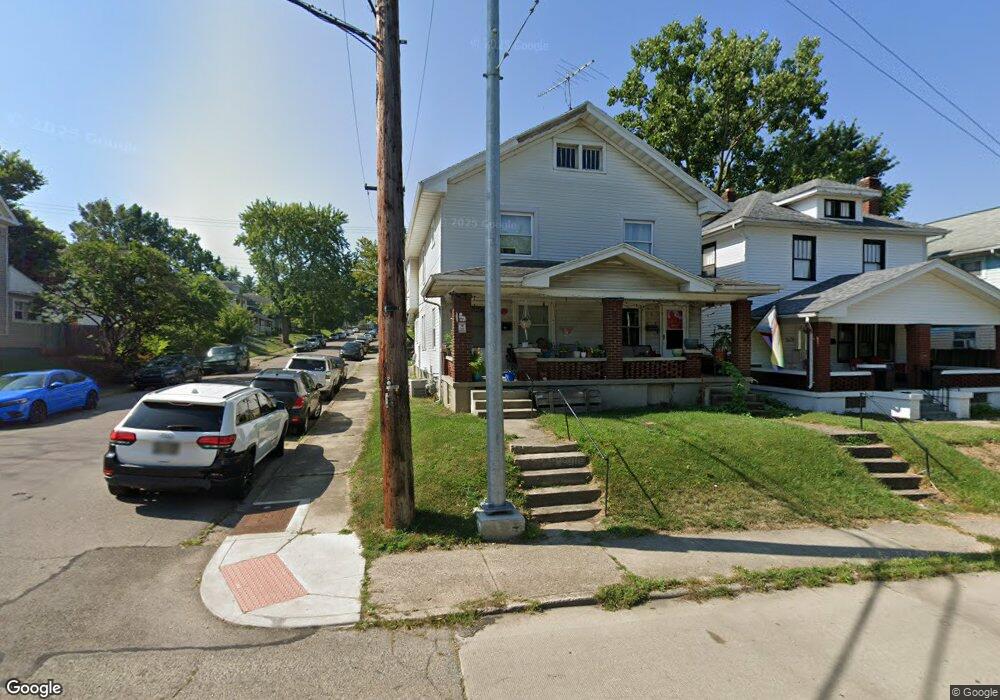

1632 Wyoming St Dayton, OH 45410

Walnut Hills NeighborhoodEstimated Value: $85,705 - $145,000

6

Beds

2

Baths

1,256

Sq Ft

$92/Sq Ft

Est. Value

About This Home

This home is located at 1632 Wyoming St, Dayton, OH 45410 and is currently estimated at $116,176, approximately $92 per square foot. 1632 Wyoming St is a home located in Montgomery County with nearby schools including Cleveland Elementary School, Horace Mann Elementary School, and Eastmont Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 11, 2021

Sold by

Mclaughlin Timothy

Bought by

Dayton Double Plus Llc

Current Estimated Value

Purchase Details

Closed on

Oct 26, 2020

Sold by

Mclaughlin Timothy and Mclaughlin Chelsea Breen

Bought by

Mclaughlin Timothy

Purchase Details

Closed on

May 15, 2018

Sold by

Luneke James and Luneke Pamela

Bought by

Mciaughlin Timothy and Mciaughlin Chelsea Breen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 28, 2004

Sold by

Jackson Sandra K

Bought by

Luneke James E and Luneke Pamela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

5.9%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dayton Double Plus Llc | -- | None Available | |

| Mclaughlin Timothy | -- | None Available | |

| Mciaughlin Timothy | $40,000 | Chicago Title Company Llc | |

| Luneke James E | $80,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mciaughlin Timothy | $30,000 | |

| Previous Owner | Luneke James E | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $635 | $10,750 | $4,740 | $6,010 |

| 2023 | $635 | $10,750 | $4,740 | $6,010 |

| 2022 | $667 | $8,740 | $3,860 | $4,880 |

| 2021 | $663 | $8,740 | $3,860 | $4,880 |

| 2020 | $662 | $8,740 | $3,860 | $4,880 |

| 2019 | $745 | $8,740 | $3,860 | $4,880 |

| 2018 | $1,412 | $17,060 | $3,860 | $13,200 |

| 2017 | $1,401 | $17,060 | $3,860 | $13,200 |

| 2016 | $1,461 | $16,930 | $3,860 | $13,070 |

| 2015 | $1,382 | $16,930 | $3,860 | $13,070 |

| 2014 | $1,382 | $16,930 | $3,860 | $13,070 |

| 2012 | -- | $18,120 | $3,890 | $14,230 |

Source: Public Records

Map

Nearby Homes

- 2010 Argyle Ave

- 1159 Highland Ave

- 2105 Wyoming St

- 722 Saint Nicholas Ave

- 708 Saint Nicholas Ave

- 853 Carlisle Ave

- 1254 Phillips Ave

- 1154 Demphle Ave

- 2012 Saint Charles Ave

- 624 Pritz Ave

- 1254 Creighton Ave

- 222 Illinois Ave

- 2316 Wyoming St

- 1105 Pursell Ave

- 1221 Arbor Ave

- 215 Heaton Ave

- 267 Indiana Ave

- 662 Carlisle Ave

- 621 Creighton Ave

- 208 Heaton Ave

- 1634 Wyoming St

- 1628 Wyoming St

- 1624 Wyoming St

- 1620 Wyoming St

- 1700 Wyoming St

- 1017 Pritz Ave

- 1616 Wyoming St

- 1704 Wyoming St

- 1021 Pritz Ave

- 1708 Wyoming St

- 1014 Pritz Ave

- 1020 Pritz Ave

- 1027 Pritz Ave

- 1712 Wyoming St

- 1022 Pritz Ave

- 1016 Highland Ave

- 1604 Wyoming St

- 1031 Pritz Ave

- 1020 Highland Ave

- 1028 Pritz Ave