16268 SW Audubon St Unit 436 Beaverton, OR 97003

Five Oaks NeighborhoodEstimated Value: $323,045 - $342,000

2

Beds

2

Baths

1,069

Sq Ft

$313/Sq Ft

Est. Value

About This Home

This home is located at 16268 SW Audubon St Unit 436, Beaverton, OR 97003 and is currently estimated at $334,261, approximately $312 per square foot. 16268 SW Audubon St Unit 436 is a home located in Washington County with nearby schools including Barnes Elementary School, Meadow Park Middle School, and Beaverton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 28, 2004

Sold by

Hefter Brian G and Hefter Mitchell K

Bought by

Gray Sharman

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Outstanding Balance

$55,743

Interest Rate

5.74%

Mortgage Type

Unknown

Estimated Equity

$278,518

Purchase Details

Closed on

Aug 20, 2001

Sold by

Magnolia Carriage One Llc

Bought by

Hefter Brian G and Hefter Mitchell K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,300

Interest Rate

7.19%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gray Sharman | $140,000 | First American | |

| Hefter Brian G | $127,990 | Transnation Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gray Sharman | $112,000 | |

| Previous Owner | Hefter Brian G | $124,300 | |

| Closed | Gray Sharman | $28,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,947 | $192,680 | -- | -- |

| 2025 | $3,947 | $187,070 | -- | -- |

| 2024 | $3,727 | $181,630 | -- | -- |

| 2023 | $3,727 | $176,340 | $0 | $0 |

| 2022 | $3,567 | $176,340 | $0 | $0 |

| 2021 | $3,442 | $166,230 | $0 | $0 |

| 2020 | $3,337 | $161,390 | $0 | $0 |

| 2019 | $3,232 | $156,690 | $0 | $0 |

| 2018 | $3,129 | $152,130 | $0 | $0 |

| 2017 | $3,012 | $147,700 | $0 | $0 |

| 2016 | $2,907 | $143,400 | $0 | $0 |

| 2015 | $2,763 | $139,230 | $0 | $0 |

| 2014 | $2,683 | $135,180 | $0 | $0 |

Source: Public Records

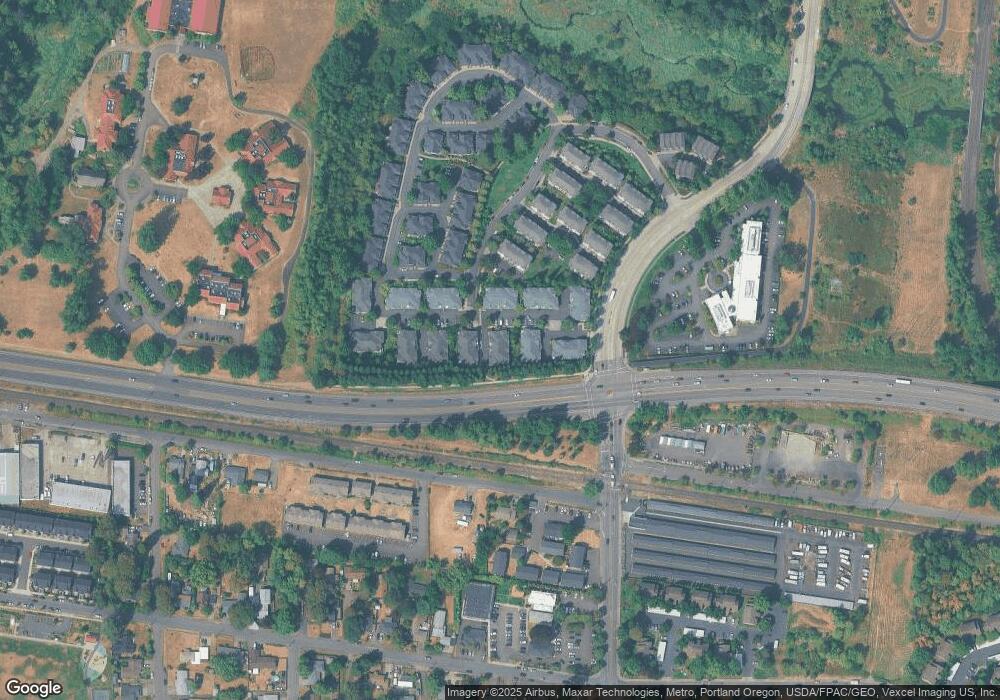

Map

Nearby Homes

- 16248 SW Audubon St Unit 101

- 16080 SW Audubon St Unit 103

- 16040 SW Audubon St Unit 101

- 16020 SW Audubon St Unit 105

- 16117 SW Audubon St

- 16375 SW Blanton St

- 4264 SW Highgate Terrace

- 4290 SW Highgate Terrace

- 4405 SW 160th Ave

- 4422 SW Appletree Place

- 18038 SW Alvord Ln

- 16600 SW Florence St

- 16846 SW Kavitt Ln

- 4600 SW 170th Ave

- 17055 SW Florence St

- 4905 SW 166th Ave Unit 7

- 4905 SW 166th Ave

- 17155 SW Florence St

- 4841 SW Chianti Place

- 17385 SW Carson Ct

- 16268 SW Audubon St Unit 203

- 16268 SW Audubon St Unit 201

- 16268 SW Audubon St Unit 435

- 16268 SW Audubon St

- 16268 SW Audubon St Unit 433

- 16268 SW Audubon St Unit 432

- 16268 SW Audubon St

- 16268 SW Audubon St Unit 101

- 16268 SW Audubon St Unit 102

- 16265 SW Audubon St Unit 202

- 16265 SW Audubon St Unit 201

- 16265 SW Audubon St Unit 102

- 16265 SW Audubon St

- 16265 SW Audubon St

- 16265 SW Audubon St Unit 443

- 16265 SW Audubon St Unit 442

- 16265 SW Audubon St Unit 441

- 16265 SW Audubon St Unit 44

- 16265 SW Audubon St Unit 101

- 16265 SW Audubon St Unit 203