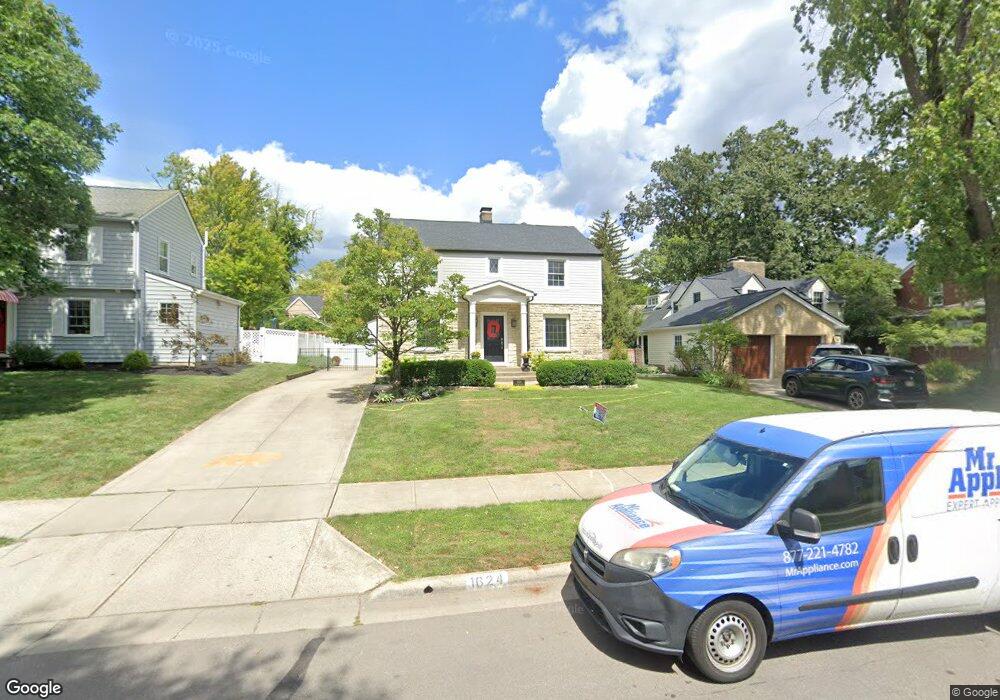

1624 Grenoble Rd Columbus, OH 43221

Estimated Value: $777,190 - $1,071,000

3

Beds

3

Baths

2,652

Sq Ft

$337/Sq Ft

Est. Value

About This Home

This home is located at 1624 Grenoble Rd, Columbus, OH 43221 and is currently estimated at $893,798, approximately $337 per square foot. 1624 Grenoble Rd is a home located in Franklin County with nearby schools including Barrington Road Elementary School, Jones Middle School, and Upper Arlington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 5, 2013

Sold by

Reed Mary E

Bought by

Maurer Thomas J and Maurer Krystal R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$411,750

Outstanding Balance

$291,456

Interest Rate

3.38%

Mortgage Type

New Conventional

Estimated Equity

$602,342

Purchase Details

Closed on

Jun 22, 1992

Bought by

Reed Mary E

Purchase Details

Closed on

Jun 1, 1987

Purchase Details

Closed on

Oct 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maurer Thomas J | $457,500 | None Available | |

| Reed Mary E | $166,000 | -- | |

| -- | $115,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Maurer Thomas J | $411,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,172 | $202,660 | $71,300 | $131,360 |

| 2023 | $12,027 | $202,650 | $71,295 | $131,355 |

| 2022 | $11,845 | $164,430 | $45,360 | $119,070 |

| 2021 | $10,629 | $164,430 | $45,360 | $119,070 |

| 2020 | $10,436 | $164,430 | $45,360 | $119,070 |

| 2019 | $9,825 | $136,570 | $45,360 | $91,210 |

| 2018 | $9,758 | $136,570 | $45,360 | $91,210 |

| 2017 | $9,719 | $136,570 | $45,360 | $91,210 |

| 2016 | $9,778 | $143,920 | $36,610 | $107,310 |

| 2015 | $9,744 | $143,920 | $36,610 | $107,310 |

| 2014 | $9,518 | $143,920 | $36,610 | $107,310 |

| 2013 | $4,595 | $130,830 | $33,285 | $97,545 |

Source: Public Records

Map

Nearby Homes

- 2110 Northwest Blvd

- 1535 Doone Rd

- 1488 Essex Rd

- 1481 Doone Rd

- 1565 Berkshire Rd

- 1470 Cardiff Rd

- 2276 Northwest Blvd

- 1934 Bedford Rd

- 1932 Suffolk Rd Unit 1932

- 1398 Lower Green Cir Unit 1398

- 1395 Upper Green Cir Unit 1395

- 1825 Northwest Ct Unit D

- 1659 Tremont Rd

- 1733 Elmwood Ave

- 1729 Elmwood Ave

- 1550 College Hill Dr

- 2569 Chester Rd

- 2585 Westmont Blvd

- 1661 Ashland Ave Unit 663

- 1655-1657 Ashland Ave

- 1618 Grenoble Rd

- 1632 Grenoble Rd

- 1640 Grenoble Rd

- 1604 Grenoble Rd

- 1619 Guilford Rd

- 1611 Guilford Rd

- 1625 Guilford Rd

- 1648 Grenoble Rd

- 1625 Grenoble Rd

- 1603 Guilford Rd

- 1635 Guilford Rd

- 1633 Grenoble Rd

- 1619 Grenoble Rd

- 1641 Grenoble Rd

- 1656 Grenoble Rd

- 1645 Guilford Rd

- 1592 Grenoble Rd

- 1649 Grenoble Rd

- 1603 Grenoble Rd

- 1587 Guilford Rd