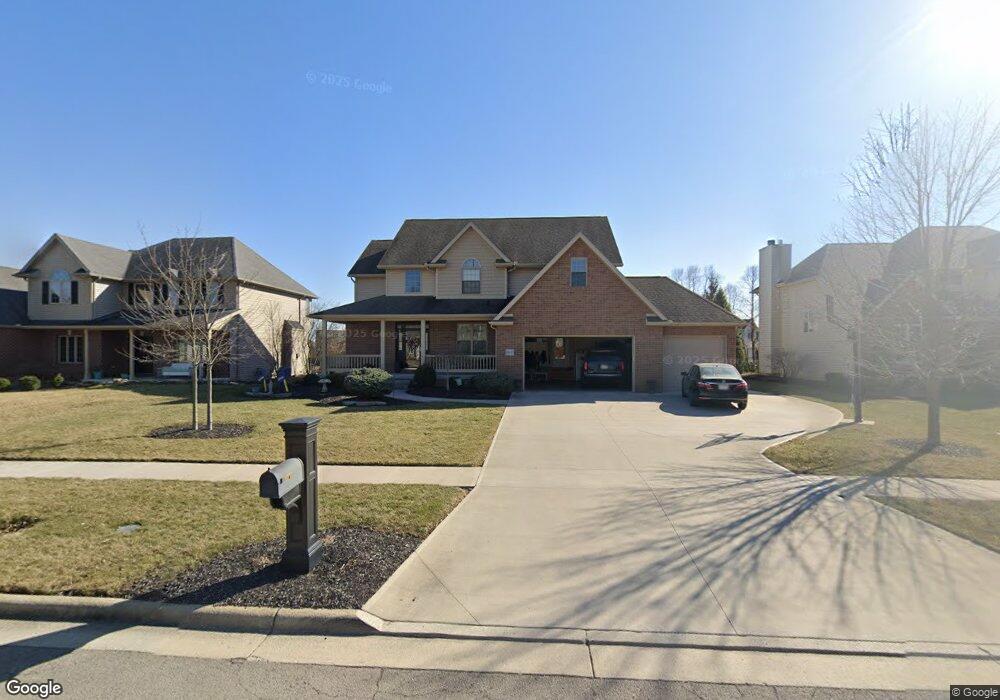

16157 Forest Edge Dr Findlay, OH 45840

Estimated Value: $560,676 - $636,000

4

Beds

4

Baths

3,130

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 16157 Forest Edge Dr, Findlay, OH 45840 and is currently estimated at $599,919, approximately $191 per square foot. 16157 Forest Edge Dr is a home located in Hancock County with nearby schools including Wilson Vance Elementary School, Whittier Elementary School, and Glenwood Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 11, 2017

Sold by

Harp Matthew A and Harp Jennifer L

Bought by

Kasselmann Christopher M and Kasselmann Lori M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Outstanding Balance

$266,231

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$333,688

Purchase Details

Closed on

Apr 22, 2013

Sold by

Jerry Niese Construction Llc

Bought by

Harp Matthew A and Harp Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$349,135

Interest Rate

3.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 7, 2012

Sold by

Weinko Inc

Bought by

Jerry Niese Construction Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$42,900

Interest Rate

3.9%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kasselmann Christopher M | $400,000 | Flag City Title Agency | |

| Harp Matthew A | $367,500 | Flag City Title Agency | |

| Jerry Niese Construction Llc | $43,066 | Abstract Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kasselmann Christopher M | $320,000 | |

| Previous Owner | Harp Matthew A | $349,135 | |

| Previous Owner | Jerry Niese Construction Llc | $42,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,879 | $164,930 | $22,490 | $142,440 |

| 2023 | $5,888 | $164,930 | $22,490 | $142,440 |

| 2022 | $5,867 | $164,930 | $22,490 | $142,440 |

| 2021 | $6,210 | $151,660 | $12,850 | $138,810 |

| 2020 | $6,210 | $151,660 | $12,850 | $138,810 |

| 2019 | $6,085 | $151,660 | $12,850 | $138,810 |

| 2018 | $5,760 | $131,420 | $10,710 | $120,710 |

| 2017 | $2,879 | $131,420 | $10,710 | $120,710 |

| 2016 | $5,649 | $131,420 | $10,710 | $120,710 |

| 2015 | $5,428 | $123,040 | $11,310 | $111,730 |

| 2014 | $5,268 | $122,170 | $11,310 | $110,860 |

| 2012 | $405 | $9,040 | $9,040 | $0 |

Source: Public Records

Map

Nearby Homes

- 15818 Forest Ln

- 8320 Tawa Creek Dr

- 8499 Indian Lake Dr

- 8405 Indian Lake Dr

- 8464 Indian Lake Dr

- 0 Hickory Ln Unit 6133896

- 0 Hickory Ln Unit 1 307878

- 0 Hickory Ln Unit 20252999

- 8131 Brookfield Cir

- 8457 Lakewood Dr

- 7507 Township Road 212

- 2772 Timberview Ct

- 0 E Us Route 224

- 15329 E Us Route 224

- 827 Abbey Ln

- 456 Strathaven Dr

- 1121 Fox Run Rd

- 2245 Fox Run Cir Unit 1037

- 845 Fox Run Rd

- 801 Fox Run Rd

- 16173 Forest Edge Dr

- 16141 Forest Edge Dr

- 16068 Lakeside Ct

- 16189 Forest Edge Dr

- 16125 Forest Edge Dr

- 16056 Lakeside Ct

- 16065 Lakeside Ct

- 16156 Forest Edge Dr

- 16172 Forest Edge Dr

- 8128 Ash Ridge Ln

- 16188 Forest Edge Dr

- 16109 Forest Edge Dr

- 8146 Ash Ridge Ln

- 16208 Forest Edge Dr

- 16092 Forest Lake Dr

- 16058 Forest Lake Dr

- 16053 Lakeside Ct

- 8162 Ash Ridge Ln

- 16093 Forest Edge Dr

- 16102 Forest Lake Dr

Your Personal Tour Guide

Ask me questions while you tour the home.