1606 Pine Tree Ln Unit 39 Dayton, OH 45449

Estimated Value: $102,000 - $138,000

2

Beds

2

Baths

1,341

Sq Ft

$94/Sq Ft

Est. Value

About This Home

This home is located at 1606 Pine Tree Ln Unit 39, Dayton, OH 45449 and is currently estimated at $125,729, approximately $93 per square foot. 1606 Pine Tree Ln Unit 39 is a home located in Montgomery County with nearby schools including West Carrollton High School and Bethel Baptist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 24, 2019

Sold by

Dunham Kenneth Thomas

Bought by

Cauley Diane M

Current Estimated Value

Purchase Details

Closed on

May 21, 2018

Sold by

Runyeon Dan and Runyeon Kerry

Bought by

Dunham Kenneth Thomas

Purchase Details

Closed on

Jan 31, 2018

Sold by

Griffen Roger

Bought by

Runyeon Dan

Purchase Details

Closed on

May 18, 2015

Sold by

Secretary Of Housing & Urban Development

Bought by

Griffen Roger

Purchase Details

Closed on

Nov 14, 2006

Sold by

Richardson L Shay and Richardson Candie M

Bought by

Molina Jade May

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,111

Interest Rate

6.4%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 19, 2003

Sold by

Sue Cole and Sue Cordelia

Bought by

Richardson L Shay

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,600

Interest Rate

5.9%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 23, 1998

Sold by

Rickling John A

Bought by

Frey Karen E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,950

Interest Rate

6.8%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cauley Diane M | $70,000 | First Ohio Title Insurance | |

| Dunham Kenneth Thomas | $77,000 | None Available | |

| Runyeon Dan | $35,500 | None Available | |

| Griffen Roger | $41,500 | Attorney | |

| Molina Jade May | $83,400 | Attorney | |

| Richardson L Shay | $77,000 | -- | |

| Frey Karen E | $68,500 | Ati Title Agency Of Ohio Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Molina Jade May | $82,111 | |

| Previous Owner | Richardson L Shay | $74,600 | |

| Previous Owner | Frey Karen E | $66,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,792 | $28,800 | $4,090 | $24,710 |

| 2023 | $1,792 | $28,800 | $4,090 | $24,710 |

| 2022 | $1,797 | $22,710 | $3,220 | $19,490 |

| 2021 | $1,801 | $22,710 | $3,220 | $19,490 |

| 2020 | $1,800 | $22,710 | $3,220 | $19,490 |

| 2019 | $1,505 | $17,450 | $2,800 | $14,650 |

| 2018 | $1,411 | $17,450 | $2,800 | $14,650 |

| 2017 | $1,402 | $17,450 | $2,800 | $14,650 |

| 2016 | $1,650 | $20,130 | $2,800 | $17,330 |

| 2015 | $1,539 | $20,130 | $2,800 | $17,330 |

| 2014 | $1,478 | $20,130 | $2,800 | $17,330 |

| 2012 | -- | $22,490 | $5,600 | $16,890 |

Source: Public Records

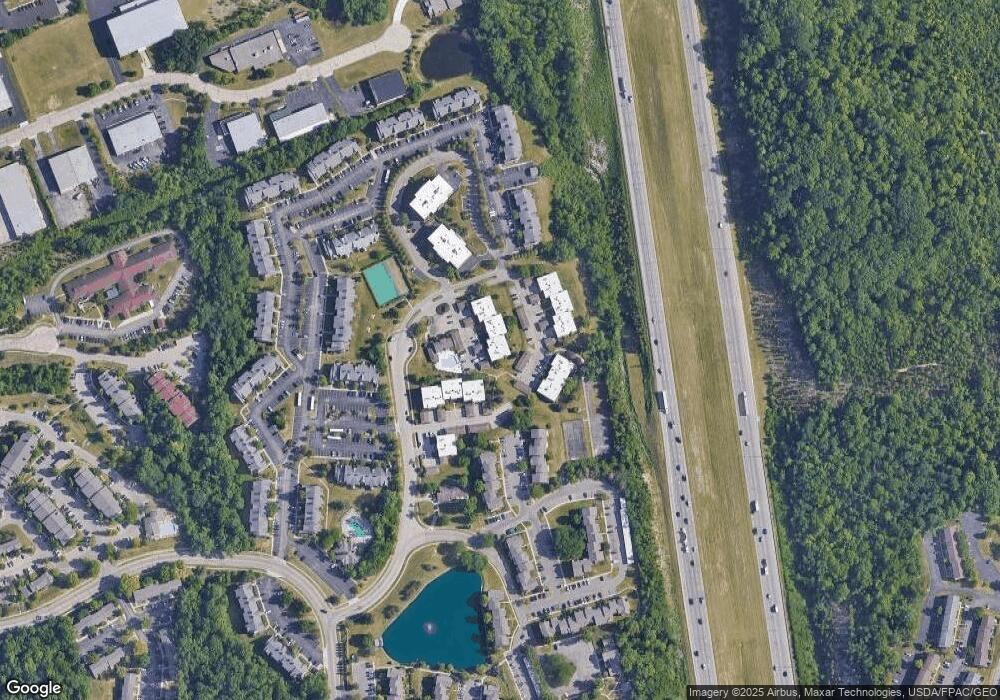

Map

Nearby Homes

- 1606 Pine Tree Ln Unit 38

- 1109 Arrowhead Crossing Unit A

- 1112 Eagle Feather Cir Unit A

- 1104 Arrowhead Crossing Unit B

- 1116 Eagle Feather Cir Unit E

- 1016 Hidden Landing Trail Unit F

- 1788 Cherokee Dr Unit F

- 1792 Cherokee Dr Unit A

- 6484 Quintessa Ct Unit 29

- 6409 Interlude Ln Unit 415

- 3316 Vanquil Trail Unit 387

- 3304 Ultimate Way Unit 399

- 3218 Gambit Square Unit 471

- 3254 Gambit Square Unit 451

- 6407 Kindred Square Unit 9-4

- 7153 Springboro Pike Unit A

- 430 Donington Dr

- 3034 Bright Bounty Ln Unit 29

- 609 Kings Cross Ct

- 500 Lincoln Green Dr

- 1606 Pine Tree Ln Unit 42

- 1606 Pine Tree Ln Unit 41

- 1606 Pine Tree Ln Unit 40

- 1606 Pine Tree Ln Unit 37

- 1606 Pine Tree Ln

- 1602 Pine Tree Ln Unit 36

- 1602 Pine Tree Ln Unit 35

- 1602 Pine Tree Ln Unit 34

- 1602 Pine Tree Ln Unit 33

- 1602 Pine Tree Ln Unit 32

- 1602 Pine Tree Ln Unit 31

- 1602 Pine Tree Ln

- 1113 Snowshoe Trail Unit 24

- 1113 Snowshoe Trail Unit 23

- 1113 Snowshoe Trail Unit 22

- 1113 Snowshoe Trail Unit 21

- 1113 Snowshoe Trail Unit 20

- 1113 Snowshoe Trail Unit 19

- 1113 Snowshoe Trail Unit 24 Bldg 2

- 1600 Pine Tree Ln Unit 30