16243 Heather Ln Unit 19D3 Middleburg Heights, OH 44130

Estimated Value: $175,000 - $199,000

3

Beds

2

Baths

1,484

Sq Ft

$125/Sq Ft

Est. Value

About This Home

This home is located at 16243 Heather Ln Unit 19D3, Middleburg Heights, OH 44130 and is currently estimated at $184,881, approximately $124 per square foot. 16243 Heather Ln Unit 19D3 is a home located in Cuyahoga County with nearby schools including Big Creek Elementary School, Berea-Midpark Middle School, and Berea-Midpark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 9, 2008

Sold by

Blaze Deborah L and Blaze Thomas J

Bought by

Woodring Joellen K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,200

Outstanding Balance

$58,595

Interest Rate

6.41%

Mortgage Type

Unknown

Estimated Equity

$126,286

Purchase Details

Closed on

Sep 22, 2008

Sold by

Blaze Thomas

Bought by

Blaze Deborah L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,200

Outstanding Balance

$58,595

Interest Rate

6.41%

Mortgage Type

Unknown

Estimated Equity

$126,286

Purchase Details

Closed on

Jul 15, 1977

Sold by

Bracken Gary G and B G

Bought by

Blaze Thomas J

Purchase Details

Closed on

Jan 1, 1975

Bought by

Bracken Gary G and B G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Woodring Joellen K | $98,000 | Real Living Title Agency Ltd | |

| Blaze Deborah L | -- | Attorney | |

| Blaze Thomas J | $35,000 | -- | |

| Bracken Gary G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Woodring Joellen K | $88,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,817 | $51,975 | $5,180 | $46,795 |

| 2023 | $2,273 | $34,590 | $3,470 | $31,120 |

| 2022 | $2,259 | $34,580 | $3,470 | $31,120 |

| 2021 | $2,246 | $34,580 | $3,470 | $31,120 |

| 2020 | $1,983 | $26,600 | $2,660 | $23,940 |

| 2019 | $1,929 | $76,000 | $7,600 | $68,400 |

| 2018 | $1,805 | $26,600 | $2,660 | $23,940 |

| 2017 | $1,815 | $23,070 | $2,310 | $20,760 |

| 2016 | $1,801 | $23,070 | $2,310 | $20,760 |

| 2015 | $2,085 | $23,070 | $2,310 | $20,760 |

| 2014 | $2,085 | $28,850 | $2,910 | $25,940 |

Source: Public Records

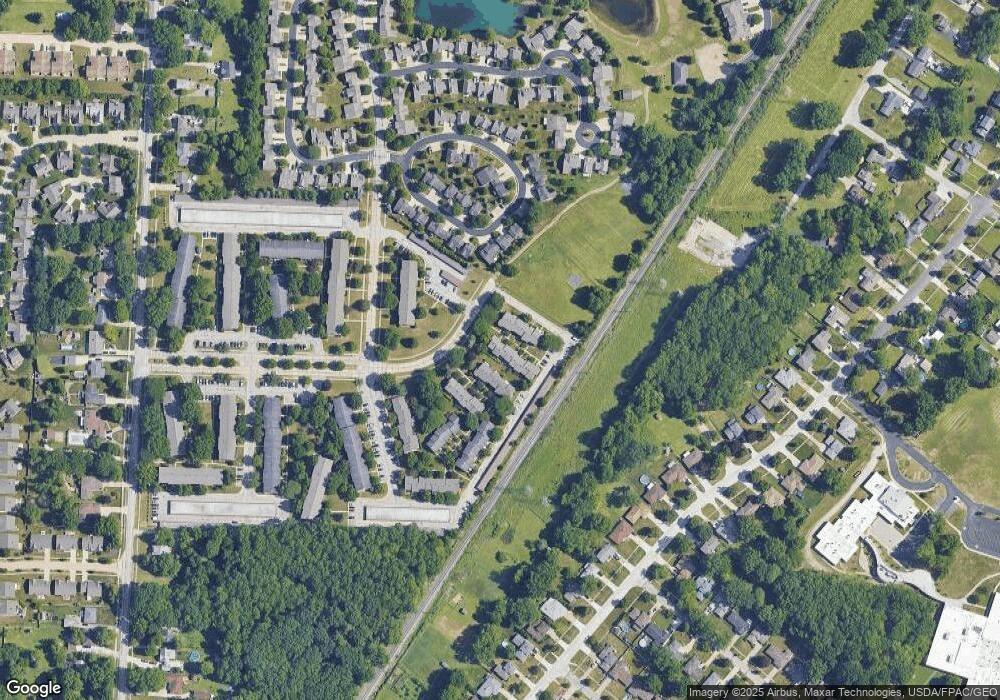

Map

Nearby Homes

- 6809 Meadow Ln

- 6823 Fry Rd

- 6689 Fry Rd

- 15983 Galemore Dr

- 15510 Sandalhaven Dr

- 6736 Rockridge Ct

- 6736 Columbine Ct

- 16761 Orchard Grove Dr Unit 6808A

- 6710 Woodruff Ct

- 15490 Oakshire Ct

- 6724 Benedict Dr

- 6720 Benedict Dr

- 6744 Benedict Dr

- 6748 Benedict Dr

- 6749 Middlebrook Blvd

- 16147 Ramona Dr

- 16259 Emerald Point Unit 16259

- 6771 Wood Creek Dr

- 15446 Sheldon Rd

- 6755 Benedict Dr

- 16249 Heather Ln Unit B1

- 16253 Heather Ln Unit E-1

- 16249 Heather Ln Unit 19B1

- 16255 Heather Ln

- 16247 Heather Ln

- 16253 Heather Ln

- 16251 Heather Ln

- 16245 Heather Ln

- 16241 Heather Ln

- 16253 Heather Ln Unit 19E1

- 16241 Heather Ln Unit E

- 16247 Heather Ln Unit D2

- 16251 Heather Ln Unit D1

- 16255 Heather Ln Unit A

- 16245 Heather Ln Unit B2

- 16257 Heather Ln Unit A

- 16259 Heather Ln Unit E1

- 16261 Heather Ln Unit 18D1

- 16265 Heather Ln Unit D2

- 16267 Heather Ln