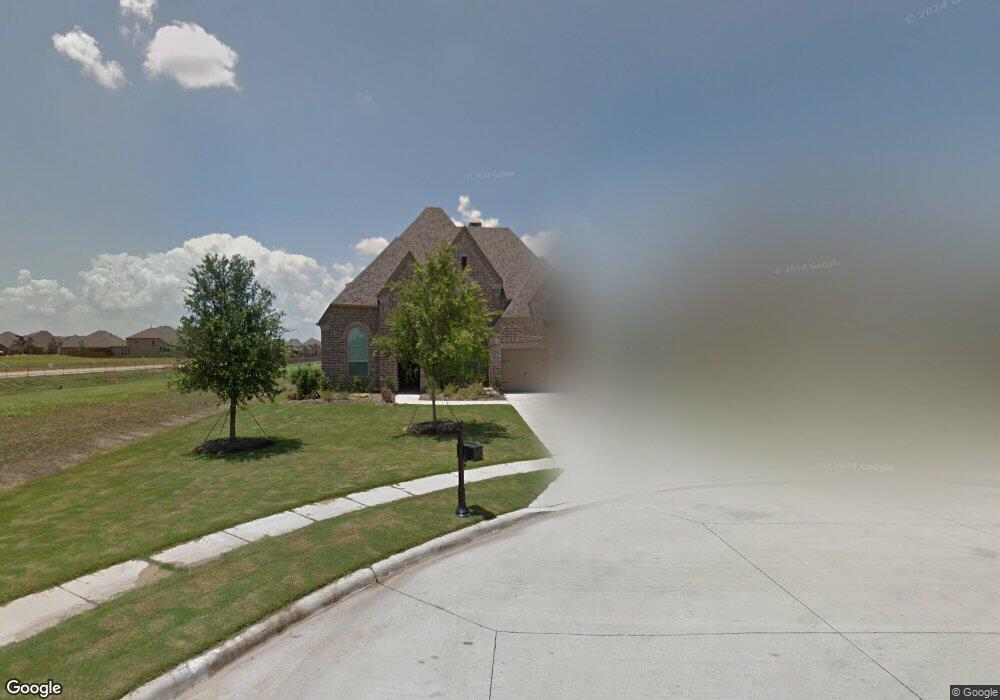

1621 Old Oak Prosper, TX 75078

Estimated Value: $752,187 - $796,000

5

Beds

4

Baths

3,701

Sq Ft

$208/Sq Ft

Est. Value

About This Home

This home is located at 1621 Old Oak, Prosper, TX 75078 and is currently estimated at $770,297, approximately $208 per square foot. 1621 Old Oak is a home located in Collin County with nearby schools including Ralph and Mary Lynn Boyer Elementary School, Reynolds Middle School, and Prosper High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 3, 2021

Sold by

Ginalick Gregg A and Ginalick Donolynn A

Bought by

Mane Anil Shriram and Mane Ashwini

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,400

Outstanding Balance

$53,141

Interest Rate

3.09%

Mortgage Type

Stand Alone First

Estimated Equity

$717,156

Purchase Details

Closed on

Jul 29, 2016

Sold by

Highland Homes-Dallas Llc

Bought by

Ginalick Gregg A and Ginalick Donolynn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

3.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 12, 2015

Sold by

Forestar Usa Real Estate Group Inc

Bought by

Highland Homes Ltd

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mane Anil Shriram | -- | None Listed On Document | |

| Ginalick Gregg A | -- | Attorney | |

| Highland Homes Ltd | -- | Ortc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mane Anil Shriram | $58,400 | |

| Previous Owner | Ginalick Gregg A | $417,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,699 | $777,325 | $199,500 | $577,825 |

| 2024 | $13,699 | $796,348 | $189,000 | $613,179 |

| 2023 | $13,699 | $723,953 | $189,000 | $569,918 |

| 2022 | $14,430 | $658,139 | $147,000 | $511,139 |

| 2021 | $11,276 | $508,000 | $110,250 | $397,750 |

| 2020 | $11,363 | $484,668 | $105,000 | $379,668 |

| 2019 | $12,008 | $489,724 | $100,000 | $389,724 |

| 2018 | $11,693 | $474,913 | $100,000 | $374,913 |

| 2017 | $12,100 | $491,448 | $100,000 | $391,448 |

| 2016 | $1,959 | $79,000 | $79,000 | $0 |

| 2015 | -- | $57,600 | $57,600 | $0 |

Source: Public Records

Map

Nearby Homes

- 1630 Old Oak

- 341 Evening Sun Dr

- 140 Godstone Ln

- 431 Fawn Mist Dr

- 221 Saint Mark Ln

- 411 Fox Crossing Ln

- 1541 Havenbrook Ln

- 150 Darian Dr

- 401 Komron Ct

- 520 Devonshire Dr

- 721 Berkshire Dr

- 870 Sabine Dr

- 1661 Pepperdine Place

- 1700 Pepperdine Place

- 920 Sabine Dr

- 971 Georgetown Place

- 981 Stanford Ln

- 981 Georgetown Place

- 941 Fox Ridge Trail

- 721 Broderick Ln

Your Personal Tour Guide

Ask me questions while you tour the home.