1623 Fortson Cir Elberton, GA 30635

Estimated Value: $109,000 - $151,000

3

Beds

1

Bath

1,025

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 1623 Fortson Cir, Elberton, GA 30635 and is currently estimated at $132,600, approximately $129 per square foot. 1623 Fortson Cir is a home located in Elbert County with nearby schools including Elbert County Elementary School, Elbert County Primary School, and Elbert County Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 12, 2021

Sold by

Trio Red Properties Lllp

Bought by

Jones William D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,487

Interest Rate

2.73%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 14, 2005

Sold by

Webb Mary Jean Brady

Bought by

Trio Red Properties Lllp

Purchase Details

Closed on

Jul 19, 2004

Sold by

Est Of Ophelia B Maxwell 4C

Bought by

Webb Mary Jean Brady

Purchase Details

Closed on

Sep 1, 1984

Purchase Details

Closed on

May 1, 1980

Purchase Details

Closed on

Jun 1, 1978

Purchase Details

Closed on

Sep 1, 1977

Purchase Details

Closed on

Nov 1, 1974

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones William D | $50,500 | -- | |

| Trio Red Properties Lllp | $57,200 | -- | |

| Webb Mary Jean Brady | -- | -- | |

| -- | $13,600 | -- | |

| -- | -- | -- | |

| -- | -- | -- | |

| -- | -- | -- | |

| -- | $17,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Jones William D | $52,487 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $659 | $27,474 | $2,532 | $24,942 |

| 2023 | $659 | $27,474 | $2,532 | $24,942 |

| 2022 | $273 | $19,927 | $1,508 | $18,419 |

| 2021 | $479 | $19,927 | $1,508 | $18,419 |

| 2020 | $525 | $19,321 | $1,206 | $18,115 |

| 2019 | $546 | $19,321 | $1,206 | $18,115 |

| 2018 | $562 | $19,321 | $1,206 | $18,115 |

| 2017 | $509 | $16,195 | $1,206 | $14,989 |

| 2016 | $475 | $16,195 | $1,206 | $14,989 |

| 2015 | -- | $16,195 | $1,206 | $14,989 |

| 2014 | -- | $16,195 | $1,206 | $14,989 |

| 2013 | -- | $16,195 | $1,206 | $14,989 |

Source: Public Records

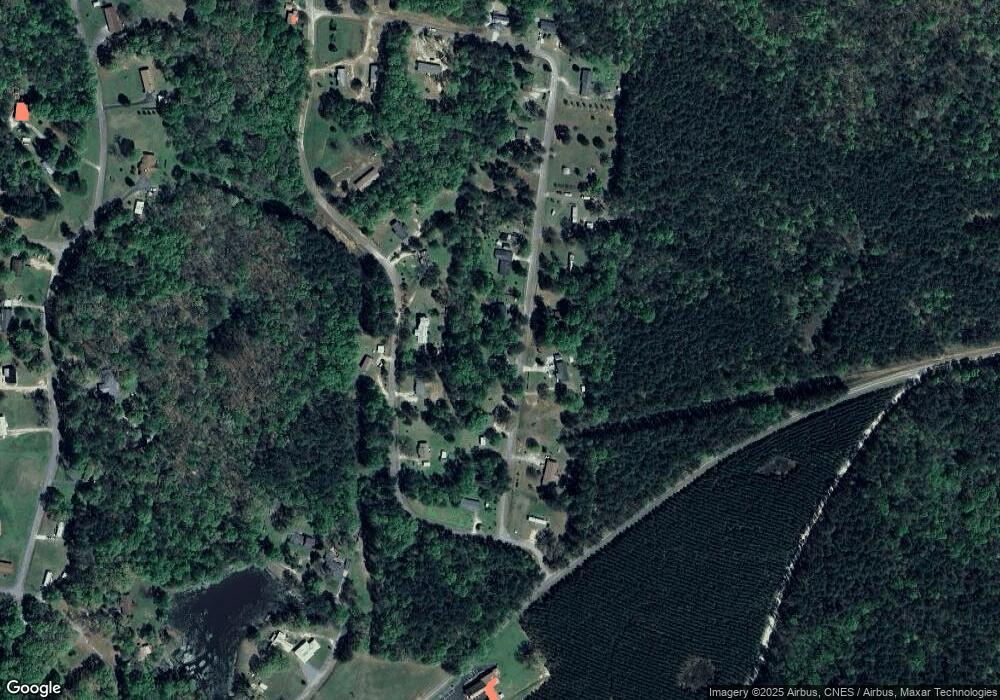

Map

Nearby Homes

- 0 Fortson Dr

- 1621 Dickerson Rd

- 1504 Woodyard Rd

- 0 Cromer Rd

- 0 Henry Moon Dr Unit 10452056

- 15 Emmaus Dr

- 5 Emmaus Dr

- 2 Emmaus Dr

- 20 Emmaus Dr

- 14 Emmaus Dr

- 21 Emmaus Dr

- 19 Emmaus Dr

- 11 Emmaus Dr

- 4 Emmaus Dr

- 8 Emmaus Dr

- 16 Emmaus Dr

- 1 Powerhouse Dr

- 1724 Martin Villa Rd

- 15693 Tanglewood Dr

- 1511 N Rainbow Dr

- 1627 Fortson Cir

- 1622 Fortson Cir

- 1613 Fortson Cir

- 1628 Fortson Cir

- 1636 Fortson Dr

- 1635 Fortson Cir

- 1628 Fortson Dr

- 1610 Fortson Cir

- 1654 Fortson Dr

- 1612 Fortson Dr

- 0 Fortson Cir Unit 8215260

- 0 Fortson Cir Unit 7325451

- 1641 Fortson Dr

- 1604 Fortson Cir

- 1644 Fortson Cir

- 1621 Fortson Dr

- 1651 Fortson Cir

- 1636 Pinelake Dr

- 1632 Pinelake Dr

- 1659 Fortson Cir