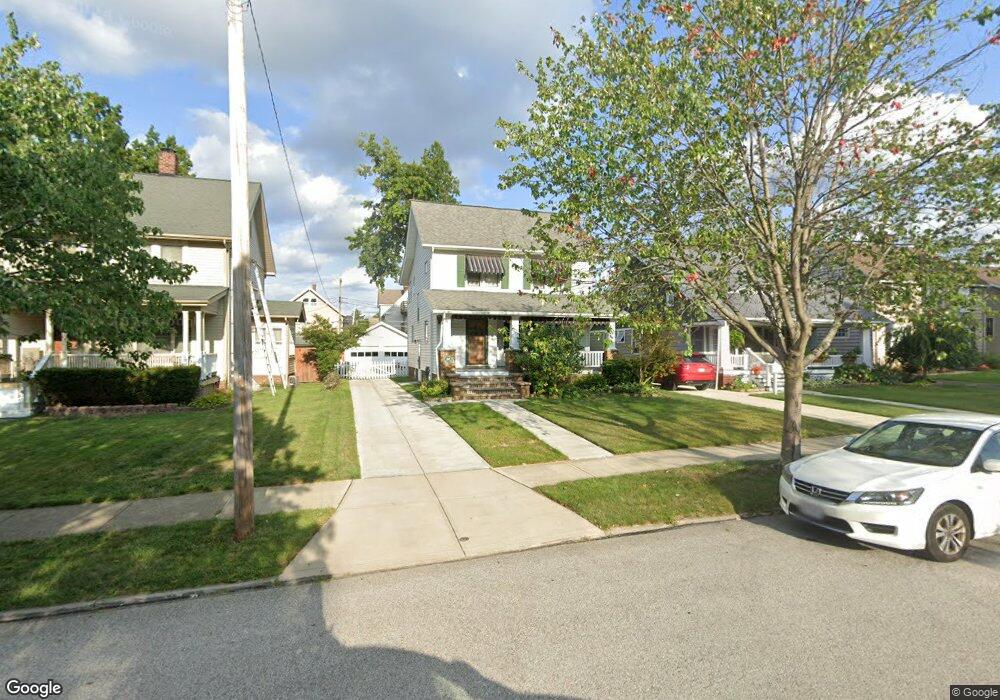

1641 Chesterland Ave Lakewood, OH 44107

Estimated Value: $342,416 - $383,000

3

Beds

2

Baths

1,506

Sq Ft

$237/Sq Ft

Est. Value

About This Home

This home is located at 1641 Chesterland Ave, Lakewood, OH 44107 and is currently estimated at $356,354, approximately $236 per square foot. 1641 Chesterland Ave is a home located in Cuyahoga County with nearby schools including Roosevelt Elementary School, Garfield Middle School, and Lakewood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2001

Sold by

Fisher Michael T Moran Susan J

Bought by

Fluty Monty E and Sinarski Karen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,500

Interest Rate

7.05%

Purchase Details

Closed on

Sep 22, 1997

Sold by

Est Susan J Moran

Bought by

Fisher Michael T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,896

Interest Rate

7.55%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 15, 1984

Sold by

Draheim John L and Draheim Janice I

Bought by

Draheim Shirley

Purchase Details

Closed on

Sep 28, 1982

Sold by

Draheim Shirley

Bought by

Draheim John L and Draheim Janice I

Purchase Details

Closed on

Jul 31, 1981

Sold by

Draheim Lester W and Draheim Shirley

Bought by

Draheim Shirley

Purchase Details

Closed on

Jan 1, 1975

Bought by

Draheim Lester W and Draheim Shirley

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fluty Monty E | $162,500 | Hometown Usa Title Agency Lt | |

| Fisher Michael T | $109,000 | -- | |

| Draheim Shirley | -- | -- | |

| Draheim John L | $50,000 | -- | |

| Draheim Shirley | -- | -- | |

| Draheim Lester W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Fluty Monty E | $101,500 | |

| Closed | Fisher Michael T | $108,896 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,380 | $99,330 | $22,120 | $77,210 |

| 2023 | $5,622 | $74,900 | $17,780 | $57,120 |

| 2022 | $5,658 | $74,900 | $17,780 | $57,120 |

| 2021 | $5,600 | $74,900 | $17,780 | $57,120 |

| 2020 | $4,967 | $58,070 | $13,790 | $44,280 |

| 2019 | $4,868 | $165,900 | $39,400 | $126,500 |

| 2018 | $4,861 | $58,070 | $13,790 | $44,280 |

| 2017 | $4,361 | $47,330 | $10,540 | $36,790 |

| 2016 | $4,331 | $47,330 | $10,540 | $36,790 |

| 2015 | $4,334 | $47,330 | $10,540 | $36,790 |

| 2014 | $4,334 | $45,510 | $10,120 | $35,390 |

Source: Public Records

Map

Nearby Homes

- 1605 Lewis Dr

- 1617 Clarence Ave

- 2035 Chesterland Ave

- 2045 Chesterland Ave

- 1539 Elbur Ave

- 2070 Clarence Ave

- 1576 Wyandotte Ave

- 1503 Chesterland Ave

- 1511 Clarence Ave

- 1603 Cohassett Ave

- 1585 Cohassett Ave

- 1598 Alameda Ave

- 1485 Waterbury Rd

- 2026 Dowd Ave

- 1532 Parkwood Rd

- 2100 Wascana Ave

- 1484 Alameda Ave

- 1463 Wyandotte Ave

- 1669 Robinwood Ave

- 13532 Elbur Ln

- 1645 Chesterland Ave

- 1637 Chesterland Ave

- 1649 Chesterland Ave

- 1631 Chesterland Ave

- 1629 Chesterland Ave

- 1653 Chesterland Ave

- 1630 Waterbury Rd

- 1626 Waterbury Rd

- 1634 Waterbury Rd

- 1620 1622 Waterbury Rd

- 1622 Waterbury Rd

- 1620 Waterbury Rd

- 1638 Waterbury Rd

- 1625 Chesterland Ave

- 1659 Chesterland Ave

- 1644 Chesterland Ave

- 1640 Chesterland Ave

- 1618 Waterbury Rd

- 1648 Chesterland Ave

- 1644 Waterbury Rd