239,700 | $77,000 | $162,700 |

| 2017 | $2,939 | $222,450 | $74,950 | $147,500 |

| 2016 | $2,880 | $210,350 | $77,850 | $132,500 |

| 2014 | -- | $204,650 | $80,250 | $124,400 |

Source: Public Records

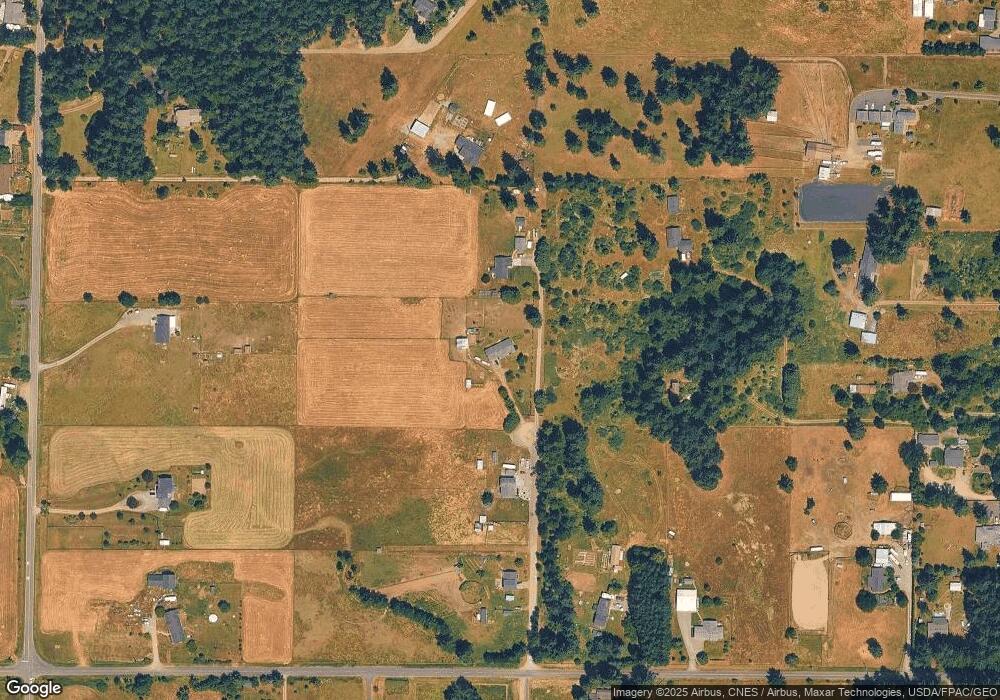

Map

Nearby Homes

- 14134 Morris Rd SE

- 13945 Morris Rd SE

- 16718 146th Ave SE

- 13604 Vail Rd SE

- 0 Martinson Rd SE Unit NWM2326402

- 15840 130th Trail SE

- 14109 Solberg Rd SE

- 14710 Regal Ln SE

- 14919 141st Ln SE

- 15818 153rd Ave SE

- 15442 Ursula Ln SE

- 17536 138th Ave SE

- 13929 Mariposa Ln SE

- 15405 Lindsay Rd SE

- 15427 Bald Pate St SE

- 17619 153rd Way SE

- 15648 Topaz Dr SE

- 17602 154th Way SE

- 15835 Jade St SE

- 15816 Lindsay Rd SE

- 16028 143rd Ave SE

- 16042 143rd Ave SE

- 14024 Morris Rd SE

- 16022 143rd Ave SE

- 14102 Morris Rd SE

- 14131 Vail Rd SE

- 14125 Vail Rd SE

- 16302 143rd Ave SE

- 14004 Morris Rd SE

- 16046 143rd Ave SE

- 16334 143rd Ave SE

- 16111 143rd Ave SE

- 14103 Vail Rd SE

- 16305 143rd Ave SE

- 16135 143rd Ave SE

- 14135 Vail Rd SE

- 16420 143rd Ave SE

- 13948 Morris Rd SE

- 14001 Morris Rd SE

- 13947 Morris Rd SE