Estimated Value: $645,000 - $844,000

5

Beds

3

Baths

3,808

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 1620 Crows Nest Ln, York, PA 17403 and is currently estimated at $708,824, approximately $186 per square foot. 1620 Crows Nest Ln is a home located in York County with nearby schools including York Suburban Middle School, York Suburban Senior High School, and Lincoln Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2007

Sold by

Johnston David R and Johnston Jeanne S

Bought by

Vedder Christopher M and Vedder Alison E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$415,200

Outstanding Balance

$255,969

Interest Rate

6.24%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$452,855

Purchase Details

Closed on

Aug 1, 2005

Sold by

Updike Furman T and Updike Frances K

Bought by

Johnston David R and Johnston Jeanne S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$359,650

Interest Rate

5.63%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vedder Christopher M | $519,000 | None Available | |

| Johnston David R | $450,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vedder Christopher M | $415,200 | |

| Previous Owner | Johnston David R | $359,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,450 | $302,430 | $61,600 | $240,830 |

| 2024 | $11,152 | $302,430 | $61,600 | $240,830 |

| 2023 | $10,812 | $302,430 | $61,600 | $240,830 |

| 2022 | $10,521 | $302,430 | $61,600 | $240,830 |

| 2021 | $10,108 | $302,430 | $61,600 | $240,830 |

| 2020 | $10,037 | $302,430 | $61,600 | $240,830 |

| 2019 | $9,786 | $302,430 | $61,600 | $240,830 |

| 2018 | $9,580 | $302,430 | $61,600 | $240,830 |

| 2017 | $9,452 | $302,430 | $61,600 | $240,830 |

| 2016 | $0 | $302,430 | $61,600 | $240,830 |

| 2015 | -- | $302,430 | $61,600 | $240,830 |

| 2014 | -- | $302,430 | $61,600 | $240,830 |

Source: Public Records

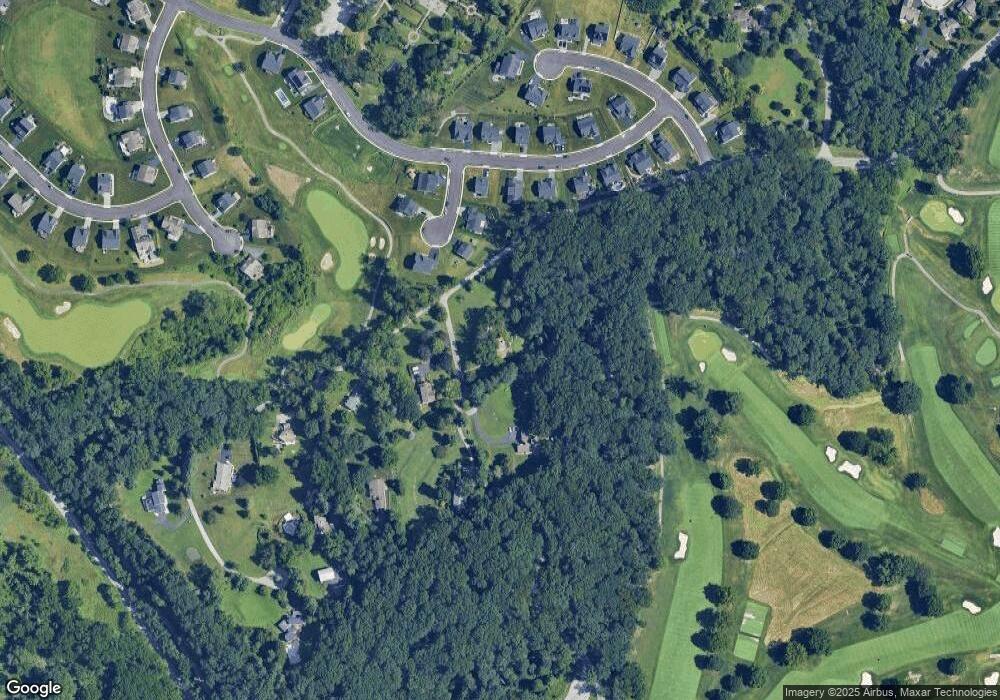

Map

Nearby Homes

- 1404 Crest Way

- 1359 Ben Hogan Way

- 1115 Glen View Dr

- 1010 Crest Way Unit 403

- 1016 Rosecroft Ln Unit 8

- 1058 Rosecroft Ln Unit 25

- 1138 Rosecroft Ln

- 1133 Rosecroft Ln

- 1149 Rosecroft Ln Unit 58

- 1161 Rosecroft Ln Unit 54

- 1028 Rosecroft Ln

- 1190 Country Club Rd

- 938 Stonehaven Way

- 1265 Stonehaven Way Unit 82

- 1000 Country Club Rd Unit B-2

- 1000 Country Club Rd Unit A13

- 1000 Country Club Rd Unit 10

- 1000 Country Club Rd Unit C5

- 1000 Country Club Rd Unit 8

- 1269 Elderslie Ln Unit 112

- 1607 River Birch Cir

- 1610 River Birch Cir

- 1680 Crows Nest Ln

- 1605 River Birch Cir

- 1408 Copper Beech Dr

- 1640 Crows Nest Ln

- 1402 Copper Beech Dr

- 1606 River Birch Cir

- 1414 Copper Beech Dr

- 1602 River Birch Cir

- 1710 Crows Nest Ln

- 1420 Copper Beech Dr

- 1660 Crows Nest Ln

- 1411 Copper Beech Dr

- 1405 Copper Beech Dr

- 1426 Copper Beech Dr

- 1397 Copper Beech Dr

- 1417 Copper Beech Dr

- 1730 Crows Nest Ln

- 1423 Copper Beech Dr