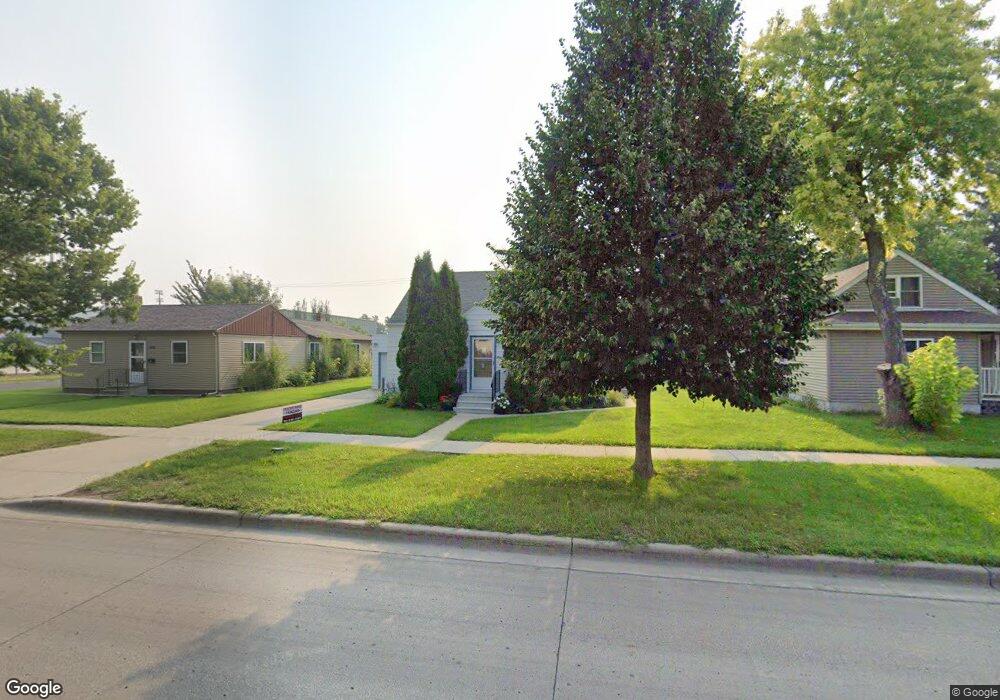

1637 10th St N Fargo, ND 58102

Washington NeighborhoodEstimated Value: $197,526 - $221,000

--

Bed

--

Bath

1,196

Sq Ft

$177/Sq Ft

Est. Value

About This Home

This home is located at 1637 10th St N, Fargo, ND 58102 and is currently estimated at $212,132, approximately $177 per square foot. 1637 10th St N is a home located in Cass County with nearby schools including Washington Elementary School, Ben Franklin Middle School, and North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 27, 2019

Sold by

Amundson Debbie D Dahl and Amundson Steven M

Bought by

Amundson Debbie D Dashl and Amundson Steven M

Current Estimated Value

Purchase Details

Closed on

Feb 9, 2017

Sold by

Dahl Norman Orris and Dahl David M

Bought by

Dahl David M

Purchase Details

Closed on

Jul 21, 2015

Sold by

Dahl Amundson Debbie D and Amundson Steve

Bought by

Dahl Norman O

Purchase Details

Closed on

Dec 20, 2012

Sold by

Dahl Norman O and Dahl Carolyn A

Bought by

Dalh Amundson Debbie D and Dahl David M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Amundson Debbie D Dashl | -- | None Available | |

| Dahl Amundson Debbie D | -- | None Available | |

| Dahl David M | -- | None Available | |

| Dahl Norman O | -- | None Available | |

| Dalh Amundson Debbie D | -- | None Available | |

| Dahl Norman O | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,008 | $93,450 | $20,050 | $73,400 |

| 2023 | $2,332 | $87,350 | $20,050 | $67,300 |

| 2022 | $2,323 | $85,600 | $20,050 | $65,550 |

| 2021 | $2,151 | $80,750 | $20,050 | $60,700 |

| 2020 | $2,123 | $80,750 | $20,050 | $60,700 |

| 2019 | $2,125 | $80,750 | $11,900 | $68,850 |

| 2018 | $1,812 | $69,750 | $11,900 | $57,850 |

| 2017 | $1,675 | $65,200 | $11,900 | $53,300 |

| 2016 | $1,436 | $60,950 | $11,900 | $49,050 |

| 2015 | $1,854 | $60,950 | $8,150 | $52,800 |

| 2014 | $1,816 | $57,950 | $8,150 | $49,800 |

| 2013 | $1,818 | $57,950 | $8,150 | $49,800 |

Source: Public Records

Map

Nearby Homes

- 1610 9th St N

- 1625 11th St N

- 1626 11th St N

- 1538 10th St N

- 1629 12th St N

- 1626 Broadway N

- 3216 Broadway N

- 1645 Broadway N

- 1914 9th St N

- 917 14th Ave N

- 1437 Broadway N Unit 102

- 1357 12th St N

- 1346 9th St N

- 314 18th Ave N

- 1633 3rd St N

- 1329 12th St N

- 2214 9 1 2 St N

- 1822 3rd St N

- 1316 8th St N

- 305 19th Ave N