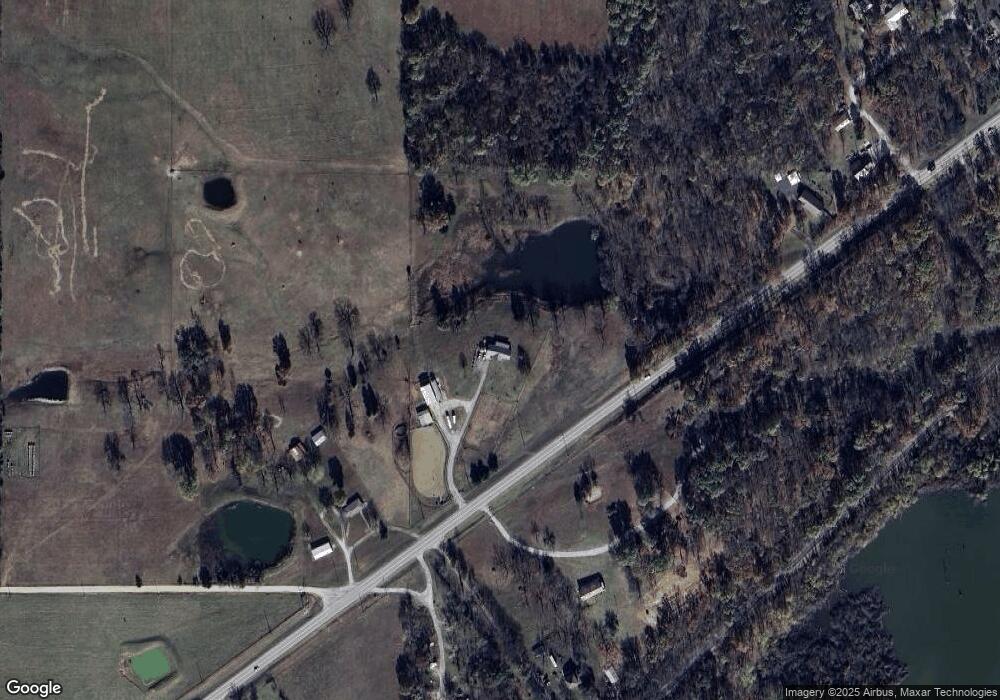

16401 S 606 Rd Fairland, OK 74343

Estimated Value: $167,000 - $223,000

3

Beds

2

Baths

1,600

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 16401 S 606 Rd, Fairland, OK 74343 and is currently estimated at $186,799, approximately $116 per square foot. 16401 S 606 Rd is a home located in Ottawa County with nearby schools including Fairland Elementary School and Fairland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2015

Sold by

Wilmington Savings Fund Society Fsb

Bought by

Graham Donald G and Graham Jana L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

3.81%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Mar 8, 2007

Sold by

Happy Michael L and Happy Michael L

Bought by

Happy Mary E

Purchase Details

Closed on

Jan 21, 2005

Sold by

Funk Gary S and Funk Vicki L

Bought by

Happy Michael L and Happy Mary E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,800

Interest Rate

5.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 28, 2002

Bought by

Funk Gary S and Funk Vicki L

Purchase Details

Closed on

Aug 20, 2001

Bought by

Funk Gary S

Purchase Details

Closed on

Jul 20, 1994

Bought by

Funk Gary and Funk Kathleen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Graham Donald G | $78,000 | None Available | |

| Happy Mary E | -- | None Available | |

| Happy Michael L | $121,000 | Photo Abstract Co | |

| Funk Gary S | -- | -- | |

| Funk Gary S | -- | -- | |

| Funk Gary | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Graham Donald G | $125,000 | |

| Previous Owner | Happy Michael L | $96,800 | |

| Previous Owner | Happy Michael L | $24,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,516 | $17,659 | $1,009 | $16,650 |

| 2024 | $1,516 | $17,659 | $1,009 | $16,650 |

| 2023 | $1,516 | $17,659 | $1,009 | $16,650 |

| 2022 | $1,495 | $16,586 | $1,009 | $15,577 |

| 2021 | $1,364 | $15,891 | $1,009 | $14,882 |

| 2020 | $1,201 | $15,134 | $1,009 | $14,125 |

| 2019 | $1,227 | $15,246 | $1,009 | $14,237 |

| 2018 | $1,242 | $15,246 | $1,009 | $14,237 |

| 2017 | $957 | $11,693 | $1,009 | $10,684 |

| 2016 | $993 | $12,002 | $1,009 | $10,993 |

| 2015 | $931 | $12,002 | $698 | $11,304 |

| 2014 | $1,009 | $12,002 | $698 | $11,304 |

Source: Public Records

Map

Nearby Homes

- 60661 U S 60

- 59300 E 170 Rd

- 60399 E 140 Rd

- 61510 Tarhe Trail

- 61570 Tarhe Trail

- 63060 E 157 Rd

- 0 Hwy 60 Unit 2536880

- 0 E 160 Rd

- 63030 E 157 Rd

- 0 S Arrow Rd Unit 24-1901

- 60901 E 130 Rd

- 61215 E 194 Rd

- 307 S 3rd

- 301 E Church Ave

- 19250 S 625 Rd

- 60780 E 198 Rd

- 0 Tbd E 200 Rd

- 16 E Church Ave

- 180 Wyandotte Ave

- 0 W Unit 25-1855

- 60540 E Highway 60

- 60601 E Highway 60

- 16408 S 606 Rd

- 60651 E Highway 60

- 16451 S 606 Rd

- 16885 S 606 Rd

- 16457 S 606 Rd

- 60661 E Highway 60

- 60660 E Highway 60

- 60681 U S 60

- 60403 E 160 Rd

- 60701 E Highway 60

- 60701 E Highway 60

- 60715 E Highway 60

- 60729 E Highway 60

- 60729 E Highway 60

- 60729 U S 60

- 60840 E Highway 60

- 60450 E Highway 60

- 60450 E Highway 60