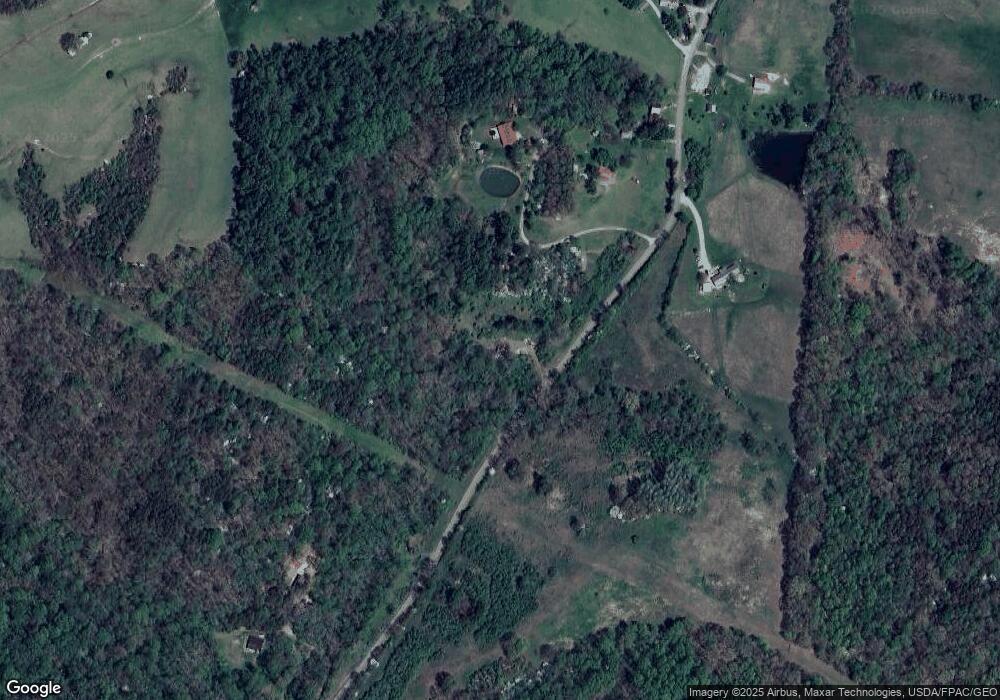

1625 Glen Roy Rd Wellston, OH 45692

Estimated Value: $99,000 - $147,000

2

Beds

1

Bath

972

Sq Ft

$126/Sq Ft

Est. Value

About This Home

This home is located at 1625 Glen Roy Rd, Wellston, OH 45692 and is currently estimated at $122,696, approximately $126 per square foot. 1625 Glen Roy Rd is a home located in Jackson County with nearby schools including Bundy Elementary School, Wellston Intermediate School, and Wellston Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2025

Sold by

Coughenour Amanda and Coughenour Kristopher

Bought by

Coughenour Kristopher

Current Estimated Value

Purchase Details

Closed on

Jul 28, 2023

Sold by

Yoder Roman J and Weaver Eli J

Bought by

Coughenour Amanda and Coughenour Kristopher

Purchase Details

Closed on

Feb 5, 2020

Sold by

White James

Bought by

Yoder Roman J and Weaver Eli J

Purchase Details

Closed on

May 28, 2014

Sold by

Short Lionel

Bought by

White James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$37,500

Interest Rate

4.28%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 7, 2013

Sold by

Riegel Kimberly A

Bought by

Short Lionel

Purchase Details

Closed on

Jul 30, 1997

Sold by

Tilley John

Bought by

Tilley Ruth

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Coughenour Kristopher | -- | None Listed On Document | |

| Coughenour Amanda | $24,000 | Northwest Title | |

| Yoder Roman J | $15,500 | None Available | |

| White James | $40,000 | Aaron Title Agency | |

| Short Lionel | $14,000 | None Available | |

| Tilley Ruth | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | White James | $37,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $766 | $24,480 | $8,440 | $16,040 |

| 2023 | $765 | $24,480 | $8,440 | $16,040 |

| 2022 | $670 | $17,540 | $6,500 | $11,040 |

| 2021 | $577 | $17,540 | $6,500 | $11,040 |

| 2020 | $291 | $17,540 | $6,500 | $11,040 |

| 2019 | $522 | $15,260 | $5,660 | $9,600 |

| 2018 | $503 | $15,260 | $5,660 | $9,600 |

| 2017 | $3,787 | $15,260 | $5,660 | $9,600 |

| 2016 | $1,696 | $15,910 | $5,290 | $10,620 |

| 2015 | $499 | $15,910 | $5,290 | $10,620 |

| 2013 | $460 | $14,670 | $4,570 | $10,100 |

| 2012 | $417 | $14,670 | $4,570 | $10,100 |

Source: Public Records

Map

Nearby Homes

- 23711 Ohio 93

- 82 Main St

- 4826 Ohio 788

- 522 Hard Scrapple Rd

- 11834 Ohio 327

- 1040 W Broadway St

- 0 Womeldorf Ln

- 374 Exline Rd

- 552 W B St

- 629 W D St

- 238 S Wisconsin Ave

- 103 Meadow Run Rd

- 224 W 4th St

- 103&103B Meadow Run

- 21 S Michigan Ave

- 616 S Michigan Ave

- 222 N Michigan Ave

- 16 E Broadway St

- 408 N Park Ave

- 0 Ohio 327