1644 Painesville, OH 44077

Estimated Value: $297,390 - $349,000

4

Beds

3

Baths

1,020

Sq Ft

$315/Sq Ft

Est. Value

About This Home

This home is located at 1644, Painesville, OH 44077 and is currently estimated at $321,098, approximately $314 per square foot. 1644 is a home located in Lake County with nearby schools including Henry F. Lamuth Middle School, Riverside Junior/Senior High School, and Summit Academy Community School - Painesville.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2011

Sold by

Lubecky Robert J and Lubecky Deana L

Bought by

Fresenko Heather E and Fresenko Timothy J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,074

Outstanding Balance

$116,682

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$204,416

Purchase Details

Closed on

Jan 31, 2003

Sold by

Gilliland Richard A

Bought by

Lubecky Robert J and Lubecky Deana L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,210

Interest Rate

6%

Purchase Details

Closed on

Apr 10, 1996

Sold by

Tressler Robert S

Bought by

Gilliland Richard A and Gilliland Bethann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,850

Interest Rate

7.46%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fresenko Heather E | $173,500 | Attorney | |

| Lubecky Robert J | $177,500 | -- | |

| Gilliland Richard A | $146,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fresenko Heather E | $169,074 | |

| Previous Owner | Lubecky Robert J | $172,210 | |

| Previous Owner | Gilliland Richard A | $131,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $83,070 | $20,460 | $62,610 |

| 2023 | $7,058 | $64,770 | $16,340 | $48,430 |

| 2022 | $3,952 | $64,770 | $16,340 | $48,430 |

| 2021 | $3,875 | $64,770 | $16,340 | $48,430 |

| 2020 | $3,819 | $56,330 | $14,210 | $42,120 |

| 2019 | $3,847 | $56,330 | $14,210 | $42,120 |

| 2018 | $3,862 | $54,780 | $10,540 | $44,240 |

| 2017 | $3,865 | $54,780 | $10,540 | $44,240 |

| 2016 | $3,410 | $54,780 | $10,540 | $44,240 |

| 2015 | $3,135 | $54,780 | $10,540 | $44,240 |

| 2014 | $3,187 | $54,780 | $10,540 | $44,240 |

| 2013 | $3,114 | $54,780 | $10,540 | $44,240 |

Source: Public Records

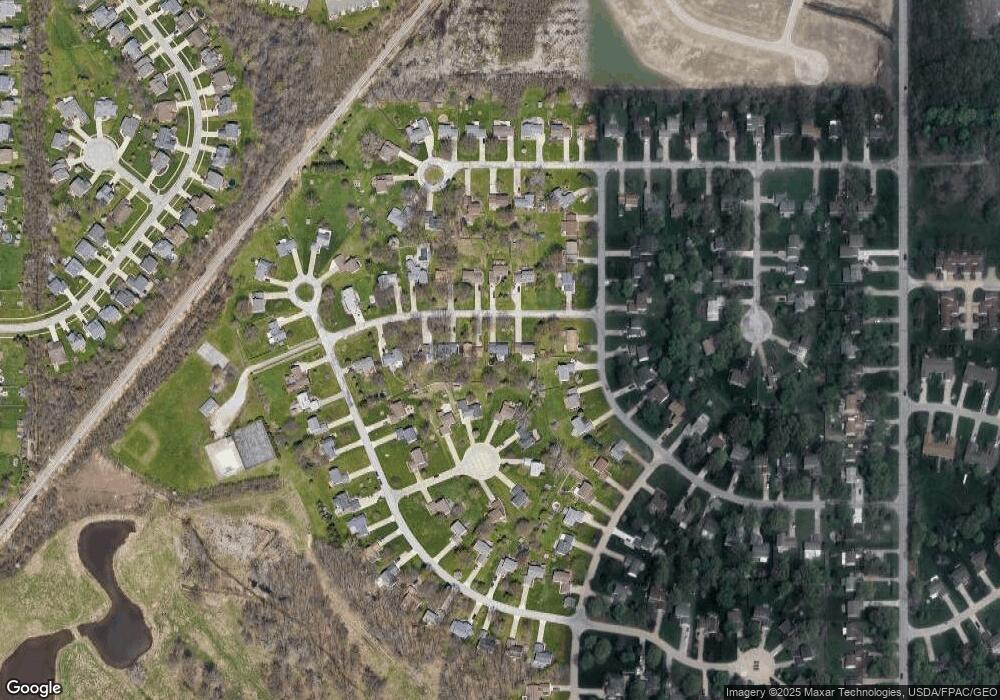

Map

Nearby Homes

- 1679 Duffton Ln

- 1719 Duffton Ln

- 751 Bacon Rd

- 1806 Muirfield Ln

- 124 Kenilworth Ave

- 1791 Muirfield Ln

- 1978 Marsh Ln Unit 1978

- 1865 Marsh Ln Unit 1865

- 720 N Creek Dr

- 634 N Creek Dr

- 960 Robinhood Ave

- 961 Beachfront Dr

- 808 N Creek Dr

- 1006 Robinhood Ave

- 547 Greenside Dr

- 988 Oakwood Blvd

- 499 Sand Trap Cir

- 0 Bellevue Ave Unit 5152736

- 0 Fremont Ave Unit 5152717

- 125 Sycamore Dr

- 1644 Wickham Place

- 1650 Wickham Place

- 1636 Wickham Place

- 1630 Wickham Place

- 1640 Buxton Cir

- 1630 Buxton Cir

- 1640 Sheffield Terrace

- 1645 Wickham Place

- 1620 Wickham Place

- 1651 Wickham Place

- 1637 Wickham Place

- 1660 Sheffield Terrace

- 1650 Buxton Cir

- 1620 Buxton Cir

- 1630 Sheffield Terrace

- 1629 Wickham Place

- 1610 Wickham Place

- 1670 Sheffield Terrace

- 1621 Wickham Place

- 1620 Sheffield Terrace